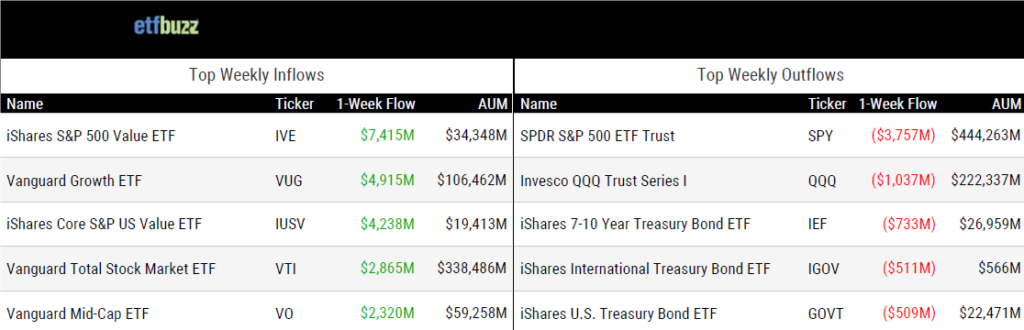

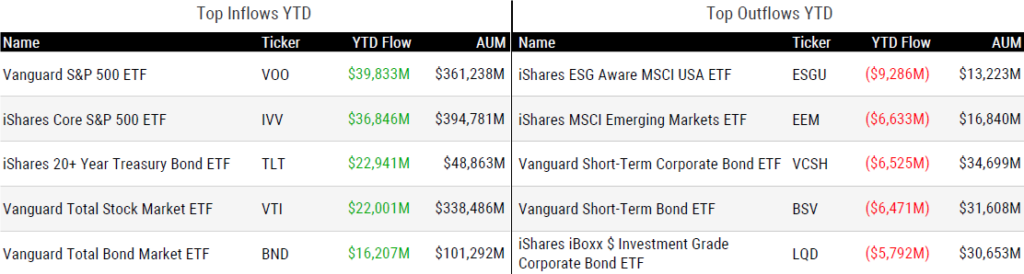

ETF Inflows & Outflows

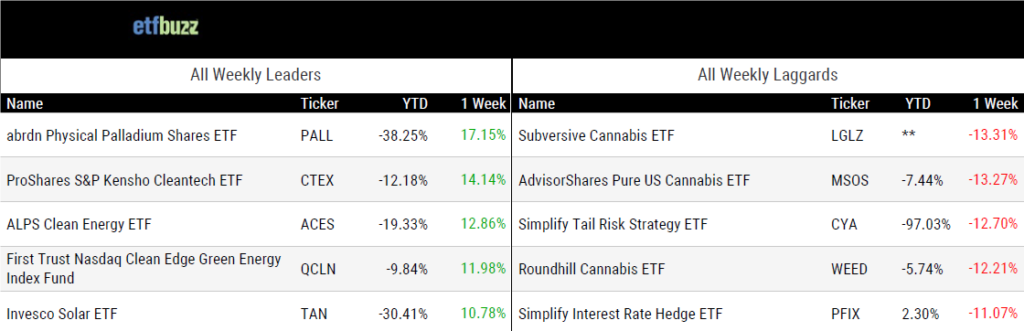

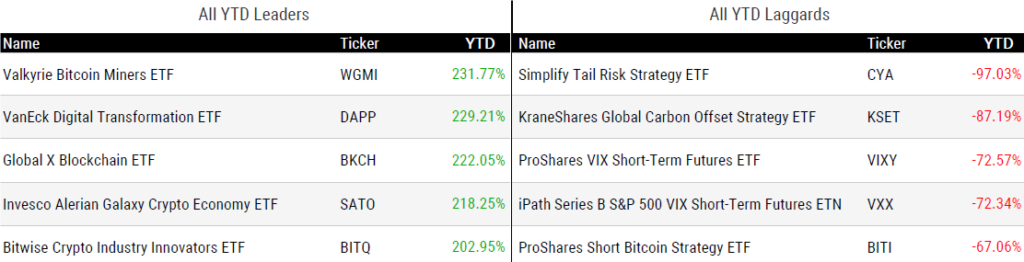

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/14/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

Volatility ebbs as $26bn pours into option-writing ETFs by Will Schmitt

“The zeitgeist of the retail ETF investor has moved on to income-based products and options-based products.”

Simple ETFs offer best opportunity for new SSGA exec by Ari Weinberg

“Historically, SSGA has focused on liquidity and institutional investors, but there’s still opportunity in the low-cost portfolio products.”

