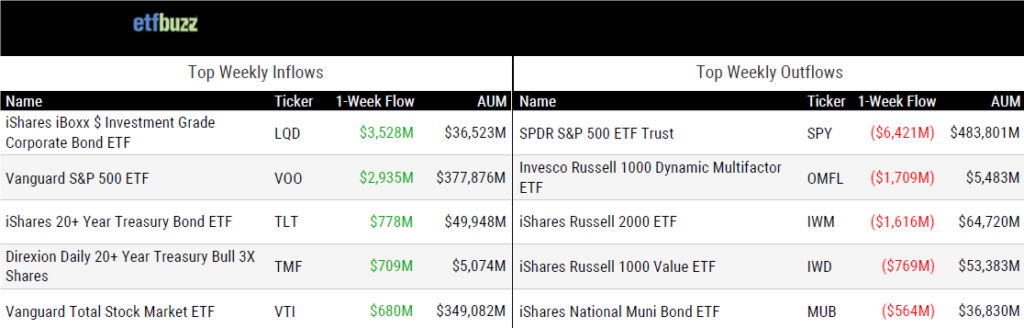

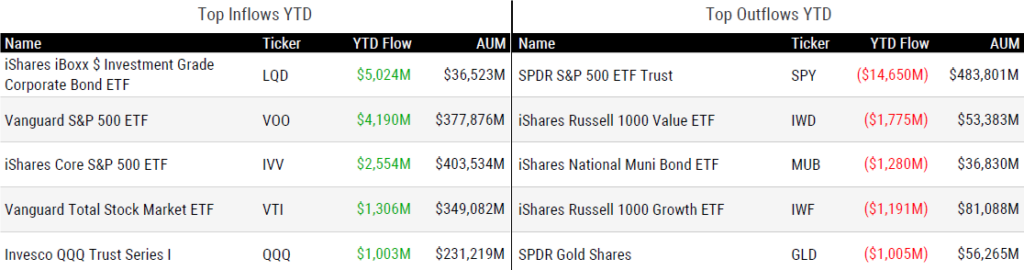

ETF Inflows & Outflows

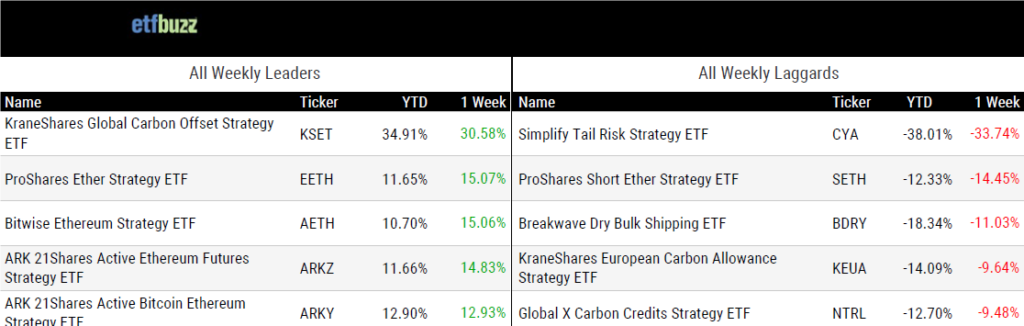

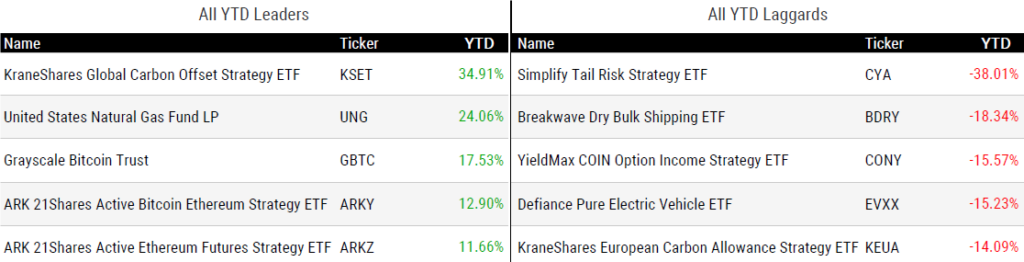

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/11/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Note: The story of the week (year?) was obviously the debut of spot bitcoin ETFs. Every major media outlet covered this saga ad nauseam, so I’m linking only a handful of my favorite pieces or ones offering my unique perspective. For those fatigued on the topic, I’ve also included a couple of non-spot bitcoin ETF reads for you as well!

