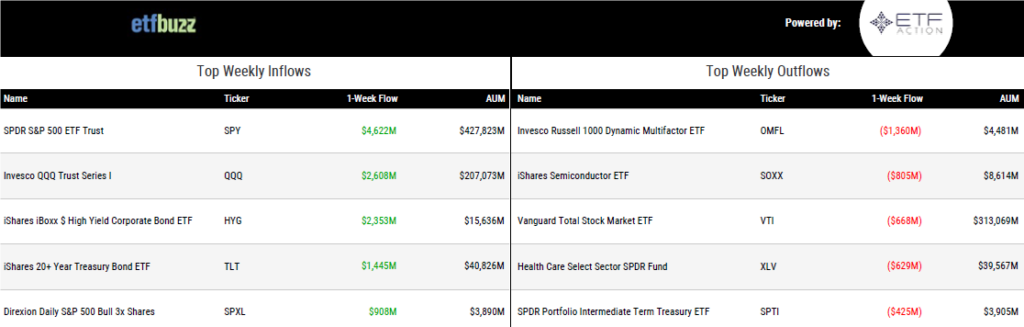

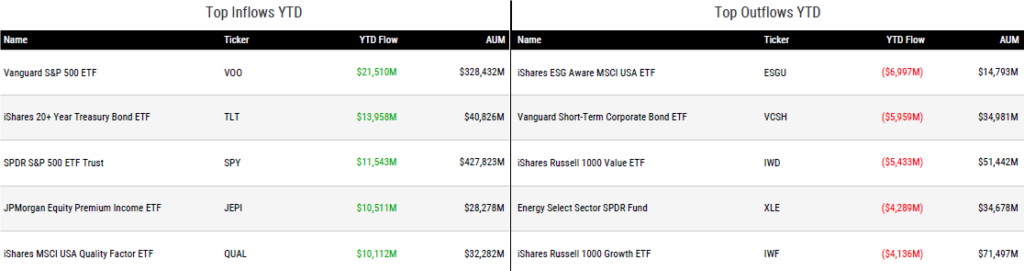

ETF Inflows & Outflows

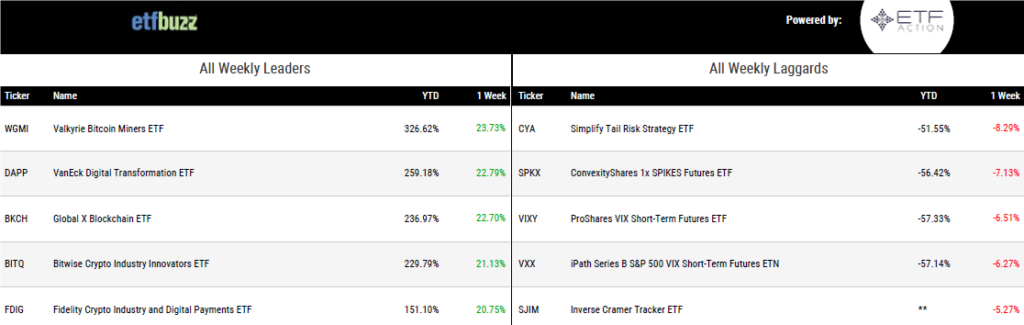

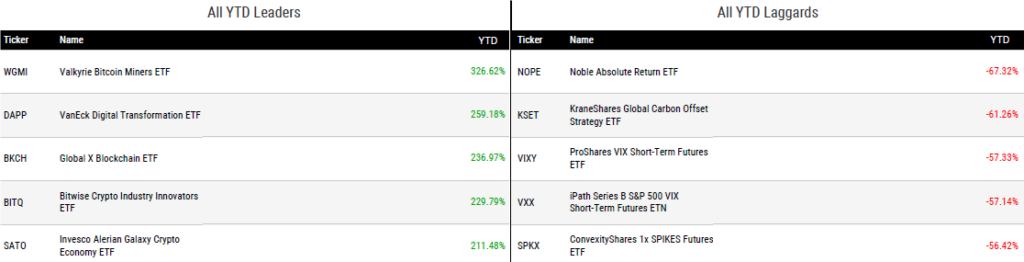

Performance Leaders & Laggards

Weekly ETF Reads

Applying for ETF Share Class Exemptive Relief by Gerard O’Reilly

“Our mutual funds also uniquely position Dimensional to offer ETF share classes the right way for ETF shareholders.”

Dimensional files for Vanguard-style ETF share classes by Emma Boyde

“The ability to offer an ETF share class to their broader suite will make them an even larger player.”

