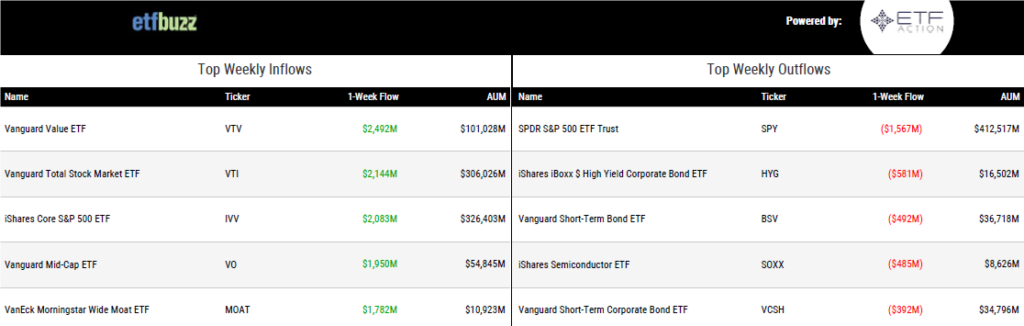

ETF Inflows & Outflows

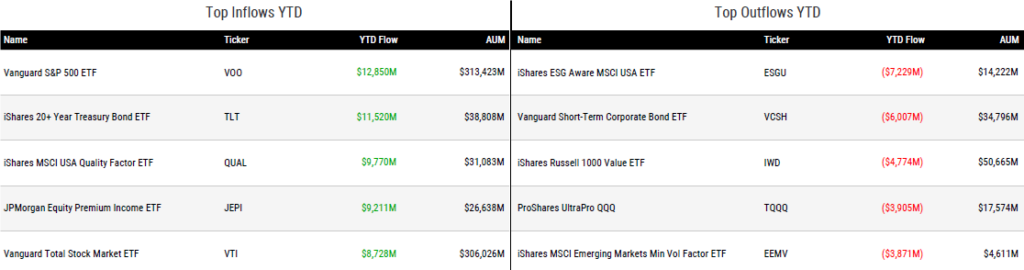

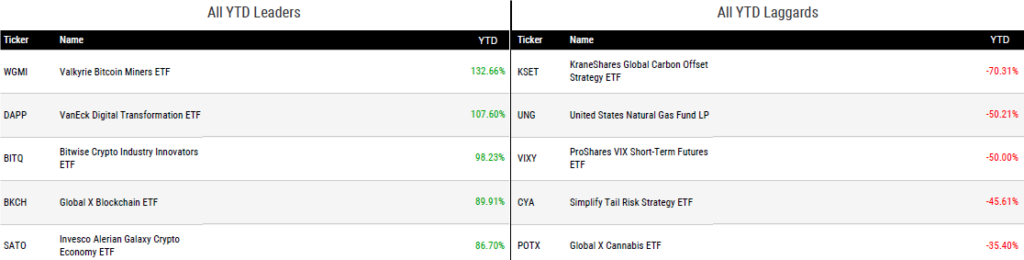

Performance Leaders & Laggards

Weekly ETF Reads

View From 30,000 Feet: ETFs Are the Future by Rob Isbitts

“ETFs are the past, present and future of portfolio management.”

The Worst Back-Test by Phil Bak

“I just launched a fund that has the worst back-test anyone has ever seen, and I couldn’t be more excited.”

Let’s See What We Can Squeeze From These ETFs ‘From Concentrate’ by Mark Abssy

“For a truly concentrated bet, funds like these fill the bill.”

Are AI ETFs Worth the Hype? by Mo’ath Almahasneh

“Cheap total-market ETFs may be the best option for taking advantage of wide-reaching innovations across not just AI but all other themes.”

ETF niche players combine to form nearly $8 billion suite of specialty funds by Jeff Benjamin

“Combined, the two firms have a dozen solid hits.”

Carving Up the Bond Market Swells Into $39 Billion ETF Business by Katie Greifeld

“ETFs give you that exposure with one trade, one click, it settles in your account.”

Managers sharpen focus of active ETFs, gain flows by Ari Weinberg

“What problem is being addressed and where can active management add value?”

