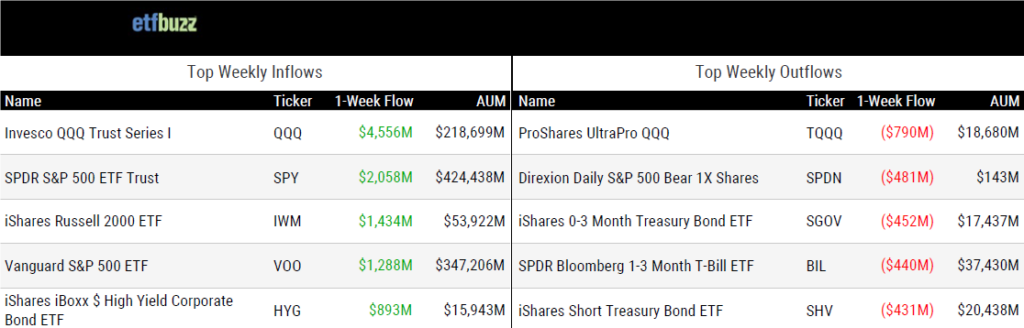

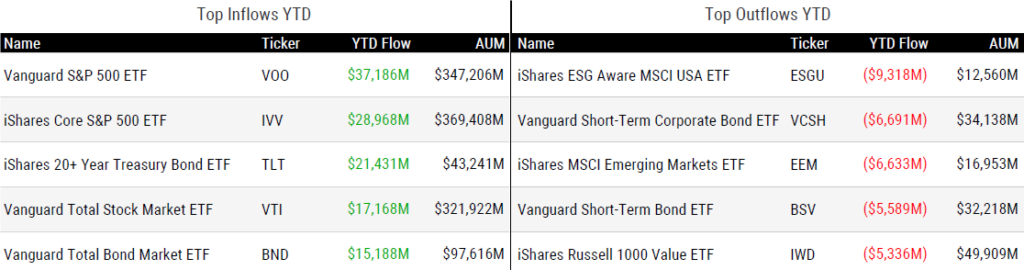

ETF Inflows & Outflows

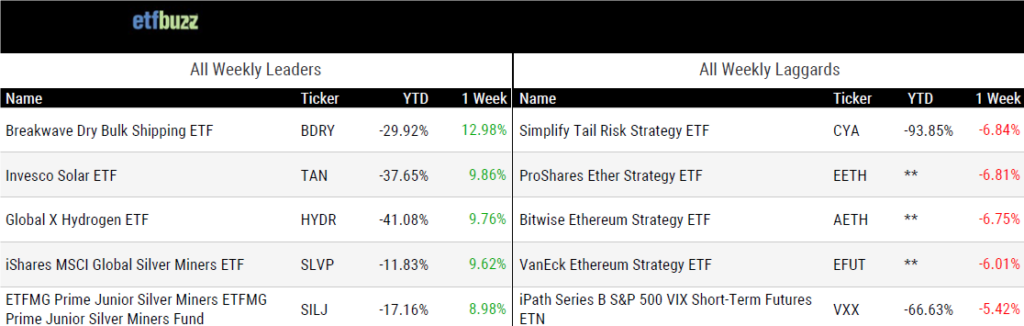

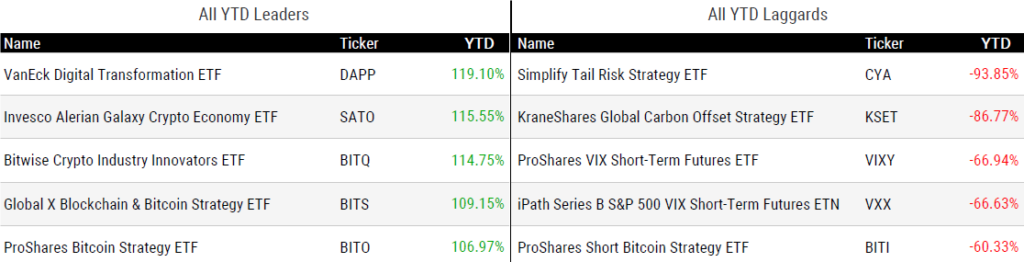

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 11/16/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

MFS, home of first-ever mutual fund, jumps into ETFs by Brian Ponte

“MFS is the largest US mutual fund complex that does not offer ETFs.”

