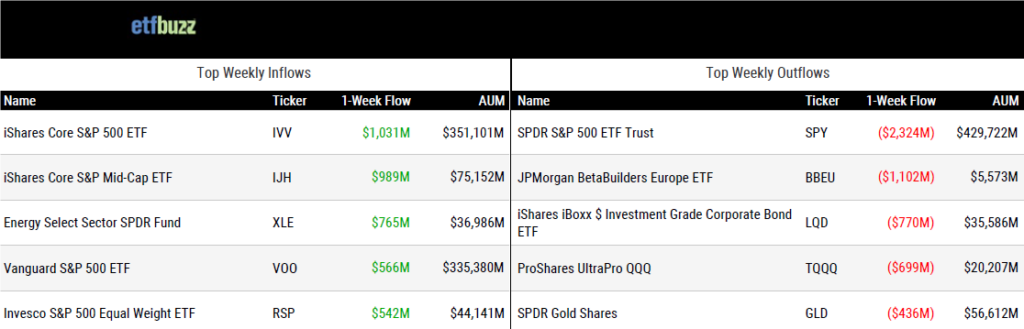

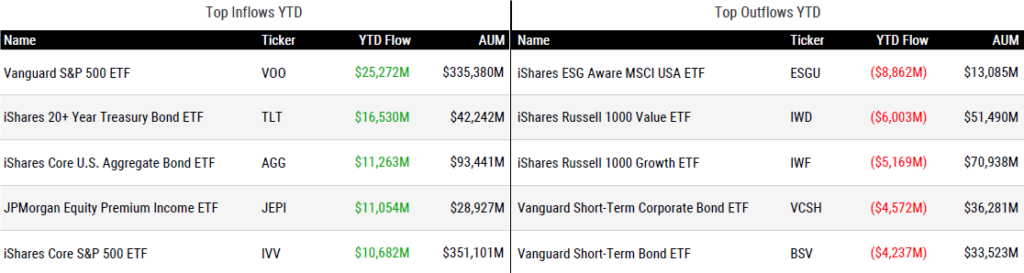

ETF Inflows & Outflows

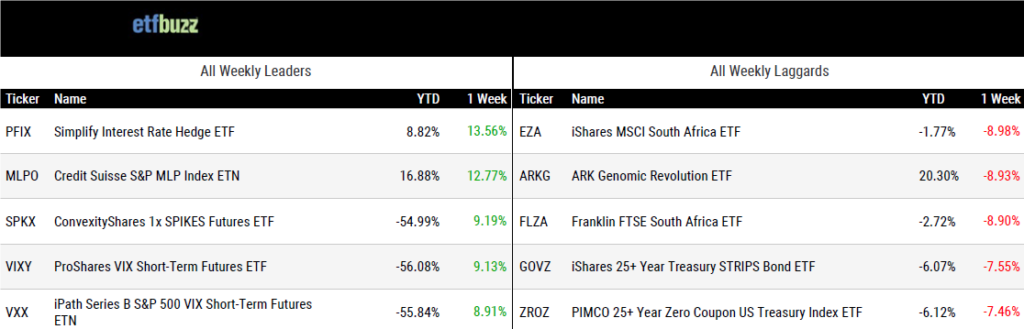

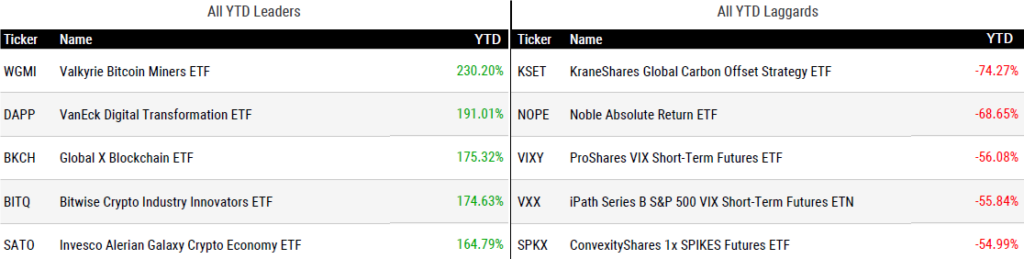

Performance Leaders & Laggards

Weekly ETF Reads

4 ETFs for Ultrashort King Summer by Elizabeth Templeton and Gabriel Denis

“There’s arguably no better oasis for conservative investors to quench their thirst for income today than ultrashort-term bond exchange-traded funds.”

