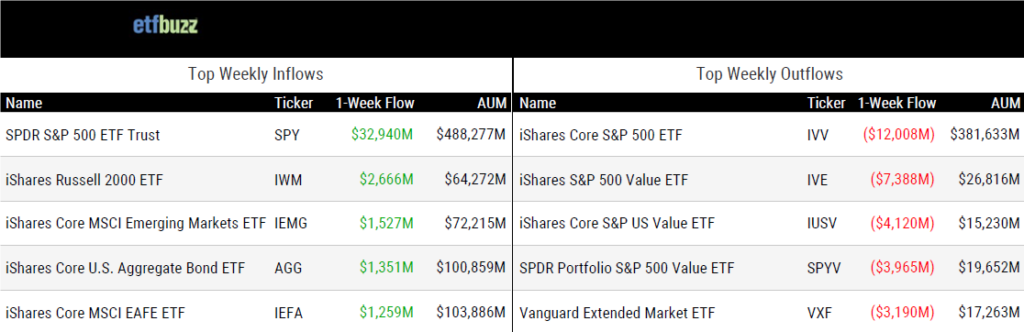

ETF Inflows & Outflows

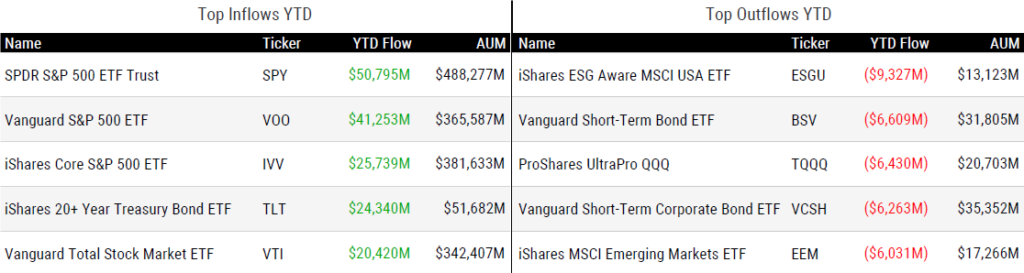

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/21/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

Early Wrap-Up of Key ETF Trends From 2023 by Todd Rosenbluth

“I think I’ll be eating very well in early 2024.”

(Note: Be sure to catch my conversation with Todd on this week’s ETF Prime, where we discuss whether the year’s biggest equity ETF stories can carry momentum into 2024.)

The Best and Worst New ETFs of 2023 by Bryan Armour

“This year’s nearly 500 exchange-traded fund launches have already broken the record set in 2021 (461).”

Star Stockpickers Are Coming to ETFs. Why They May Not Shine as Brightly. by Lauren Foster

“Picking winners ahead of a hot streak is as tough as ever.”

Bond Managers Seek To Win Back Clients Sitting On $6 Trillion In Funds by Silla Brush & Michael Mackenzie

“If you’re truly adding real alpha, there will always be a place for you in this industry. For the folks who haven’t, you might as well buy AGG.”

GE Pension Trust’s bet on hedge-fund like Simplify ETF may be game changer – analyst by Kathie O’Donnell

“The consultants are coming in and looking at it and recognizing that (the) strategies are identical, much lower price, much better liquidity.”

Is JEPI’s Wild Ride Coming to an End? by Jeff Benjamin

“Covered-call strategies thrive in an environment of a lot of uncertainty and bearishness.”

6 ETF Investing Predictions for 2024 by Zachary Evens

“Exchange-traded funds are poised to build on their 2023 successes in 2024.”

SEC tells spot bitcoin ETF hopefuls to make final changes by year-end -sources by Suzanne McGee & Hannah Lang

“The two executives who participated in Thursday’s meetings with SEC officials said the agency indicated it could grant approval in the first few business days of 2024.”

The spot bitcoin ETF race could quickly reach your 401(k) retirement plan by Cheryl Winokur Munk

“Employers will be very reticent about being the first ones out there to allow this.”

ETF Tweet of the Week

The first spot bitcoin ETFs have yet to launch, but the marketing war around these products is already heating up. Bitwise released the “most interesting bitcoin ad in the world” last week. They were followed by a creative ad from Hashdex. What did both ad campaigns have in common? These crypto-native firms were touting what I call “crypto street cred”. Everyone knows it will be extremely difficult for these firms to compete with larger asset managers such as BlackRock, Invesco, and Fidelity. One way for firms like Bitwise and Hashdex to differentiate is by essentially posing the following question to investors and financial advisors:

“Who would you rather rely on for bitcoin research, analysis, etc? BlackRock, who ‘specializes’ in every asset class under the sun or our firm – where all we do is eat, sleep, and breathe is crypto.”

Will it work? Only time will tell.

Who says it better? #bitcoinisinteresting @Matt_Hougan https://t.co/wantGiAIqJ pic.twitter.com/LE3DlJus3Q

— Bitwise (@BitwiseInvest) December 18, 2023

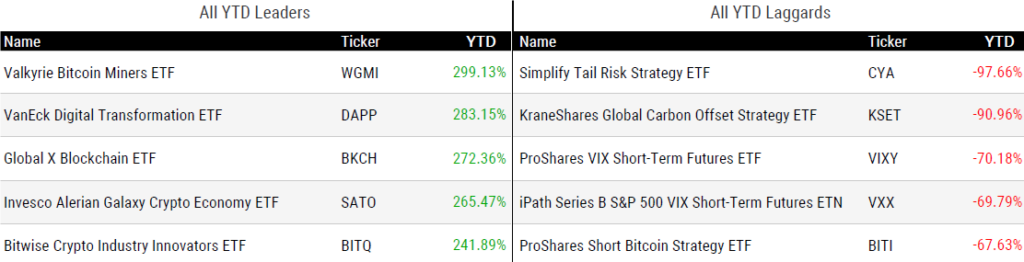

ETF Chart of the Week

Another week, another ETF milestone. This time, the SPDR S&P 500 ETF (SPY) raked-in the largest one-day flow ever for any ETF. On December 15th, $21 billion flowed into the industry’s first ETF, which debuted in 1993. State Street’s Matt Bartolini told Bloomberg:

“The flow that we saw on Friday was 100% organic from clients and investors and traders. It also reflects the massive Santa Claus rally that we have seen in the past few days — so momentum-trading going into SPY as well.”

That momentum has continued and investors have now added more than $42 billion to SPY in December, which puts the ETF on track for the biggest monthly flow on record.

(Note: Matt joined me on this week’s ETF Prime to further discuss the SPY milestone and accelerating fourth quarter ETF flows.)

Source: Bloomberg’s Emily Graffeo & Vildana Hajric