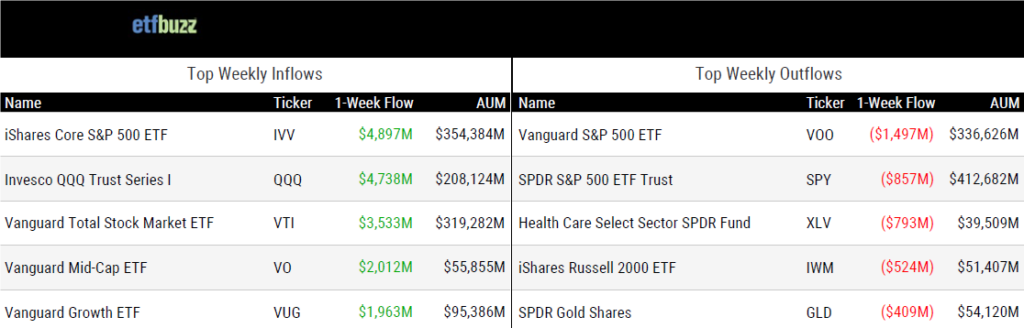

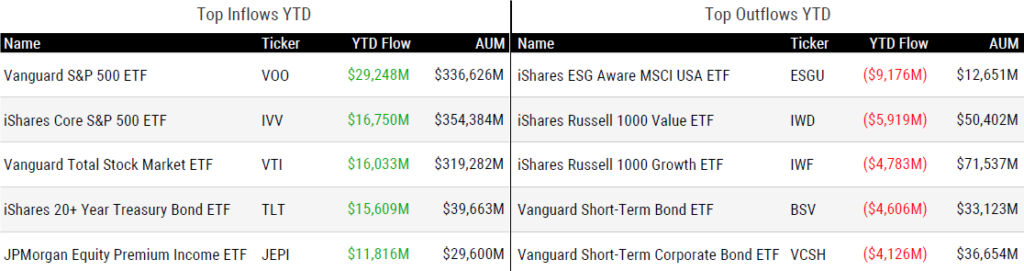

ETF Inflows & Outflows

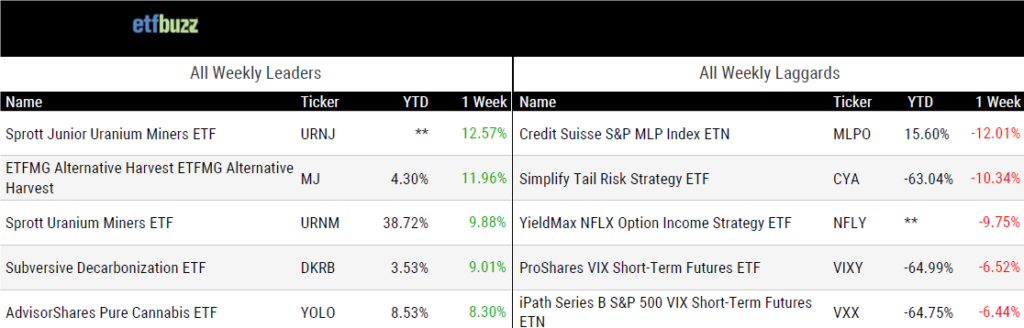

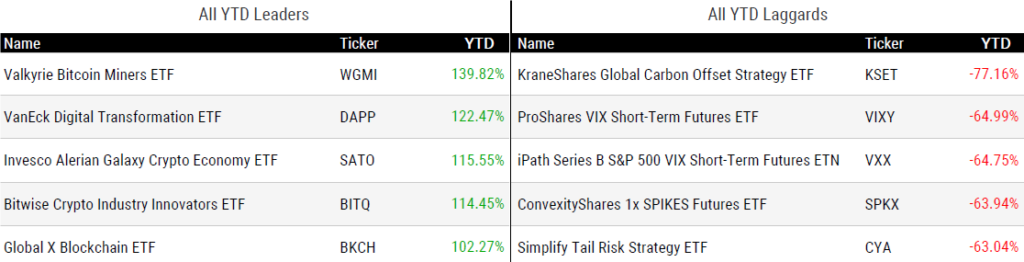

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 9/14/23; performance data excludes leveraged and inverse products

Weekly ETF Reads

What’s The Right Fee For an ETF? by Cinthia Murphy

“There are many factors to consider when pricing – or repricing – ETFs for a competitive edge.”

First ETF to trade in zero-day options launches in the US by Steve Johnson

“The daily notional trading value of 0DTE options has skyrocketed to about $1tn.”

Single stock and covered call come together in ETF line by Emile Hallez

“The investment management industry is adept at inventing products and creating new and creative ways of pitching them to the investing public at large.”

How A Bitcoin S-1 Becomes An ETF by Steven Ehrlich

“Spot bitcoin ETFs are considered to be commodity ETFs.”

