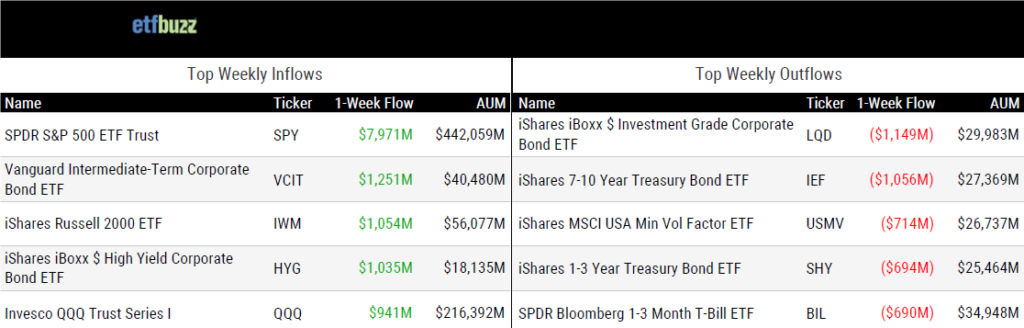

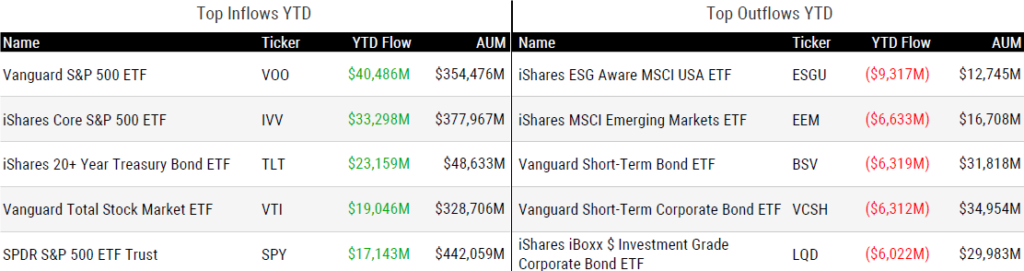

ETF Inflows & Outflows

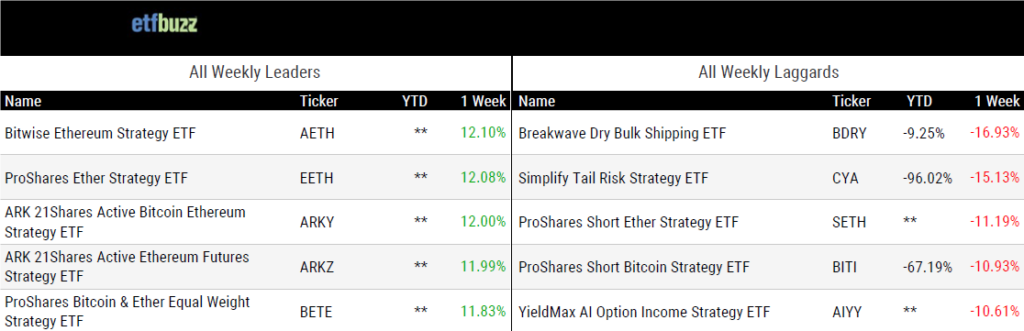

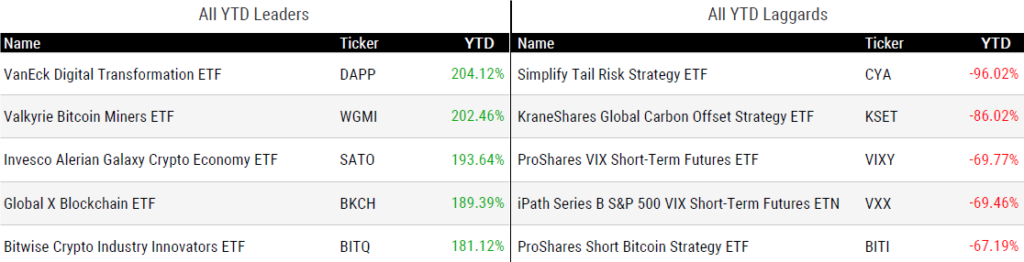

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/7/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

There’s now a juiced-up way to get 4 times the return of the S&P 500 — but it comes with many risks by Jesse Pound

“Their performance over longer periods of time can differ significantly from their stated daily objectives.”

Vanguard Is Launching a New Bond Fund. It’s Part of a Bigger Bet on Active ETFs. by Lauren Foster

“When people say: Is Vanguard an index shop or an active shop? I say we’re a fixed-income shop – we have both and there’s room for both in people’s portfolios.”

