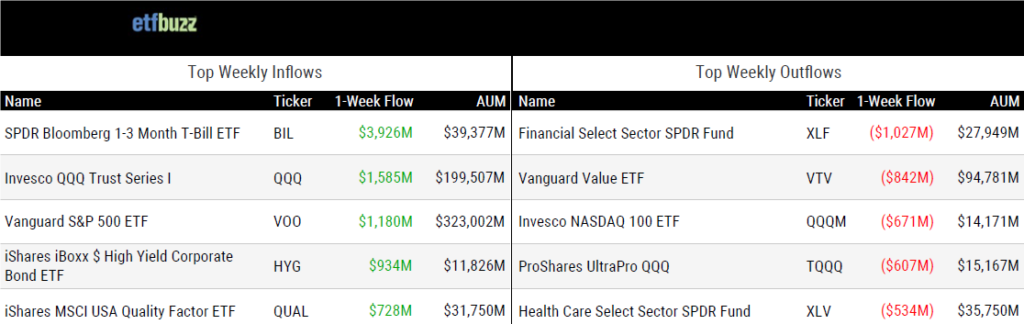

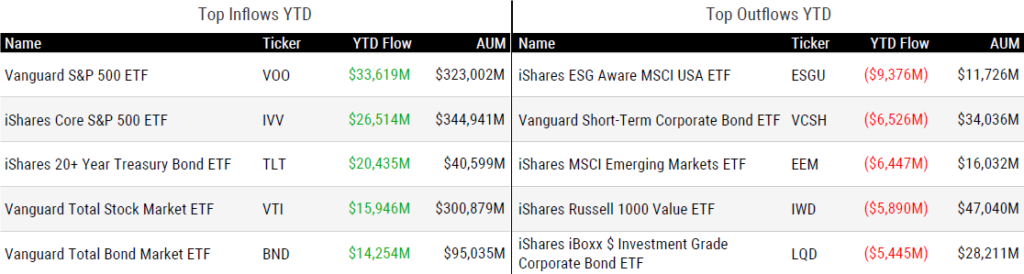

ETF Inflows & Outflows

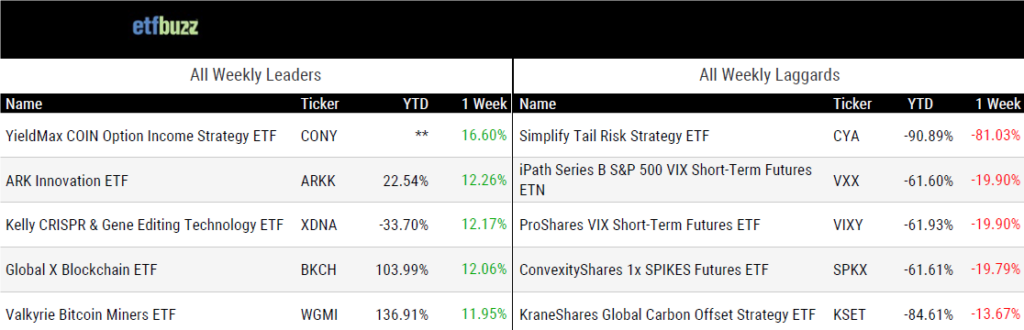

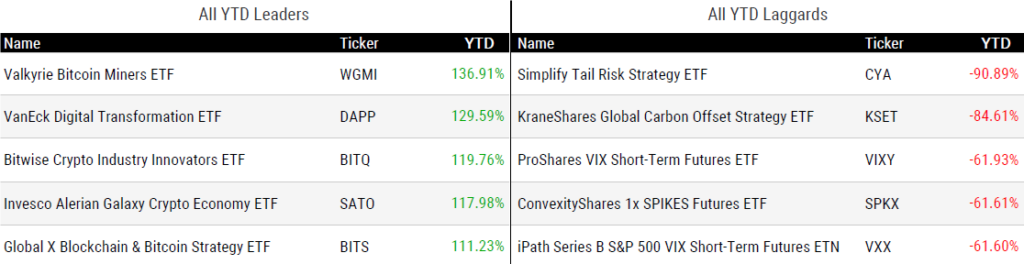

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 11/2/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETF debuts set to break 2021 record as active-fund issues jump by Suzanne McGee & Bansari Mayur Kamdar

“Most of the trends that have fueled explosive ETF growth in recent years are expected to remain intact heading into 2024.”

Active ETFs Ring Up Record Year by Gabe Alpert

“The new crop of active ETFs doesn’t herald a return to traditional stock picking.”