Is there an ETF version of that? Mutual funds fall out of favor with advisors by Emile Hallez

“More than half of financial advisors now say they prefer ETFs over mutual funds if the same strategies are available from their favorite asset managers.”

Study finds ‘new source of tax efficiency for ETFs’ by Tobias Salinger

“Since the wash-sale rule can be avoided using paired ETFs, the current tax policy effectively subsidizes ETFs.”

Lucky 13? Where spot bitcoin ETF proposals stand ahead of judgment day by Ben Strack & Katherine Ross

“The issuers hoping to launch these products range from the largest asset manager in the world, to smaller, more specialized firms.”

(Note: Valkyrie’s Steven McClurg joined me on this week’s ETF Prime to offer an update on the spot bitcoin ETF Race).

Almost Entire $8 Trillion ETF Market Hinges on a Few Key Firms by Linly Lin and Sam Potter

“For a majority of funds, more than 90% of all money entering or exiting funnels through three APs or fewer.”

TMX Group Announces Agreement to Acquire VettaFi

“Today marks an exciting chapter in VettaFi’s transformation.”

ETF Tweet of the Week

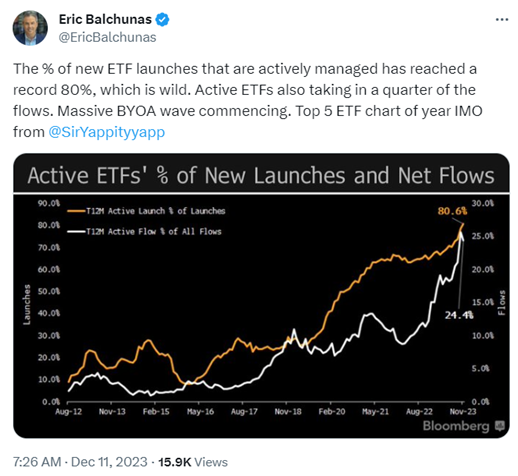

Without question, the rise of actively managed ETFs is one of the industry’s biggest stories in 2023. Bloomberg’s Eric Balchunas offers the receipts: 80% of new ETF launches this year are actively managed and the products have taken in nearly 25% of all industry flows. Balchunas notes that “BYOA”, or bring your own assets, is a critical driver behind the growth as traditional mutual fund firms transfer clients/assets from their existing mutual funds to the new ETFs.

ETF Chart of the Week

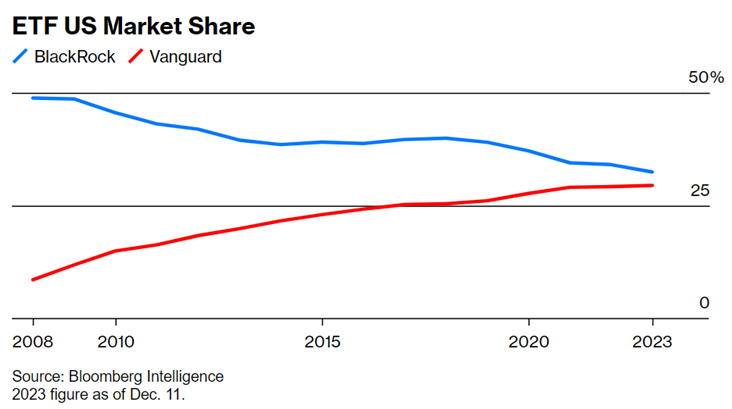

Bloomberg’s Katie Greifeld highlights that Vanguard is closing in on BlackRock’s ETF crown. Vanguard has taken in $137 billion this year compared to BlackRock’s $80 billion. 2023 will mark the fourth consecutive year that Vanguard has topped BlackRock on the ETF leaderboard. Notably, Vanguard only offers 83 ETFs versus BlackRock’s 400+. What could possibly help BlackRock fend off Vanguard? Bloomberg’s Athanasios Psarofagis:

“BlackRock can buy some time with two things: bonds and Bitcoin. BlackRock still has about 40% share of fixed income, while Vanguard has about 25%, and a way more diverse lineup. Also the Bitcoin ETF, if that gets approved, I’m sure BlackRock will take in a really good amount—probably a few billion dollars—into their product, and that’s definitely an area Vanguard won’t touch.”

Could a spot bitcoin ETF save the day for BlackRock? Perhaps in the short-term, but I wouldn’t bet against Vanguard ultimately ascending to the ETF throne.

Source: Bloomberg’s Katie Greifeld