Why a Bitcoin ETF Doesn’t Matter by Dave Nadig

“The arrival of the bitcoin ETFs doesn’t actually change anything in the crypto space. The U.S. remains singularly stupid in how we’re handling the regulatory framework for crypto.”

Spot bitcoin ETF ticker symbols are live. Here’s what investors are looking for after SEC approval. by Christine Idzelis & Andrew Keshner

“Given that there are so many horses in this race, you want to come out strong.”

Spot BTC ETF Seed Misconceptions by Dave Abner

“Whichever ETF you want to trade will have enough liquidity if you’re trading in size, and if you’re a small investor trading on the exchange, that seed money isn’t changing the spread or daily trading volume anyway.”

Spot Bitcoin ETFs Are Here. Should You Invest? by Bryan Armour

“Spot bitcoin ETFs are the best option on the fund market for bitcoin investors.”

How The IRS Will Tax Bitcoin ETFs by Shehan Chandrasekera

“If you sell your bitcoin ETF assets without holding them for a full year, the resulting short-term capital gains will be subject to ordinary income taxes.”

Vanguard’s Bitcoin ETF Snub Highlights Wall Street Divide by Joe Light

“Vanguard’s decision to shun the ETFs continues a longstanding aversion to funds that the company views as speculative or incompatible with long-term investing.”

ETFs in 2023: A Tale of Success and Failure by Mo’ath Almahasneh

“Fund providers take different approaches to product development. Some are cautious about launching new ETFs, while others swiftly respond to market trends, hoping they can attract assets.”

ETF share classes, active ETFs on industry’s radar by Kathie O’Donnell

“I kind of look at all these things as tributaries, and they all sort of flow into the ETF world and Fidelity is really starting to work these tributaries.”

ETF Tweet of the Week

This one wasn’t even close and, really, it doesn’t require any comment.

ETF Chart of the Week

While it wasn’t surprising to see a fee war break out among spot bitcoin ETF issuers, I don’t think anyone expected the lowest cost products to initially land at 0.25% or less. A mind-boggling seven issuers are competing at this level, with the cheapest ETF coming in at a paltry 0.19%. For context, the two largest physical gold ETFs, GLD and IAU, are priced at 0.40% and 0.25%, respectively. GLD and IAU have a combined $85 billion in assets. Bitwise’s Matt Hougan:

“ETFs allow every investor to access the market at prices paid by the largest institutions in the world.”

That’s for sure.

After a decade of broken private trusts trading at massive premiums & discounts, underperforming futures-based ETFs, “blockchain” ETFs, bitcoin ETF proxies like MSTR, crypto exchange fraud (FTX), and more, pure bitcoin price exposure is now available for 0.19%.

That is a monumental win for everyday investors.

Source: Bloomberg’s James Seyffart

Unchained Crypto

I had the pleasure of joining Bloomberg’s Eric Balchunas and James Seyffart, along with host Laura Shin, on Unchained. We covered pretty much everything surrounding the launch of spot bitcoin ETFs including initial trading volumes, cash creations and redemptions, and the SEC’s handling of the entire situation. As a bonus, this also features my full rant on why I have advocated for spot bitcoin ETFs to exist.

Bloomberg ETF IQ

On Wednesday, the day of spot bitcoin ETF approval, I joined Bloomberg’s Katie Greifeld, Scarlet Fu, and Eric Balchunas to offer some quick thoughts on what this long-awaited occasion means for the industry and financial advisors. Enjoy!