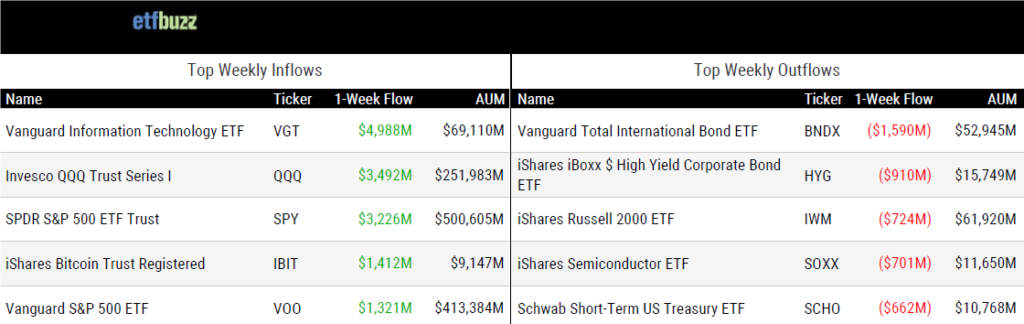

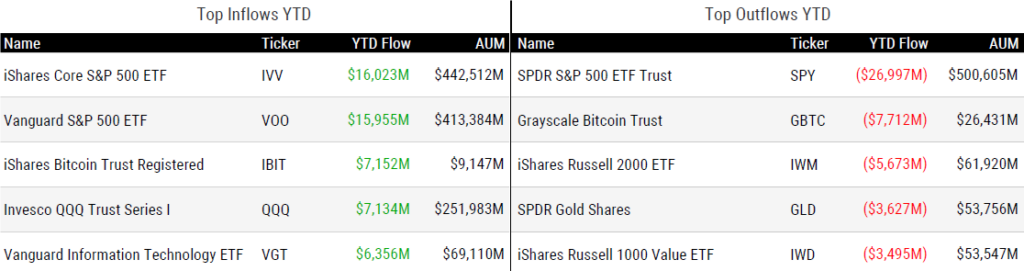

ETF Inflows & Outflows

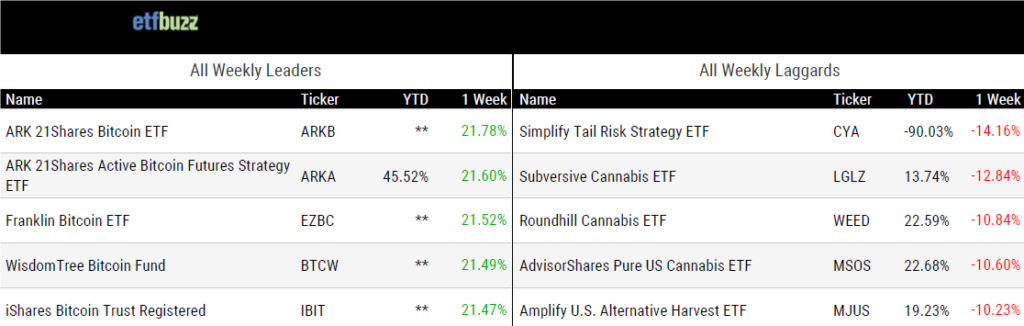

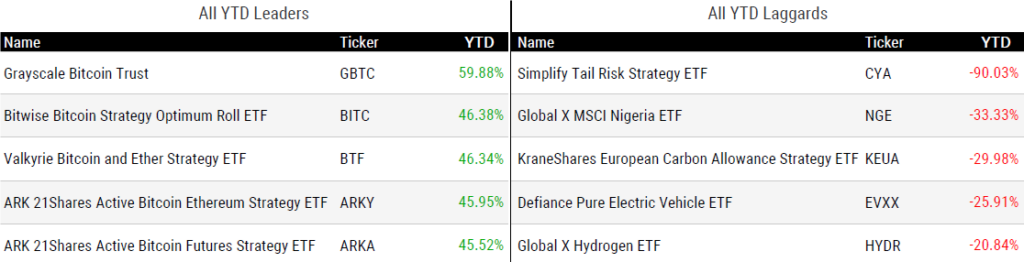

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/29/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

On the Road to a $10 Trillion U.S. ETF Industry by Sumit Roy

“Five years ago, AUM in U.S.-listed ETFs stood at only $3.5 trillion and now we’re on pace to reach triple those levels as soon as this year.”

