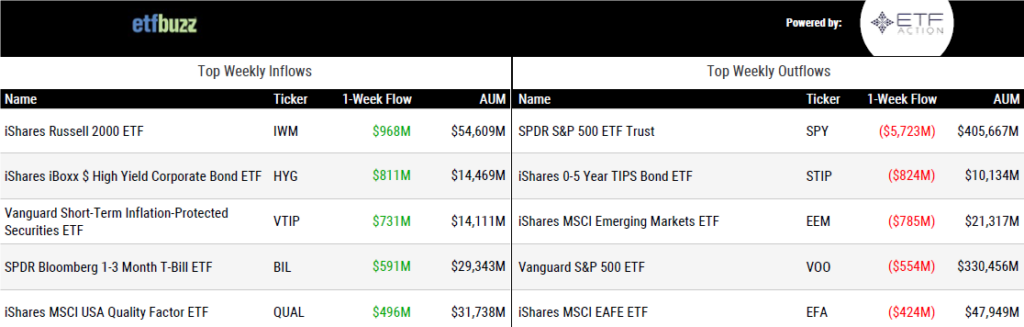

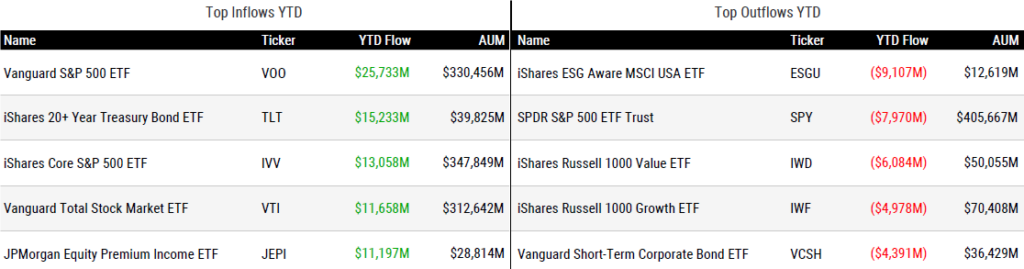

ETF Inflows & Outflows

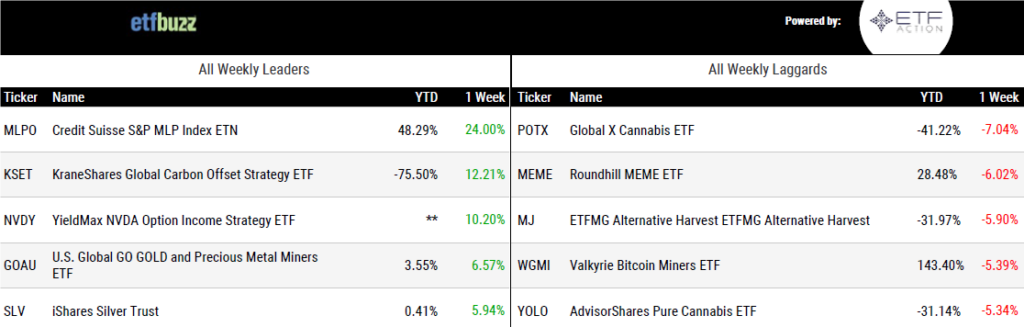

Performance Leaders & Laggards

Weekly ETF Reads

Single-bond ETF manager goes against current by asking SEC for mutual fund share class by Emile Hallez

“Mutual fund consumers get cut out of all the innovation happening in the ETF space.”

Jeremy Grantham’s GMO enters ETF space for the first time by Brian Ponte

“There is plenty of room for trusted managers offering active exposures.”

ETF Use Distinguishes Brokers From Financial Advisors by Jeff Benjamin

“Financial advisors continue to embrace ETFs, and they’re proud of it.”

The $7.4 Trillion ETF Industry Is Littered With One-Hit Wonders by Katie Greifeld and Vildana Hajric

“At least 28 firms — that run eight funds or more — have a minimum of 40% of their entire asset base in a single product.”

As potential crypto ETF ‘fee war’ looms, what will spot bitcoin ETFs cost? by Ben Strack

“ETF Terrordome in effect.”

The case for the tax-free conversion of SMAs into an ETF via Section 351 by Bob Elwood

“There are numerous nontax and tax advantages to an ETF structure.”

ETF Tweet of the Week

Morningstar’s Ben Johnson offers an excellent look at “Life After Mutual Funds” (click tweet to view the entire thread)…

“Life After Mutual Funds is about investors demanding proven strategies in wrappers that are most efficient for them. Mutual funds still have a place, but their role is diminishing. Future generations of investors will be ETF Native the same way Gen Z is tech native.”

1/9 – "Life After Mutual Funds"

— Ben Johnson, CFA (@MstarBenJohnson) August 22, 2023

Investors are allocating their incremental $'s to something other than mutual funds.

Over the 12 months through Jul. 31, 2023, investors pulled a net $702.4 Bil from mutual funds and added $530.6 Bil to ETFs. (Source: Morningstar Direct) pic.twitter.com/ib25qB6ZbH

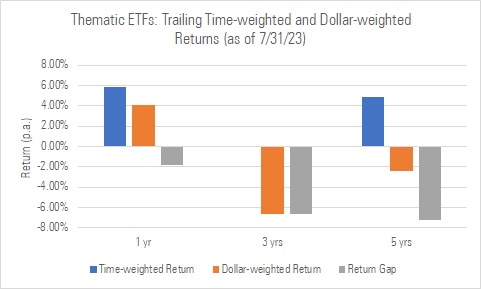

ETF Chart of the Week

Bloomberg recently noted that thematic ETFs have experienced $2.6 billion in outflows this year after a similar exodus in 2022. In 2020 and 2021, thematic ETFs took in a whopping $94 billion combined. So, what happened? Bloomberg’s Athanasios Psarofagis explains:

“I call it thematic fatigue. People got burned by themes, like with ARKK. So they either are already in and don’t want to allocate more, or didn’t want to chase returns. Flows just flatlined.”

There is no question that thematic ETF investors have been badly burned, if not fully incinerated (see cannabis ETFs). As performance in themes like “disruptive innovation”, clean energy, and blockchain surged in 2020 and 2021, investors piled in. It was classic performance chasing. Unfortunately, the timing was inopportune as performance in many of these themes peaked just as investors piled in.

Morningstar’s Jeffrey Ptak shows the investor impact of that performance chasing below. Over the trailing five years ended July 31st, the average dollar invested in thematic ETFs lost 2.4% per year. Meanwhile, the average thematic ETF gained 4.9%. The difference is essentially poor investor timing. However, the real issue is that the average dollar invested in the Vanguard Total Stock Market Index Fund gained 14%+ annually over the same time period. In other words, a combination of poor timing and thematic ETF underperformance created a painful investor experience.

To further illustrate, Jeffrey explained that thematic ETFs had approximately $40 billion in assets as of the end of March 2020. Over the next year, investors poured $65 billion into those ETFs, which then proceeded to drop 16% during that same timeframe.

If used correctly, I believe thematic ETFs can actually offer some behavioral benefits. If used incorrectly (i.e. simply chasing the latest shiny object), well… you get the results illustrated below.

The upshot is that investors appear to have learned a lesson in all of this. Blockchain ETFs have dominated the ETF performance leaderboard this year (see above in “Performance Leaders and Laggards”), yet the category has net outflows in 2023.

Fool me once, shame on you. Fool me twice, shame on me.