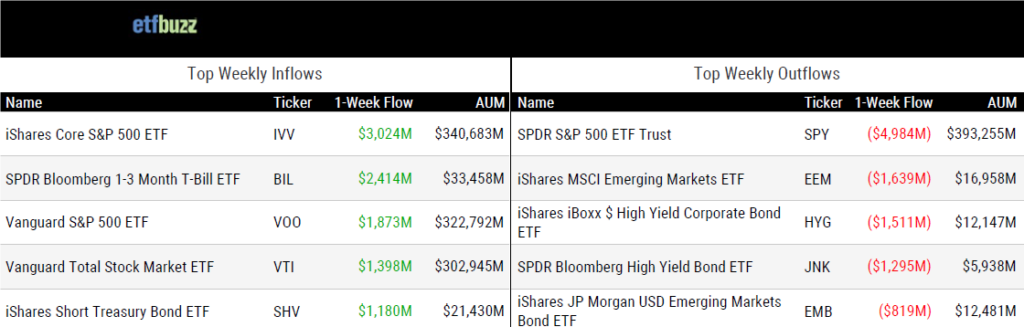

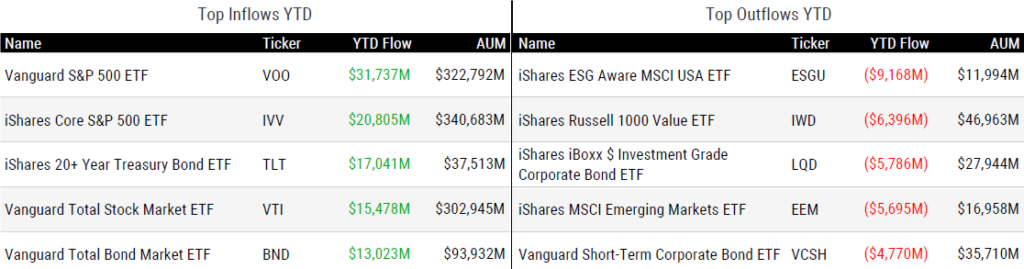

ETF Inflows & Outflows

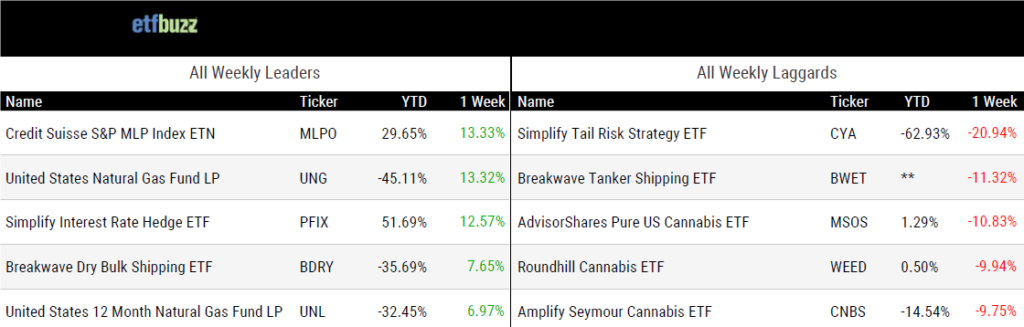

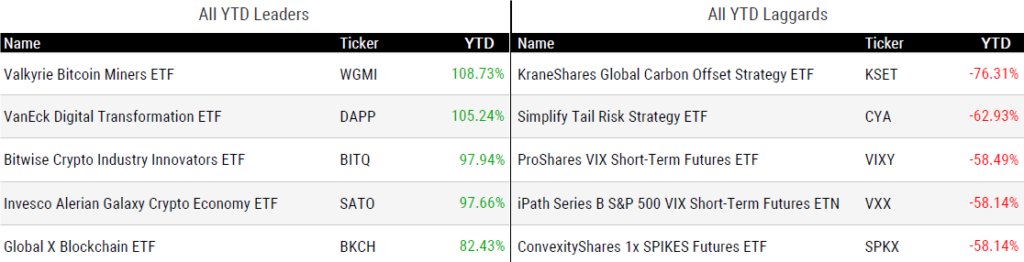

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 10/5/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

2023’s Overactive Active ETF Flows Are Mostly a Mirage by Lara Crigger

“Most of those flows have gone into fewer than three dozen ETFs, leaving the other 800+ ETFs to fight over the scraps.”

Should You Own a Covered-Call ETF Like JEPI? by Lan Anh Tran

“This is hardly the ideal payoff profile: capped upside with a limited buffer to the downside.”

Citigroup Says as Many as 50% of All ETFs Lose Money for Their Issuers by Katie Greifeld

“It’s a painful byproduct of the industry’s seemingly never-ending fee war.”

Asset managers see ETFs as biggest opportunity among investment vehicles – Cerulli by Kathie O’Donnell

“For the first time, ETFs are viewed by asset managers as affording the biggest opportunity among investment vehicles.”

Ether ETF Debut Leaves Small Investors Underwhelmed by Vicky Ge Huang & Paul Kiernan

“The seven funds combined had less than $7 million in trading volume.”

(Note: As I predicted back in early August, demand for ethereum futures ETFs appears fairly limited. Bitcoin futures ETFs have less than $1 billion in total assets, with much of that coming in the first few days post-launch in October 2021. There was no reason to think ethereum futures ETFs would light the world on fire, particularly given the much less frothy crypto market right now. Regardless of the market environment, the bigger issue is that investors simply want the real deal – spot ETFs.)

Goldman Sachs wades into third-party ETF business by Steve Johnson

“The ETF ecosystem can be hard to navigate so having friends to lean on can help a new entrant get to market faster and smarter.”

The Paradox of TLT’s Record Inflows and Nosedive Performance by Jeff Benjamin

“Even BlackRock, the issuer of TLT, acknowledged the ‘counterintuitive’ nature of the flows.”

ETF Tweet of the Week

Since the first Fed rate hike in March 2022, the iShares 20+ Year Treasury Bond ETF (TLT) has taken in over $33 billion in new investor money (nice visual here via Bloomberg’s Eric Balchunas). That includes a whopping $17 billion this year, the third most inflows of any ETF in 2023. All of this is despite the fact that TLT is down 33% since the Fed began raising rates, including a 13% decline so far this year. Who had long duration US Treasuries as an investor cash incinerator?

As $TLT and $ZROZ duration bond funds fell in price, their assets under management kept increasing as investors just kept pouring their funds in.

— Lyn Alden (@LynAldenContact) October 3, 2023

Just getting gradually run over in a mostly orderly way. pic.twitter.com/rhaMK0ienq

ETF Chart of the Week

69 ETFs launched in September, the highest total ever for the still expanding industry. Strategas’ Todd Sohn, who provided the below chart, succinctly explained to Bloomberg:

“It’s just exhibiting the affinity investors have for ETFs and issuers coming to address those needs – from all across the capital markets spectrum too.”

Already in October, another 25 ETFs have launched including 6 ethereum-futures related ETFs. Morningstar’s Ben Johnson noted there are now nearly 300 brand names in the US ETF space, which represents approximately 35% of all brands in the mutual fund and ETF business. In other words, 65%(!) of fund brands have zero ETF presence! Expect more ETF launches.

Source: Strategas’ Todd Sohn