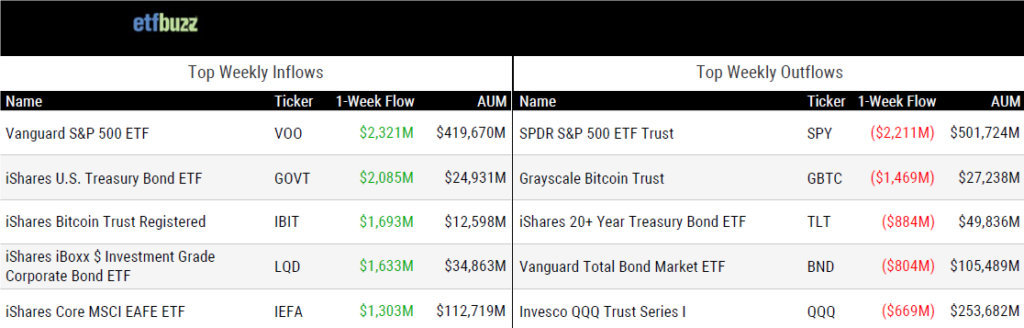

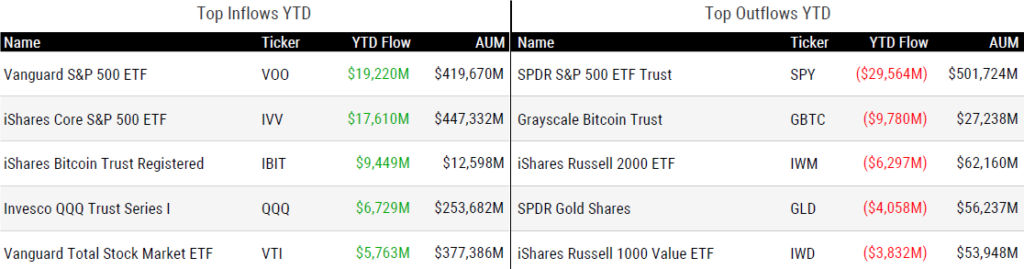

ETF Inflows & Outflows

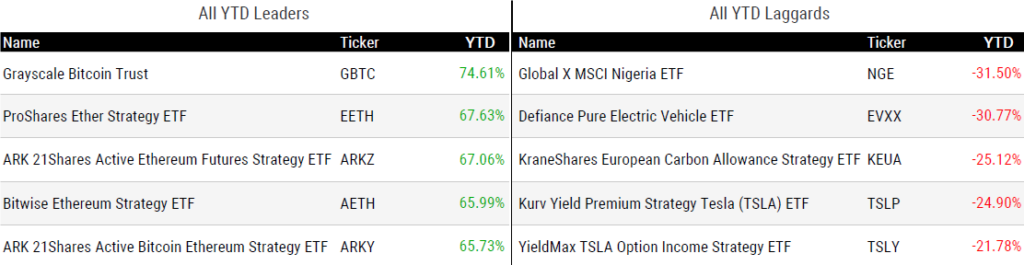

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 3/7/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Tim Buckley’s Exit Exposes Vanguard Wounds by Jeff Benjamin

“I think everyone is happy with where the fees are, so take all that new money and spend it on service.”

SEC ‘caution’ extends Vanguard’s ETF share class monopoly by Will Schmitt

“Rival asset managers are still waiting for approval to copy the structure.”

(Note: Financial regulation expert Sean Tuffy joined me on this week’s ETF Prime to discuss the multi share class structure’s potential impact and its likelihood of SEC approval.)

It’s High Time for ETF Innovation by Cinthia Murphy

“The case for more ‘room’ in the ETF space is directly linked to a fund’s ability to solve an investor problem.”

This Bond ETF Promises T-Bill Returns Without Taxable Income by Lan Anh Tran & Bryan Armour

“BOXX is the first ETF intended to access risk-free rates via an options strategy called a box spread.”

Investors pondering if time is right for small-cap ETFs by Ari Weinberg

“As large caps bounce along the top, equity investors are starting to wonder if small caps can catch up.”

MAGA, YODA and BRRR – The quest for catchy ETF tickers by Steve Johnson

“The notion that TBIL was not taken blows my mind.”

