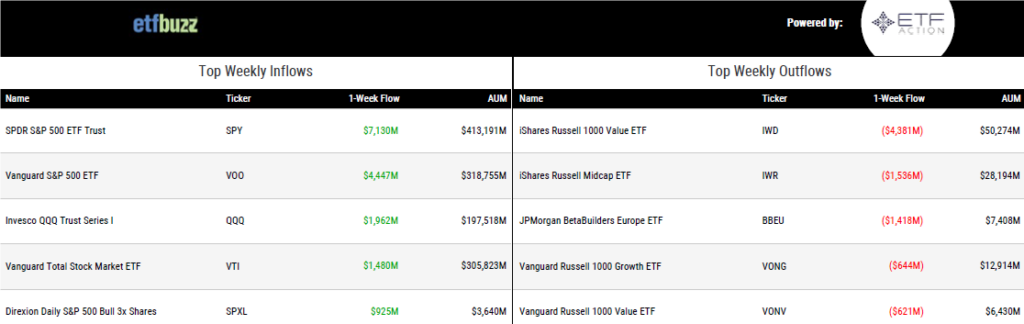

ETF Inflows & Outflows

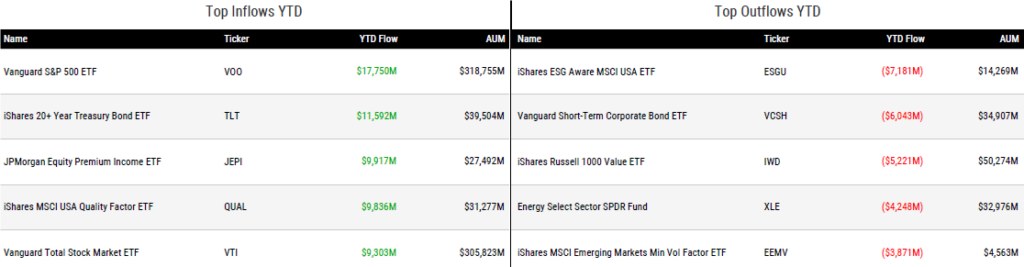

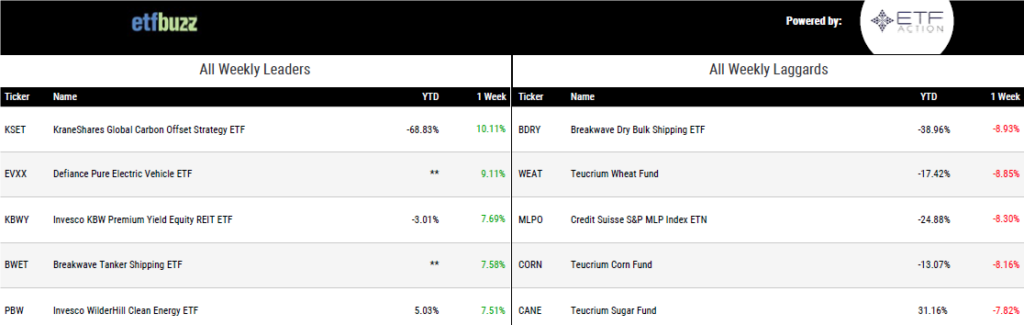

Performance Leaders & Laggards

Weekly ETF Reads

The Strategic-Beta ETF Market Has Matured, but That Doesn’t Mean the Party’s Over by Ryan Jackson

“The strategic-beta ETP treasure chest has deepened even as it has refined.”

SEC advisory group calls for leveraged ETFs name change by David Isenberg

“The lack of a clearer naming convention around exchange traded products, which include single-stock ETFs, leveraged ETFs, and other exchange traded notes (ETNs), has led to investor confusion and unnecessary loss of capital.”

Bond ETFs Approach $2 Trillion in Global Assets by Todd Rosenbluth

“While it took 17 years to reach $1 trillion, asset growth has exploded in recent years.”

Hard Lessons from an ETF Entrepreneur by Maz Jadallah

“To my knowledge, in the entire history of ETFs, there has never been an advisor that has been fired for NOT putting their client into your ETF.”

The Most Successful ETF Launch of All Time Raises Questions by Jeffrey Ptak

“The chasm between the ETF’s total returns and dollar-weighted returns is worth monitoring.”

Speculation mounts that BlackRock bitcoin ETF will get green light by Steve Johnson

“BlackRock has pretty much undercut all the SEC’s arguments other than meh, we don’t like bitcoin.”

The multi-billion dollar question posed by BlackRock’s bitcoin ETF move by Nathan Crooks

“That has never featured in any previous 19-b4 by any national stock exchange in the U.S. attempting to rule change to allow a bitcoin ETF.”

SEC Says Spot Bitcoin ETF Filings Are Inadequate by Vicky Ge Huang

“The SEC told the exchanges that it returned the filings because they didn’t name the spot bitcoin exchange with which they are expected to have a surveillance-sharing agreement or provide enough information about the details of those surveillance arrangements.”

ETF Tweet of the Week

While prospective spot bitcoin ETFs have garnered all of the attention recently, mutual fund to ETF conversions are quietly approaching $100 billion. Including the below Fidelity funds, there have now been 50+ such conversions since Guinness Atkinson completed the first one in March 2021.

Fidelity just announced a pretty massive mutual fund to ETF conversion for six enhanced index funds with about $15b in assets. Converted MF to ETF assets now getting close to $100b all told. Aside, Fidelity has the power to convert their way up the ETF leaderboard FAST. pic.twitter.com/8BUwsPDvzf

— Eric Balchunas (@EricBalchunas) June 28, 2023

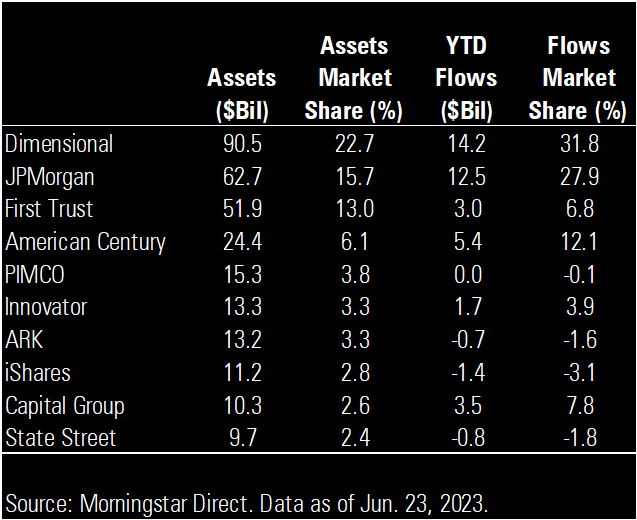

ETF Chart of the Week

Below are the 10 largest actively managed ETF issuers, led by Dimensional and JPMorgan. Morningstar’s Ben Johnson notes those two issuers have accounted for approximately 60% of year-to-date active ETF inflows. The top five issuers have comprised roughly 86% of the total.

CNBC Recap

I had the pleasure of joining CNBC’s Bob Pisani and WisdomTree’s Jeremy Schwartz to discuss all things bitcoin-ETF related. Enjoy!