What the Nasdaq 100 Rebalance Means for ETF and Index Fund Investors by Bryan Armour

“Funds tracking the Nasdaq-100 Index total nearly $300 billion globally, with $200 billion in assets under management for QQQ alone.”

BlackRock Sees Model-Portfolio Investing Growing to $10 Trillion by 2028 by Vildana Hajric and Katie Greifeld

“It’s going to be massive.”

The True Costs of ETF Ownership by Allan Roth

“Though many exchange-traded funds fulfill this goal with rock-bottom annual expense ratios, there are also other costs.”

BlackRock’s Bitcoin ETF Application Takes Surveillance to the Next Level by Ian Allison

“If that is true, I believe the SEC will not only approve this ETF, but will approve it and take a victory lap.”

Partnering with Coinbase could hinder bid for bitcoin ETF approval by John Mccrank and Michelle Price

“I don’t see that the SEC is going to open the gates.”

ETF Tweet of the Week

Several weeks ago, I opined that the Volatility Shares 2x Bitcoin Strategy ETF (BITX) launching before a spot bitcoin ETF would go down as one of the most ridiculous chapters in the entire bitcoin ETF saga. Grayscale, who is currently suing the SEC for failing to allow the conversion of their Bitcoin Trust (GBTC) into an ETF, appears to wholeheartedly agree.

“The 2x Bitcoin Strategy ETF is therefore exposed to even more risks of the bitcoin markets than

Grayscale’s proposed spot bitcoin ETP.”

Today, our attorneys filed a letter with the DC Circuit highlighting the disparity between the SEC’s approval of a leveraged #bitcoin futures ETF while continuing to deny approval of spot bitcoin ETFs like $GBTC. Let’s dive deeper. 🧵/6 pic.twitter.com/z7WyGBthhT

— Grayscale (@Grayscale) July 10, 2023

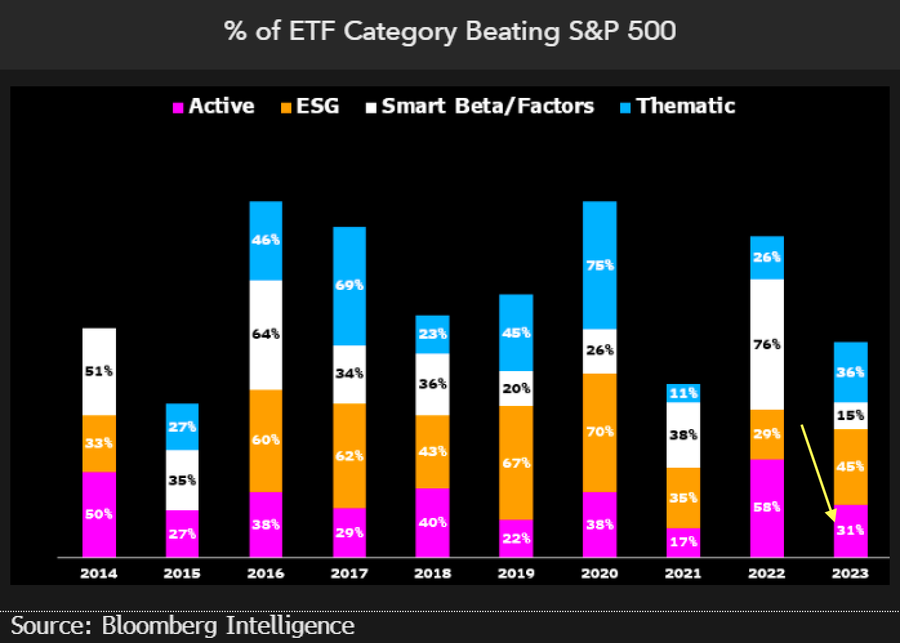

ETF Chart of the Week

Bloomberg’s Eric Balchunas notes that despite only 31% of active ETFs outperforming the S&P 500 this year, the category has taken-in nearly a quarter of all ETF flows. That inflow percentage isn’t just impressive because of the lack of performance, but also since active ETFs only comprise 5.6% of all ETF assets. Why are investors gravitating towards active ETFs despite the underperformance? A big reason is that active ETFs are now charging much lower fees. ETF.com’s Gabe Alpert points out that 83% of those flows have gone into ETFs in the lowest quintile of fees (nice read here including some thoughts from yours truly). As Eric succinctly articulates, “flows are much less performance sensitive if you dirt cheap”.