Investors poured $4tn into US ETFs over past decade by Alyson Velati

“Investors poured $4.44tn into ETFs and took $950.8bn from their mutual fund counterparts.”

The Case For and Against Dividend ETFs by Nick Maggiulli

“There are two primary reasons why you might consider owning dividend ETFs—stability and psychological comfort.”

ETF Focused on Cash-Flow Rakes In Billions Despite Snubbing AI Mania by Isabelle Lee

“The exchange-traded fund, which tracks mid- and large-cap companies with high free-cash-flow yields, has drawn an almost uninterrupted stream of money since July 2023.”

Buffer ETFs Require Precise Financial Advice by Jeff Benjamin

“There is a lot to understand with buffer ETFs, and the history of structured products shows that both advisors and investors often do not fully understand the nuance of these vehicles.”

A Deep Dive into how Short Selling Really Works by Phil Mackintosh

“Futures or ETF arbitrage helps keep ETF prices in line with underlying stock values, ensuring investors pay a fair value when they buy an ETF or Future for stock exposure.”

5 ways bitcoin ETFs are already changing how crypto is traded by Frances Yue

“Spot bitcoin exchange-traded funds are still practically brand new, but they’ve already changed the way crypto is traded.”

The SEC Must Change Course To Protect Bitcoin ETF Investors by Wiley Nickel & Mike Flood

“The bitcoin ETF market would similarly benefit from having regulated, supervised, and secure banking entities play the important role of custodian.”

ETF Tweet of the Week

As always, a little ETF education goes a long way. This week, Bitwise President Teddy Fusaro does a masterful job of explaining the basics behind ETF share creation (click tweet to read entire thread). Note this is for cash creations, not in-kind.

Have had a lot of questions about how #bitcoin ETFs interact with the underlying bitcoin market throughout the trading day, when ETF buys and sells impact the spot bitcoin market (and how and when the ETF actually gets its bitcoin). Short thread.

— Teddy Fusaro (@teddyfuse) March 1, 2024

ETF Chart of the Week

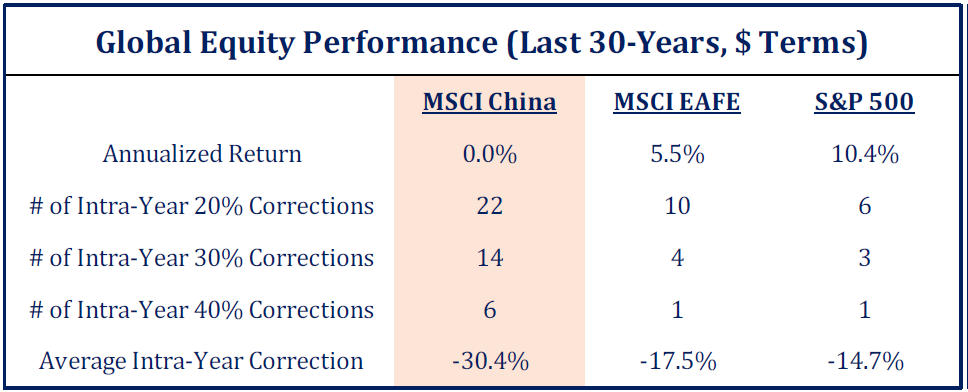

Strategas’ Todd Sohn provides one of the more shocking market data points currently in existence. Broad-based China stocks have delivered exactly 0% over the PAST 30 YEARS! Making matters worse is the volatility. Sohn:

“Over the last 30-years the MSCI China index has posted a total return of 0%. That’s been accompanied by 22 intra-year corrections of -20% (vs. 6 for the S&P 500) and an average annual correction of -30% (2x the S&P 500).”

Sohn continues:

“There will be timeframes when China meaningfully outperforms global markets – if you can get the entry

and exit correctly… but the broader numbers speak for themselves here.”

Yes, they most certainly do.

(Note: Ben Harburg, portfolio manager at CVA, will join me on next week’s ETF Prime to spotlight the CoreValues Alpha Greater China Growth ETF, discuss investing in China, and offer his thoughts on the below performance data.)

Source: Strategas Todd Sohn