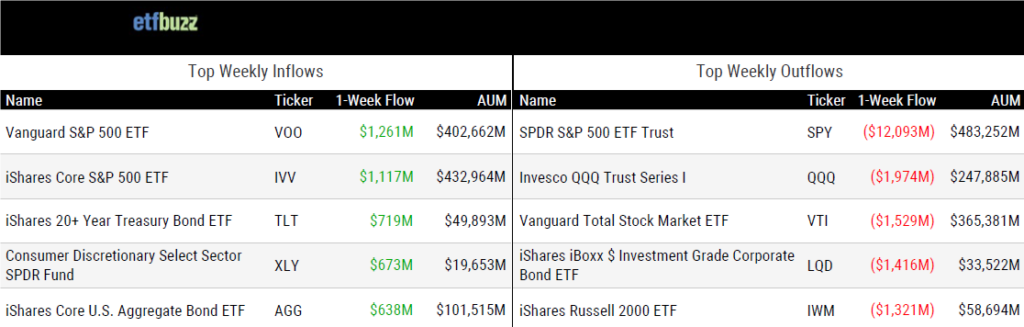

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/8/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Why ETFs work better in illiquid markets by Robin Wigglesworth

“The secondary market trading of ETF shares acts almost like a pressure release valve when the underlying bond market seizes up.”

Morgan Stanley Heats Up Race to Mimic Vanguard’s Tax-Busting Funds by Emily Graffeo & Katie Greifeld

“An approval from the SEC here — one, or maybe multiple — would be the biggest news of 2024.”

Advisor vs. Sub-Advisor – The Myth of Control by Cinthia Murphy

“Outside of owning your own Trust, both advisors and sub-advisors face similar operational and cost hurdles to entering the business.”

Advisors weigh use of covered-call ETFs as S&P 500 keeps rising by Gregg Greenberg

“The big question now facing covered-call ETF holders is whether they should banish those bear market memories and let their index holdings ride uncovered.”

Active ETF momentum among key themes in ‘vibrant’ transition of funds by Steve Randall

“This year’s Global ETF Survey underscores the vibrant expansion and the transformative potential of the ETF industry.”

(Note: Trackinsight’s “Global ETF Survey 2024: 50+ Charts on Worldwide ETF Trends”, referenced in this article, is well worth a read and can be downloaded here.)

Exchange: The Other Big Game by Todd Rosenbluth

“ETF education is paramount for the industry to continue to grow.”

(I look forward to seeing everyone in Miami for Exchange! If attending that conference, be sure to catch my quick session on ETF due diligence on Sunday at 4pm, followed by the ETF Quiz Show referenced in the above article. I’ll also be recording ETF Prime live on Tuesday at 12:45pm.)

