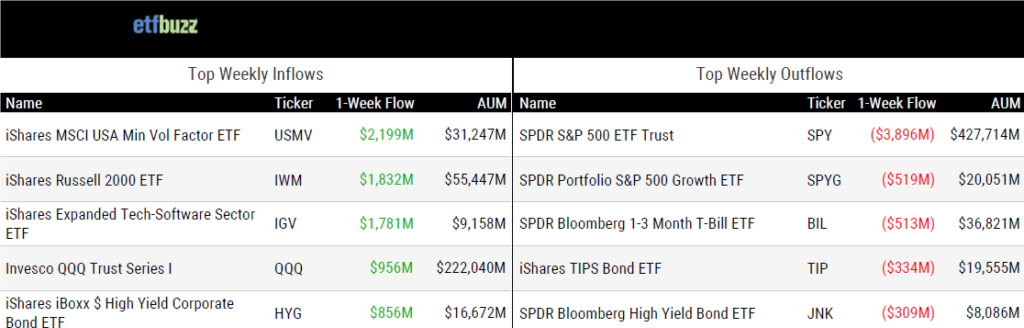

ETF Inflows & Outflows

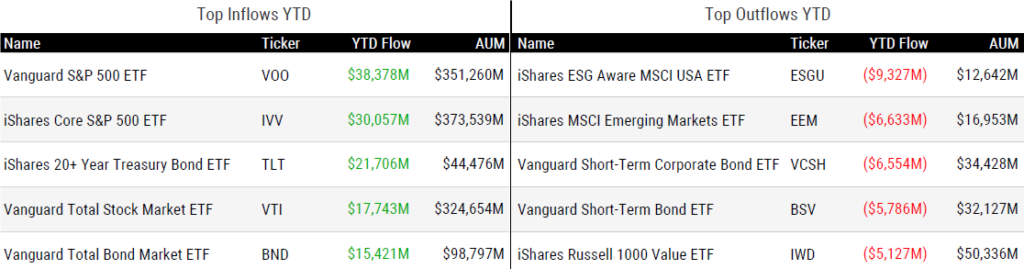

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 11/23/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETFs Take Another Big Bite Out of Mutual Fund Market Share by Jeff Benjamin

“We’re asking ourselves what investors hate more, active management or the mutual fund structure, and it seems like it’s a little of both.”

What’s Behind Dimensional’s ETF Success Story by Holly Deaton

“It would be really weird if we launched ETFs and none of our existing investors wanted to move over.”

White-label ETF provider agreement highlights Europe challenges by Steve Johnson

“We believe it is pretty amazing for an asset manager to be able to launch ‘40 Act and Ucits on or about the same day.”

All About Index Concentration by Phil Mackintosh & Robert Jankiewicz

“Index concentration also matters for the index funds that are designed to track their benchmarks.”

Bitcoin ETF Hype Has Wall Street Eyeing $100 Billion Crypto Potential by Vildana Hajric

“Sober-sounding tickers like IBTC and BTCO suggest the products will be aimed at the advisory market.”

ETF Tweet of the Week

While the “Big Three” ETF issuers (BlackRock, Vanguard, and State Street) still control nearly 76% of the industry’s market share, flows over the past several years indicate that other issuers are beginning to make up some ground. Bloomberg’s Eric Balchunas notes that 45% of ETF inflows this year are from issuers outside of the “Big Three”. Leading the charge are firms such as JPMorgan ($31bil in 2023 inflows), Dimensional ($27bil), and Avantis ($11bil).

In a nutshell, the rise of low cost, systematic, actively managed ETFs (versus traditional active stock picking ETFs) has been the primary catalyst. State Street’s Matt Bartolini explains the recent phenomenon to the Financial Times:

“Investors have always been price sensitive. There is more comfort with having active ETFs in your portfolio. There’s more of them, there is more choice and there are far more products that have an identifiable track record.”

In other words, as issuers continue rolling out low cost, active ETFs, it’s reasonable to expect the recent flow trends to remain intact. The key here is “low cost”.

ETF issuers outside of The Big Three (aka "The Other Guys") took in 45% of the net flows this year, which is their biggest grab ever and up from a mere 10% less than a decade ago, led by JPM, DFA, Avantis, Buffer ETFs.. interesting development caught by @SirYappityyapp pic.twitter.com/NDuKB5QBGy

— Eric Balchunas (@EricBalchunas) November 22, 2023

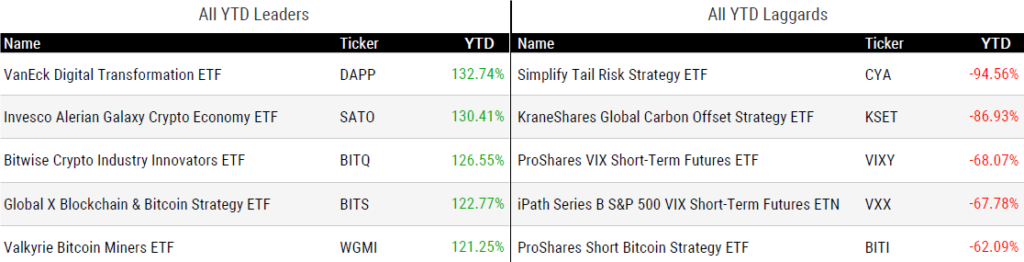

ETF Chart of the Week

The below chart isn’t specifically related to ETFs, but I found it quite eye-opening. While ETF issuers brutally battle it out in the Terrordome, money market funds are sitting back and quietly raking in boatloads of cash. The average money market fund holds $21 billion in assets. That is larger than all but 19 ETF issuers (there are approximately 330 ETF issuers overall). What’s more is that money market funds aren’t exactly cheap. Some of the largest funds are charging 30 to 60 basis points, a feat that many ETF issuers can only dream of for such a basic product.

Source: Strategas’ Todd Sohn