US bitcoin ETF issuer talks with SEC have advanced to key details – sources by Suzanne McGee & Hannah Lang

“The SEC has been engaging with issuers on substantive details, some of which are usually discussed near the end of an ETF application process.”

Amid crumbling ‘factor’ fund pricing power, Fidelity slashes factor ETF fees; low-factor-price Avantis soars to $30 billion in third year, and new study says factors are barely a factor in returns by Oisin Breen

“Most factor strategies do not add much value. A lot out there is just marketing, but not more than that.”

Big for 2024? Concentrated ETFs, Natixis Says by Nick Elward

“Investors want their active managers to take decisive bets on their top ideas.”

Bursting of Pandemic-Stock Bubble Fuels Big Wave of ETF Closures by Vildana Hajric & Isabelle Lee

“This is good in my opinion – we need to be reminded there are rules. Future launches will have to be more well-thought-out.”

ETF Tweet of the Week

Another week, another ETF milestone. 2023 will now go down as a record-breaking year for ETF launches. 478 new products have come to market this year, surpassing the 477 launches in 2021. Approximately 80% of those ETFs are actively managed – a clear growth spot for the industry. That said, ETFs have also now hit their second-highest level of annual closures. ETF.com’s Sumit Roy:

“The large number of closures this year are the result of the large number of launches in recent years. Not every fund idea is going to gain traction with investors and those that aren’t profitable for their issuers tend to be shut down eventually.”

With ETFs growing wild in recent years, some pruning is beneficial to help promote the industry’s future health.

(As an aside, be sure to catch my conversation this past week with Morningstar’s Ben Johnson where we look back on the year in ETFs!)

It's official.

— Ben Johnson, CFA (@MstarBenJohnson) December 6, 2023

As of yesterday we've seen a record number of new ETF launches in 2023.

We've also seen the second-highest number of closures for any calendar year. pic.twitter.com/VRPkS3cL2S

ETF Chart of the Week

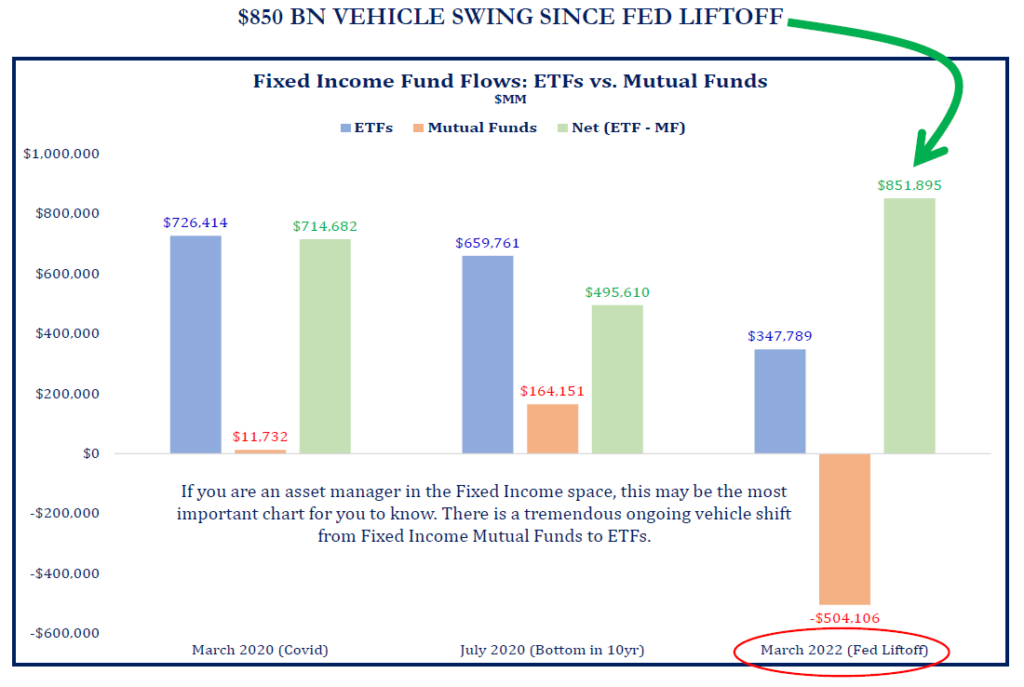

Strategas’ Todd Sohn, an “ETF Chart of the Week” regular, notes there has been an $850 billion swing from bond mutual funds to bond ETFs since the Fed began raising rates in March 2022. There are numerous drivers here including tax loss harvesting, lower fees, and expanding product choice (see “Tweet of the Week” above).

Source: Strategas’ Todd Sohn