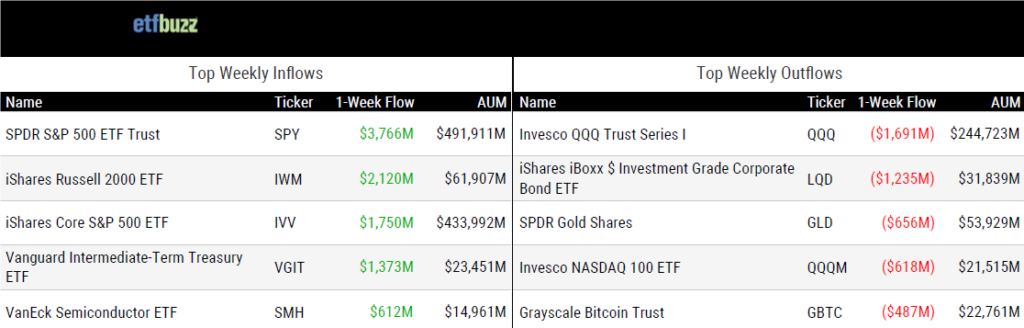

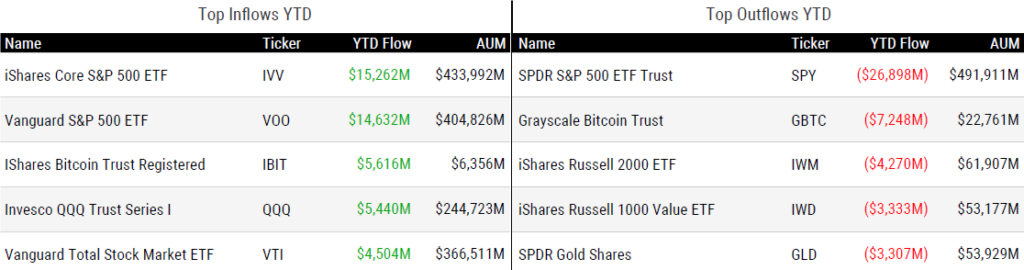

ETF Inflows & Outflows

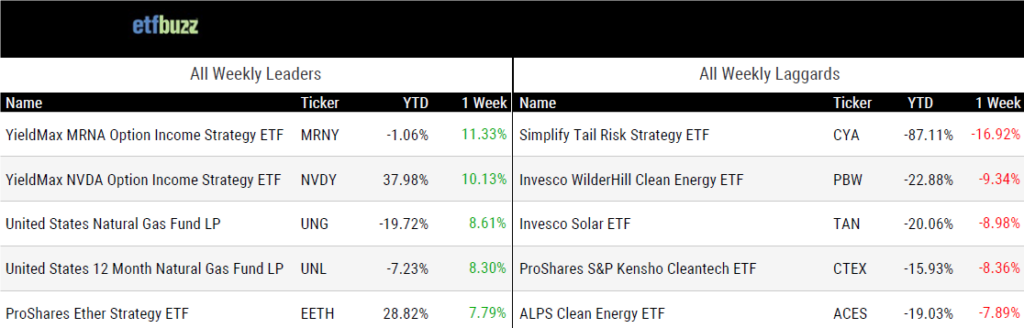

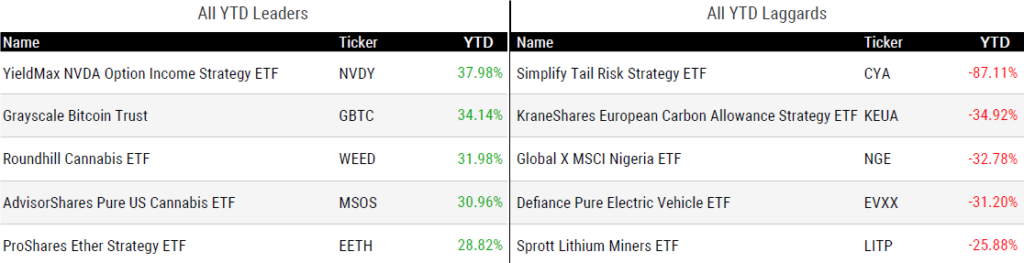

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/22/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

‘Thousands’ of New ETFs Seen in $8 Trillion Market’s Next Leap by Katie Greifeld & Emily Graffeo

“If the SEC gives its blessing to the hybrid structures, it’s not hundreds of ETFs that could enter the marketplace, it’s thousands.”

Fee pressure intensifies in the US ETF market by Emma Boyde

“Asset managers should think twice before getting into this business.”