Room for only one ‘superstar’ spot bitcoin ETF, analyst says by Kathie O’Donnell

“It’s going to be brutal.”

The Arm IPO is here, but many ETFs will not be buyers by Bob Pisani

“Some investors who would like to get immediate exposure to the Arm IPO through ETFs may be disappointed.”

Ramaswamy’s Strive: Not Just Another Anti-Woke Firm by Jeff Benjamin

“Less than 3% of the total capital BlackRock manages is invested in ESG-linked products, but they’re using 100% of the capital base to vote in favor of ESG mandates related to climate change and DEI agendas.”

Optimizing Future ETF Income by Bryan Armour

“Understanding the trade-offs of different income strategies should help investors of all circumstances make better investing decisions.”

NASDAQ 100 ETF Exposure Comes in Many Forms by Todd Rosenbluth

“While there are lots of reasons to celebrate the growth stocks inside the NASDAQ 100 index, some advisors might be looking for alternatives to the market-cap weighted index ETFs that reduce their risk profile.”

ETF Tweet of the Week

Tom Lombardi, Adjunct Professor at Pepperdine, offers a nice snapshot of where various bitcoin investment opportunities fall within four categories: claim to assets, transparency, price tracking, and fees. It’s noteworthy that the most compelling option (besides self & hosted custody) is one the SEC won’t allow to come to market (related, here’s a good read on the suboptimal futures-based bitcoin ETFs).

/ I just started writing a new, new paper on bitcoin investment opportunities for US advisors. Contemplating the following figures for illustration.

— Tom Lombardi | Professor Degen (@tomlombardi) September 13, 2023

Tell me again, why is $MSTR – a stock proxy to bitcoin – on anyone's radar? pic.twitter.com/0YT343hffX

ETF Chart of the Week

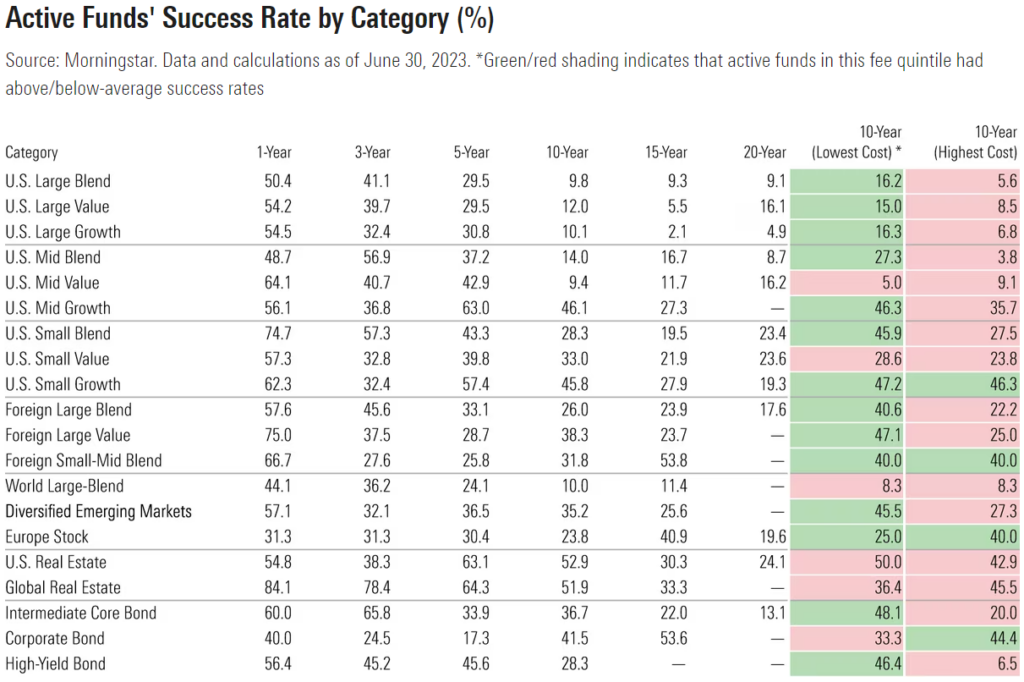

One of the biggest ETF stories over the past two years is the rise of actively managed ETFs, which have taken in outsized inflows and dominated new launches. With momentum in this category expected to continue, it raises the age-old question: Is active management actually good for investors? There are obviously many variables involved, but the data has historically (and overwhelmingly) answered “no”.

However, the success rate of active managers in beating their benchmarks is on a recent upswing. From Morningstar:

“Over the 12 months through June 2023, 57% of actively managed funds survived and beat their average passive peer, their highest success rate in years. Active strategies normally trail passive index rivals during market rallies, but strong security selection and some wobbly index returns set the stage for an unexpected active-fund renaissance.”

While this level of success is unlikely to continue, it should provide yet another boost to the active ETF boom.

Source: Morningstar’s Ryan Jackson