ETF Tweet of the Week

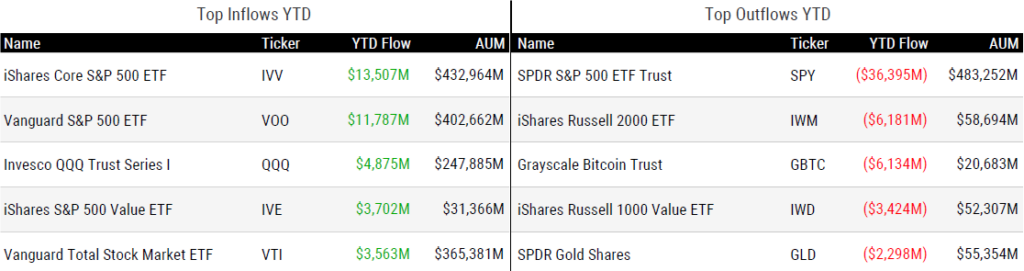

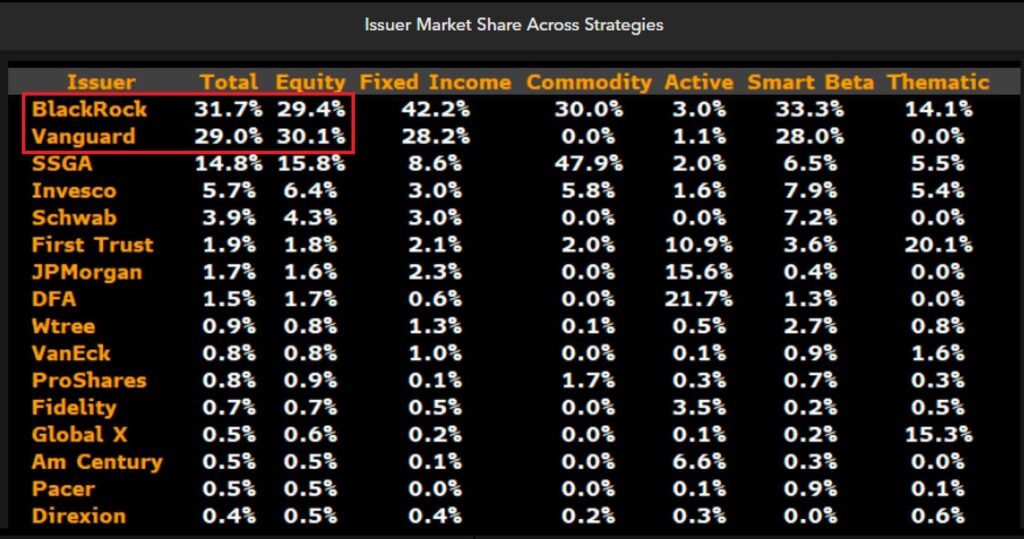

Vanguard recently eclipsed BlackRock in equity ETF market share and now sits less than 3% away from taking the crown for overall ETF market share. From Bloomberg’s Eric Balchunas:

Regular readers know one of my bold predictions for 2024 is that BlackRock will actually gain market share on Vanguard. How is that looking so far? Well, not good. Vanguard has vacuumed-up $32 billion compared to BlackRock’s $7 billion.

The Jack Bogle-founded company is simply a machine.

Vanguard has just passed BlackRock in equity ETF asset share.. altho both have around 30% each which is insane. Godzilla and King Kong, everyone else fighting for crumbs (altho 40% of eq ETF flows is some pretty big crumbs) via @psarofagis pic.twitter.com/kTvMRIS1i3

— Eric Balchunas (@EricBalchunas) February 5, 2024

ETF Chart of the Week

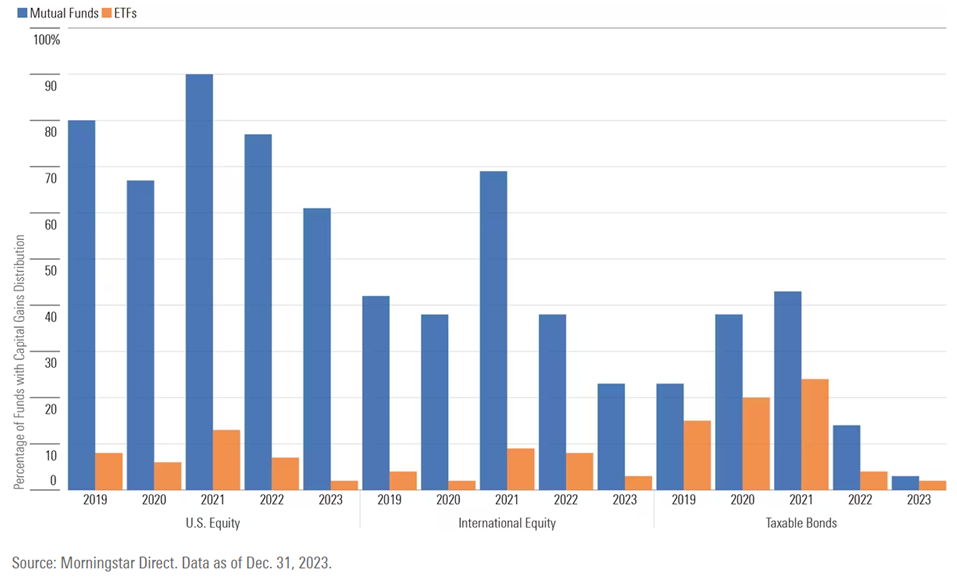

The below chart shows the percentage of mutual funds and ETFs (by very broad asset class) that had capital gain distributions over the past five years. Why are ETFs so tax efficient? Morningstar’s Bryan Armour:

“By virtue of in-kind creations and redemptions, ETFs come with tax magic that’s unrivaled by mutual funds. This creates a huge advantage for ETFs among investment strategies that kick off capital gains. The more funds trade, the more susceptible they are to selling winners and realizing capital gains. The effect is more pronounced in strategies that differentiate themselves from the market, like strategic-beta or concentrated active funds, which have higher turnover.”

In-kind creations and redemptions are the key, particularly for higher turnover strategies.

And, why does the tax efficiency of ETFs matter? Aptus Capital Advisors:

“ETFs can sidestep and defer capital gains, even when internal rebalancing or transacting individual positions within the ETF. This allows investors to potentially defer capital gains taxes from the time the ETF is purchased until its eventual sale. This deferral enables returns to compound at a higher pre-tax rate over time.”

Investors can compound at a higher pre-tax rate over time. Fund structure matters!

Source: Morningstar’s Bryan Armour