U.S. ETF Fee Compression Slows by Elisabeth Kashner

“When active gains market share, top-line fee compression slows.”

State Street Cuts Fees on 10 ETFs as Price War Heats Up by Gabe Alpert

“The cut makes SPLG the cheapest S&P 500 ETF.”

SEC now ready to consider ETH futures ETFs, sources say — but what’s changed? by Ben Strack

“SEC policy on crypto ETFs has always been haphazard. Now it is completely incoherent.”

Dimensional Aims for ETF Share Class Rollout by Heather Bell

“The SEC’s concerns are reasonable, and we think we can mitigate them.”

(Note: On the ETF Prime podcast this week, I had the pleasure of visiting with Dimensional’s Co-CEO Gerard O’Reilly. Gerard offered a quick masterclass on the ETF share class structure, which I highly recommend listening to.)

Reading the Fine Print of Mid-Cap ETFs by Mo’ath Almahasneh

“Index providers do not have a uniform definition, warranting more attention and scrutiny from investors before selecting a mid-cap fund.”

Active Bond ETFs Are Sprouting Up All Over. Should You Bite? By Lauren Foster

“The combination of those two trends has resulted in asset managers bringing some of their best and brightest from the mutual fund world into the ETF space.”

ETF Tweet of the Week

Volatility Shares, who recently launched a 2x bitcoin futures ETF, quietly filed for an ethereum futures ETF on July 28th. Since that time, there have been 13 additional ethereum futures-related ETF filings by 9 different issuers (Bloomberg’s James Seyffart has done yeoman’s work tracking the flurry of activity). Back in May, there was a smaller wave of ethereum futures ETF filings which were quickly withdrawn after some stern feedback from the SEC. However, the Wall Street Journal’s Vicky Ge Huang reported this week that the SEC apparently had a change of heart:

“The rush of filings for futures-based ether ETFs came after the SEC staff told asset managers they are ready to review such filings.”

While I am not overly bullish on potential investor demand for these ETFs, the SEC’s reversal appears very positive for the prospects of spot bitcoin ETF approval (and, of course, I am extremely bullish on potential investor demand for spot bitcoin ETFs). Whatever the reason for the change, the SEC now welcoming ethereum futures ETF filings represent a substantial shift in the agency’s sentiment towards crypto. That’s the real story here.

INTERESTING: @ValkyrieFunds just made a potentially massive move. Not certain if/how it works out. But they filed a 497 to change the investment strategy of their #Bitcoin Futures ETF ( $BTF) to include #Ethereum Futures starting Oct 3 https://t.co/EBl3RvyXYP pic.twitter.com/4XJPT0QQAa

— James Seyffart (@JSeyff) August 4, 2023

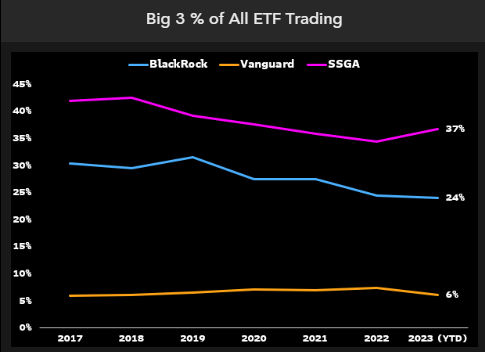

ETF Chart of the Week

The industry’s never-ending fee war raged on last week with State Street chopping fees on 10 SPDR ETFs totaling nearly $80 billion in assets. State Street launched the first U.S.-listed ETF in 1993 and reigned supreme as the industry’s market share leader by assets until iShares and Vanguard came at the king with lower fee ETFs. State Street now sits in third place on the ETF leaderboard, trailing iShares and Vanguard by over one trillion dollars in assets. However, while State Street has ceded the asset crown, they are still the undisputed liquidity king. State Street ETFs represents a staggering 37% of all ETF trading, led by the SPDR S&P 500 ETF (SPY) – the most liquid ETF in the world.