T-Bills Without Tax Bills? This Fund Says It Cracked the Code by Zachary Mider

“A Marine Corps veteran with a finance Ph.D. has come up with a new way to avoid taxes.”

Simplify’s CYA Becomes Casualty of Bad Bets by Jeff Benjamin

“We have seen cases where funds were closed right before the sun came out on the strategy.”

(Note: On this week’s ETF Prime, VettaFi’s Lara Crigger and I did a full deep-dive into the Simplify Tail Risk Strategy ETF (CYA). The fund has lost nearly 100%, including 88% this year. You can listen to our conversation on what happened to CYA here.)

ETFs in 2024: Prediction Time! by Dave Nadig

“The ETF market matters a lot because honestly, it’s becoming the market.”

ETF Ecosystem Increases Automation Ahead of T+1 by Shanny Basar

“The first few months after T+1 will be bumpy, but the industry will learn, adjust and move onto business as usual.”

Crypto no longer outsider at famed Miami Beach ETF conference by Eleanor Terrett

“Representatives from companies with bitcoin ETFs tell me they were inundated with questions from financial advisers.”

Most Bitcoin ETFs Keep All Their Eggs In One Basket. Is That Risky? by Harrison Miller

“The bitcoin ETF holdings are stored in hardware security modules (HSMs).”

ETF Tweet of the Week

While spot bitcoin ETFs have been trading for only six weeks, attention is now turning towards the potential approval of spot ether ETFs. Coinbase, the largest custodian for spot bitcoin ETFs – and the likely largest custodian for spot ether ETFs – is now publicly campaigning for the products (click tweet to read entire thread).

I’m still tired from the spot bitcoin ETF drama, but… Here. We. Go. Again.

Today @coinbase responded to @SECGov's request for comment on the proposed @Grayscale Ether Trust ($ETHE) ETP. 27 pages and 96 citations that provide the (1) legal, (2) technical, and (3) economic rationale for approval. 1/6

— paulgrewal.eth (@iampaulgrewal) February 21, 2024

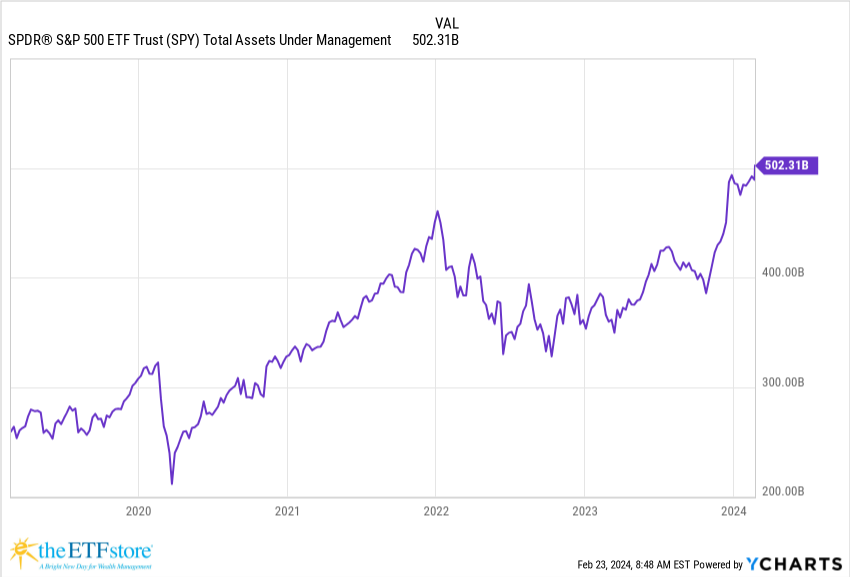

ETF Chart of the Week

This past Thursday, the SPDR S&P 500 ETF (SPY) became the first ETF to hit $500 billion in assets. Launched in January of 1993, SPY still holds the crown for the industry’s largest ETF. The next closest competitor is the iShares Core S&P 500 ETF (IVV) with $443 billion. State Street’s Matt Bartolini:

“It’s a testament to the longevity of SPY and that’s really built upon the multiple different types of use cases for SPY… the buying motivations are quite diverse.”

Matt Bartolini and I will discuss this big milestone on next week’s ETF Prime.

CNBC ETF Edge

I had the pleasure of joining CNBC’s Bob Pisani and Charles Schwab’s David Botset to discuss the challenges facing fixed income investors, the rise of active bond ETFs, S&P 500 concentration risk, spot bitcoin ETFs, and more. Enjoy!