GMO launches its first ETF by Kathie O’Donnell

“The ETF was launched in partnership with the new Goldman Sachs ETF Accelerator.”

Here’s Why Active ETFs Are So Hot Right Now by Ryan Jackson

“In the mad dash to ETFs, investors left actively managed mutual funds behind.”

A $100 Billion ETF Flood Offers Little Solace to Active Managers by Katie Greifeld

“A look under the hood of popular ETFs shows the boom is almost entirely taking place in passive-looking trades.”

Loyal ETF Investors Rewarded With No Tax Bills by Todd Rosenbluth

“81% of U.S. active equity mutual funds paid out taxable capital gains over the past five years.”

Are Bonds or Bond ETFs Best for You? by Allan Roth

“That opportunity cost of earning a below market rate is essentially the equivalent of the loss on either of those two bond ETFs.”

ETF Tweet of the Week

Last week, I explained how there was a small window open where the SEC could issue 19b-4 approval orders allowing spot bitcoin ETFs to list and trade on their respective exchanges. Alas, it was not meant to be. The SEC delayed a decision on several filings this week (Hashdex, Global X, & Franklin Templeton) and it looks increasingly likely that spot bitcoin ETF approval won’t come until January at the earliest. Bloomberg’s Eric Balchunas indicated the SEC’s Division of Trading of Markets had recently engaged with exchanges on the matter and noted a preference for cash versus in-kind ETF creations. The bottom line is that, ten years after the Winklevoss Twins filed for the first spot bitcoin ETF, the SEC is still not entirely comfortable with the backend plumbing involved here.

Who is comfortable? ETF issuers.

In the meantime, investors can buy bitcoin on publicly-traded companies such as Coinbase and Robinhood.

it's been a ten year dress rehearsal. we're ready for the main event.

— Sonnenshein (@Sonnenshein) November 13, 2023

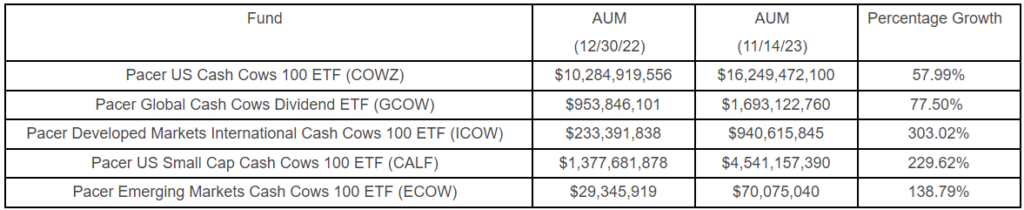

ETF Chart of the Week

I always love highlighting ETF success stories, particularly under-the-radar ones. Pacer ETFs launched in 2015 and has quietly crossed over $30 billion in assets under management, led by the $16 billion Pacer US Cash Cows ETF (COWZ). In fact, the Pacer Cash Cows Index® ETF Series overall has grown to nearly $24 billion. Bloomberg’s Eric Balchunas (once again) notes the Pacer US Small Cap Cash Cows 100 ETF (CALF) has taken in money for 42 months straight(!), a Vanguardian-type feat. Pacer ETF Distributors President Sean O’Hara:

“Reaching the $30 billion mark in assets under management stands as a testament to our team’s commitment to client service and innovative investment solutions.”

Pacer is clearly doing something right.

CNBC ETF Edge Recap

I had the pleasure of joining CNBC’s Bob Pisani and GMO’s Tom Hancock this week to discuss the rise of active ETFs, growth versus value stocks, the record pace of ETF launches, Treasury ETF flows, and more. Enjoy!