Goldman’s ETF Expertise to Help Eagle Capital Enter the Market by Todd Rosenbluth

“Just like anyone joining a party 30 years after it started, it helps to have a friend to introduce you around.”

(Note: I’m highly interested in tracking Goldman’s new white label ETF business, Goldman Sachs ETF Accelerator. Independent white label firms such as ETF Architect and Tidal have experienced tremendous success in recent years. Can Goldman “institutionalize” the white label ETF space?)

ETF Tweet of the Week

On Thursday morning, CoinDesk reported that BlackRock was close to filing an application for a spot bitcoin ETF. Despite CoinDesk’s strong reputation, the Twittersphere was full of skepticism over the report’s accuracy. Those doubts were quickly put to rest when BlackRock did, in fact, file for the iShares Bitcoin Trust later that afternoon. I have my own working theory as to what’s going on here, but the only thing you need to know is this courtesy of Bloomberg’s Eric Balchunas:

BlackRock’s record of getting ETFs approved by the SEC is 575-1.

If you’re curious, the lone rejection involved the non-transparent ETF structure which the SEC was not yet comfortable with. Simply put, BlackRock isn’t in the business of making unforced errors. Betting on a spot bitcoin ETF if they weren’t confident in approval seems like an unnecessary gamble. Plus, there isn’t another asset manager in the world who is more well-connected to government officials and regulators. Get your popcorn ready!

SCOOP: Investment giant @BlackRock is close to filling an application for a Bitcoin ETF, according to a source. @IanAllison123 reports. https://t.co/YdYDEkPo5B

— CoinDesk (@CoinDesk) June 15, 2023

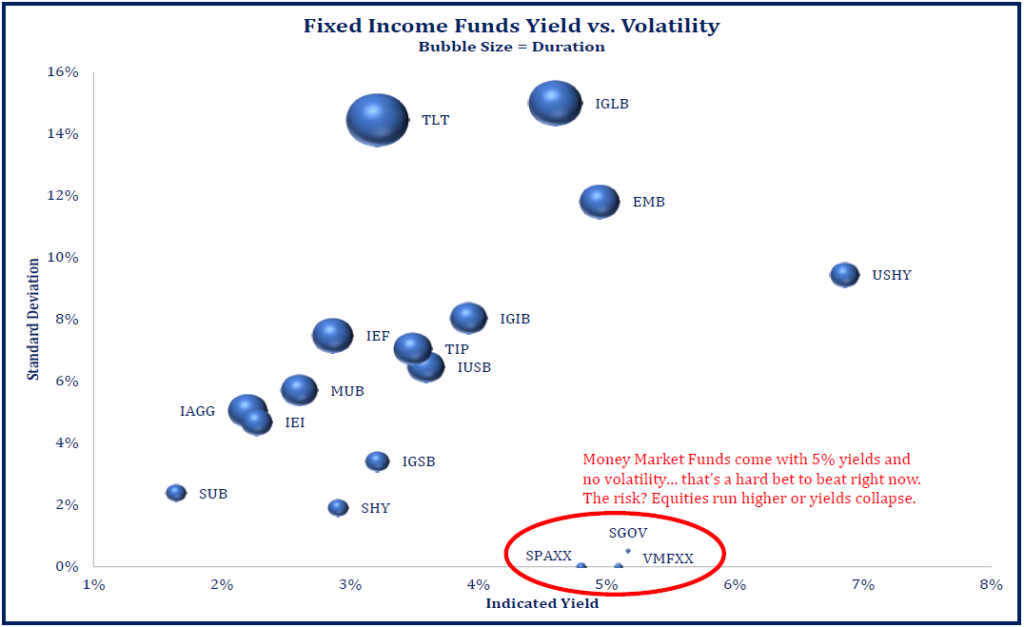

ETF Chart of the Week

For fixed income ETFs that take on meaningful credit and/or duration risk, this chart presents a nice look at what they’re up against in money market funds and ultra short-term Treasury ETFs like the iShares 0-3 Month Treasury Bond ETF (SGOV). It’s tough to beat 5% yields and near zero risk right now unless interest rates come back in or if stocks just keep running…