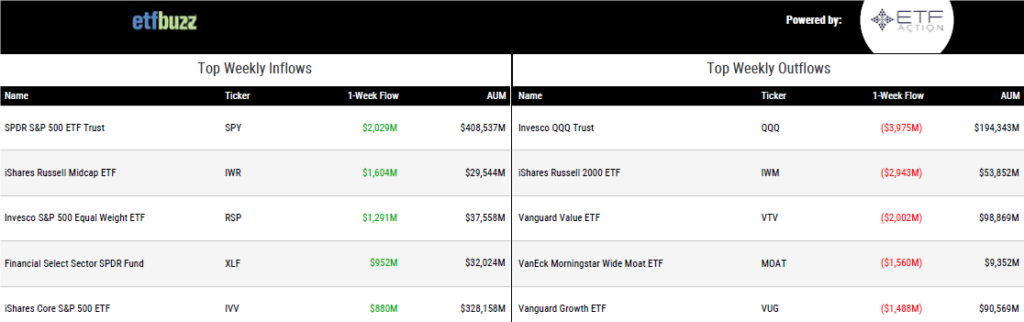

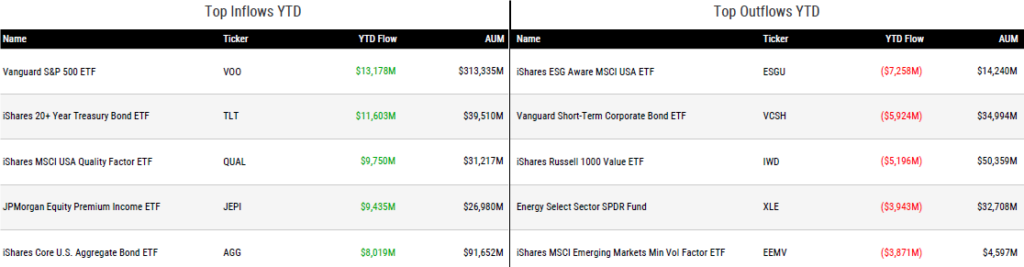

ETF Inflows & Outflows

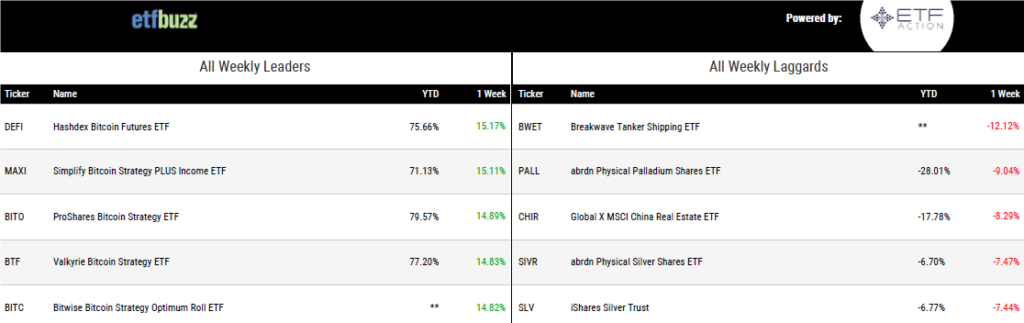

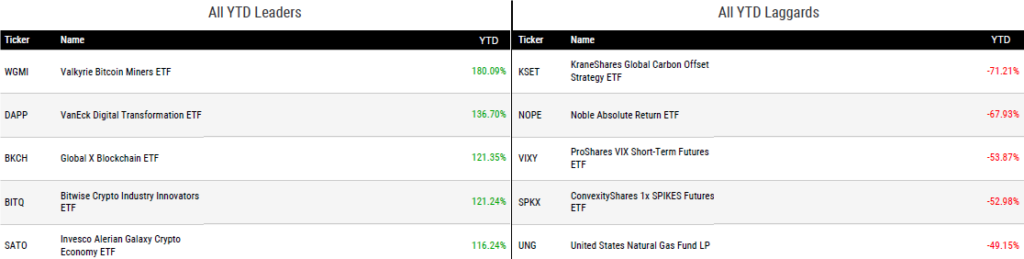

Performance Leaders & Laggards

Weekly ETF Reads

Assets invested in global exchange traded funds hit record $10.32tn by Steve Johnson

“Investor acceptance and preference for ETFs is strong and continuing, and the market move has pushed the ETF industry to record highs.”

More Than 90% of Financial Advisors Use ETFs, Survey Finds by Michelle Lodge

“Of the investment classes, ETFs were the ones most respondents agreed they would plan to increase using in the coming year.”

BlackRock Bitcoin ETF Filing: Is This The One That Finally Gets Approved By The SEC? by David Dierking

“If every spot bitcoin ETF has failed to get approved and the SEC is suing the custodian of its proposed product, why on earth would BlackRock choose now to file?”

BlackRock takes the lead, WisdomTree, Invesco follow, in renewed push for spot Bitcoin ETFs, after cracks emerge in SEC’s opposition to the funds during Grayscale court hearing by Oisin Breen

“Some will say it is just a conspiracy theory, as if there’s never any backroom dealmaking in Washington.”

How ‘surveillance-sharing’ is designed to deter bitcoin ETF manipulation by Ben Strack

“Prospective spot bitcoin ETF issuers have not established there is ‘an adequate system of surveillance’ comparable to trading on a registered exchange.”

Bull Market ‘FOMO’ Finally Sends Stock ETF Haul Past Bond Funds by Katie Greifeld

“People now understand that the view of most of the experts in the beginning of this year were wrong, and they are moving back into stocks to try and catch up.”

ETF Tweet of the Week

The JPMorgan Equity Premium Income ETF (JEPI) debuted in May of 2020 and has grown into a $26 billion behemoth, making it one of the most successful ETF launches in history. Notably, the ETF is trailing the S&P 500 by 10% this year (4% vs 14%) and has still taken in nearly $10 billion in new investor money. Morningstar’s Bryan Armour said it well in an excellent Financial Times article on the topic:

“I’m shocked that we have gone from the meme stock boom to covered call strategies, it’s kind of like whiplash.”

JPMorgan Equity Premium Income ETF gathered nearly $26 billion in net inflows over the first 36 months of its existence. That easily tops the charts, arguably making it the most successful launch of a U.S. ETF in history. pic.twitter.com/ShWlZfmAV5

— Jeffrey Ptak (@syouth1) June 23, 2023

ETF Chart of the Week

This week’s chart is actually a picture… but a noteworthy one in my opinion. All indications are that the Volatility Shares 2x Bitcoin Strategy ETF (BITX) will begin trading next week. That’s right, a double leveraged bitcoin futures ETF is hitting the market before a spot bitcoin ETF. When we look back on the bitcoin ETF saga five or ten years from now, I believe this will be one of the most ridiculous chapters of the entire story.