VettaFi Voices On: 2023’s Record Crop of New ETFs by Heather Bell

“ETFs are not just investment products, but solutions to unsatisfied investment needs.”

Which Popular Funds Could Hand Their Shareholders Big Tax Bills? by Stephen Welch

“Get ready for capital gains distribution season, mutual fund investors.”

Bond Ladders’ New Appeal Puts Spotlight on Target-Maturity ETFs by Jeff Benjamin

“They are designed to mature like a bond, trade like a stock, and are diversified like a fund.”

(Note: Another good read on building bond ladders with ETFs can be found here).

Will Hashdex’s ‘Undeniable’ Distinctions Help Win Bitcoin ETF Race? Some Analysts Think So by Amitoj Singh

“A filing for a strategy change of a futures ETF allows an issuer to take an SEC-approved approach and make changes to directly address SEC concerns around holding spot.”

Can Cathie Wood’s Ark conquer Europe? by Chris Flood & Emma Boyde

“Europe is a tough nut to crack.”

(Note: VettaFi’s Lara Crigger and I discussed the future of Ark’s ETF business on this week’s ETF Prime).

ETF Tweet of the Week

Much ink has already been spilled on the iShares 20+ Year Treasury Bond ETF (TLT). That said, this ETF will be a strong contender for the industry’s story of the year. Bloomberg’s Eric Balchunas notes TLT’s trading volume hit nearly $100 billion last month, a record for a bond ETF. Balchunas:

“This may be the first time ever where a volume record was broken and it wasn’t around a mass freak out/crisis situation, eg most volume records were set in March 2020. Conversely, TLT was up 2% in Oct. Shows just how much it has become the focal point of Fed/rate betting.”

$TLT traded a stunning $99b worth of shares in October, which is a new world record for a bond ETF in terms of monthly volume (old record was HYG in March 2020). Nice work everyone. pic.twitter.com/Z5vFg3Vex7

— Eric Balchunas (@EricBalchunas) November 1, 2023

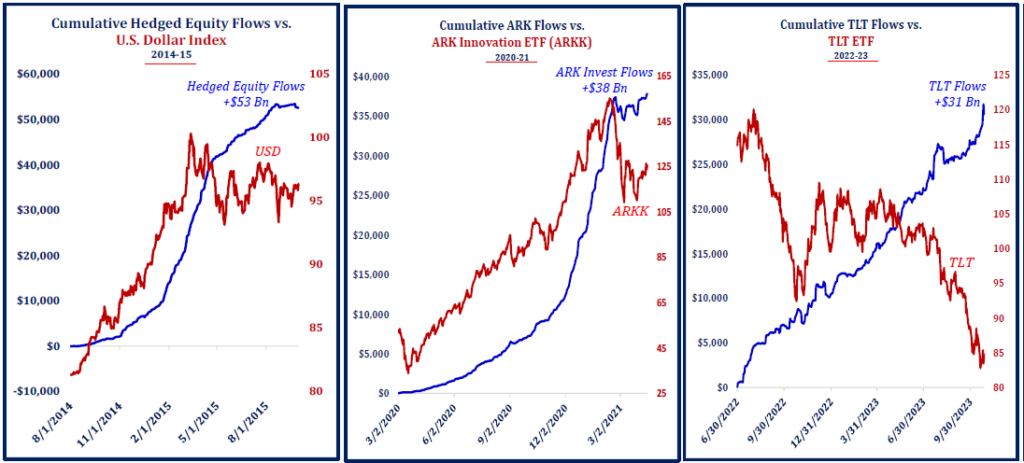

ETF Chart of the Week

Speaking of TLT, Strategas’ Todd Sohn makes an interesting comparision to past ETF manias including hedged equity products (such as the WisdomTree Japan Hedged Equity ETF – DXJ) and the ARK Innovation ETF (ARKK). So far this year, TLT has taken-in a whopping $20.5 billion – good enough for third most among all ETFs. Meanwhile, it has delivered a negative 10% return (down about 40% since December 2021). Sohn:

“What do currency hedged, ARK products, and TLT have in common? Vertical-like inflows as investors piled into them. Clearly different portfolio applications, but perhaps similar investor psychology.”

Sohn goes onto say, “While not an apples-to-apples comparison, we’re reminded of prior ‘crazes’ into hedged equity (2014) and ARK (2020) products. Both eventually burned a fair contingent of holders.”

Will TLT investors suffer the same fate?

Source: Strategas’ Todd Sohn