Is it too soon to name BlackRock the bitcoin ETF segment winner? by Ben Strack

“The asset management giant might be building a lead it won’t ever relinquish.”

How Grayscale’s big gamble on fees is paying off with Bitcoin’s rally to record high by Adam Morgan McCarthy

“While Grayscale is losing investors it has more assets than when it launched, a phenomenon we call the bull-market subsidy.”

Crypto Exuberance Is Hitting Overdrive as Ether ETF Battle Looms by Emily Graffeo & Yueqi Yang

“If we don’t see an approval, we will likely see a court challenge by someone.”

ETF Tweet of the Week

In less than two months, spot bitcoin ETFs have eclipsed $50 billion in assets. While the Grayscale Bitcoin ETF uplisted with over $28 billion and has since experienced $10.5 billion in outflows, the other nine new ETFs have taken in a staggering $20 billion. Add-in the surging price of bitcoin – up nearly 50% since these ETFs debuted – and you have a category that’s already over half the size of physical gold ETFs. As a matter of fact, total flows into the nine new spot bitcoin ETFs have exceeded total flows into all physical gold ETFs over the past five years! Despite plenty of naysayers, ETFs and bitcoin appear like a match made in heaven. As ETF Insight’s Mike Cronan told Bloomberg:

“I think of bitcoin like the ETF industry, no one gave it a chance until they couldn’t ignore it anymore. It makes a lot of sense that they are linked in their success.”

The ten spot bitcoin ETFs have blown through $50b in assets.. began life 7 weeks ago under $30b. About $8b of it is from flows, the rest from bitcoin value going up. pic.twitter.com/CZCl4mdd7Y

— Eric Balchunas (@EricBalchunas) March 5, 2024

ETF Chart of the Week

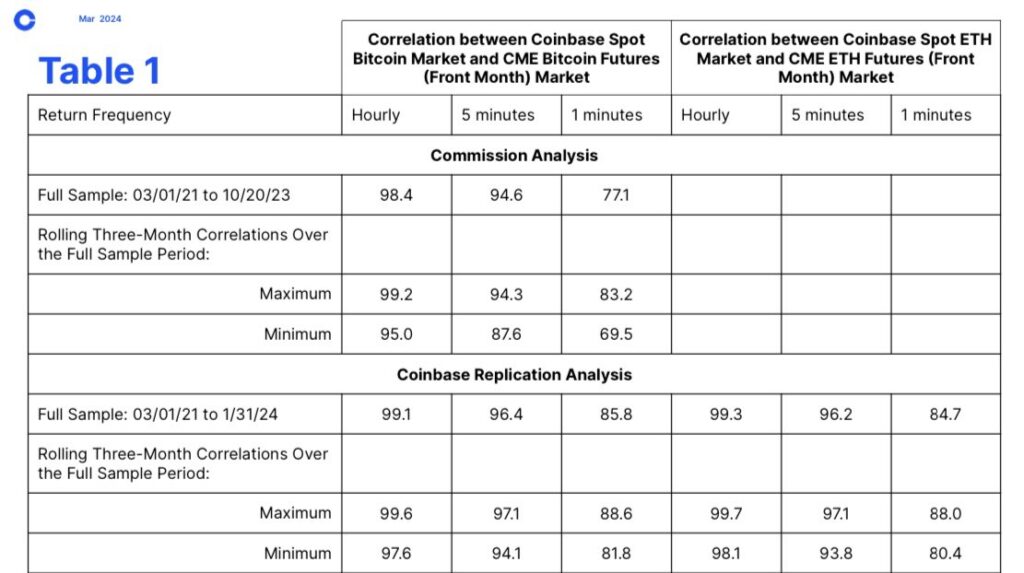

This past week, the SEC Division of Trading & Markets met with Grayscale attorneys and several Coinbase representatives regarding the potential uplisting of Grayscale’s Ethereum Trust. Recent speculation regarding the prospects for spot ether ETF approval has centered around the correlation between the spot and futures ether markets. There is a narrative that perhaps these markets aren’t as tightly correlated as the bitcoin markets. Coinbase’s analysis appears to show otherwise. Will the SEC agree?