ETF Inflows & Outflows

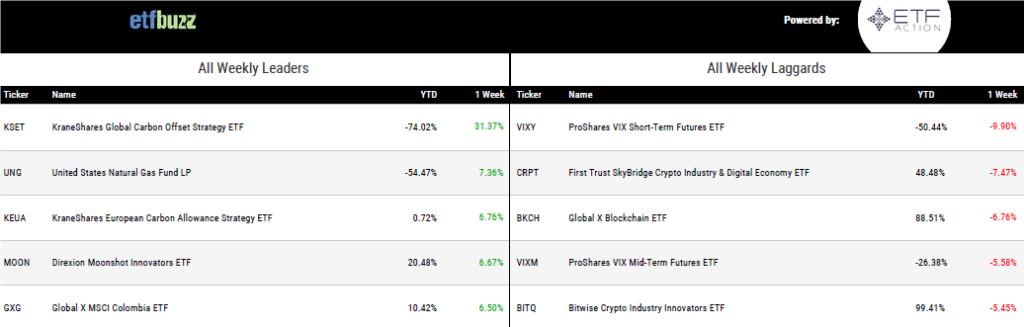

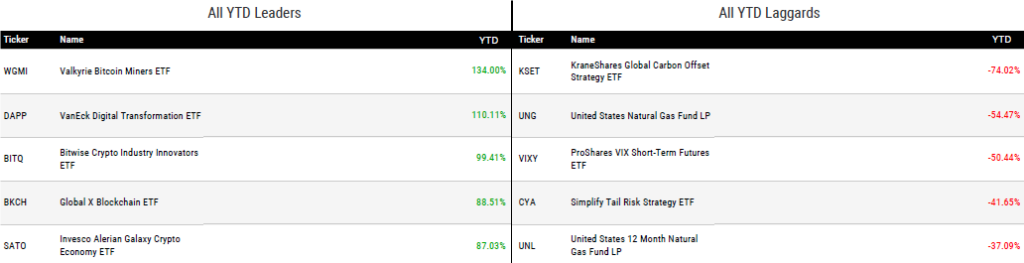

Performance Leaders & Laggards

Weekly ETF Reads

Calamos files to launch convertible bond ETF by Steve Johnson

“We are looking across the board at our core competences. Calamos is extremely committed to the ETF space.”

Thematic Investing: Just Say No by John Rekenthaler

“Buying the current headlines was, is, and always will be a mug’s game.”

(Note: Long-time readers know I believe thematic ETFs can offer some benefits from an investor behavior perspective. However, there’s no disputing the data presented by John. That said, the next article below shows ETF issuers aren’t going to stop bringing new thematic products to market.)

New ETF Claims to Offer ‘Convenient Solution’ for Investors Looking for Exposure to the Global Music Industry by Daniel Tencer

“The MUSQ Global Music Industry Index is the first and official music industry index to capture the performance of the global music industry.”

Copycats Target JPMorgan’s Smash-Hit ETFs Just as Market Turns by Katie Greifeld

“JEPI taking in money despite being down and lagging I think shows JPMorgan’s distribution power. Goldman has that as well.”

How fooling around with ESG put Vanguard and BlackRock on countdown for still selling many ETFs as ‘passive’ indexing portfolios by Oisin Breen

“It’s a messy situation.”

Volatility Shares Trust Seeks Leveraged Bitcoin ETF Approval by Gabe Alpert

“Between the major regulatory crackdowns on Binance and Coinbase, and the withdrawal of the ProShares fund, it doesn’t bode well for the product being greenlit by the SEC.”

Leveraged and inverse ETFs are ‘like walking into a casino’ by Steve Johnson

“These are not the type of product that are buy and hold. They are not appropriate for everybody. What is important is education.”

ETF Tweet of the Week

For the second time in two months, approximately $2 billion has moved out of an existing ESG ETF and into a newly launched ESG ETF. In April, DWS debuted the Xtrackers MSCI USA Climate Action Equity ETF (USCA) and issued a press release claiming it as the “largest ETF launch of all time”. In reality, Finnish pension company Ilmarinen simply moved $2 billion out of the Xtrackers MSCI USA ESG Leaders Equity ETF (USSG) and plunked it into USCA. This week, Ilmarinen transitioned a similar amount from the iShares ESG MSCI USA Leaders ETF (SUSL) to the recently launched iShares Climate Conscious & Transition MSCI USA ETF (USCL). What do these moves have in common? The new ETFs are missing the “ESG” acronym. Bloomberg’s Eric Balchunas speculates (correctly in my opinion) that perhaps institutions are running away from the baggage-laden “ESG” label and swapping it for something less tainted. The upshot? ESG ETFs are highly liquid.

It's Déjà vu. The finnish pension fund Ilmarinen' moved $2.1 billion from one Blackrock ESG ETF into another brand new Climate focused ESG ETF and are claiming it to be another record breaking ETF launch. Cue up the presses!

— James Seyffart (@JSeyff) June 9, 2023

h/t @emily_graffeo https://t.co/HVVVkGaFIx pic.twitter.com/AUZuzxr69i

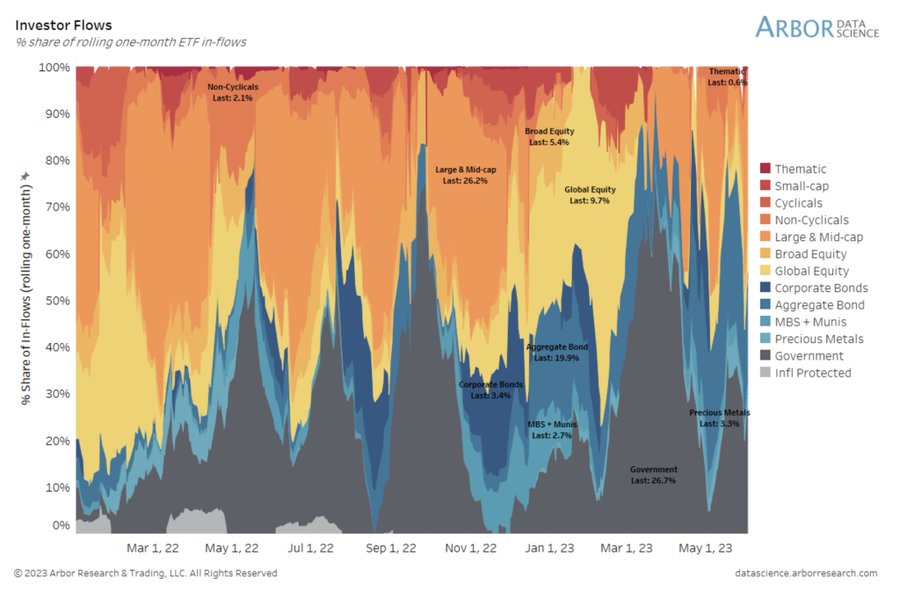

ETF Chart of the Week

I like to periodically post this eye-catching piece of artwork from Arbor Data Science depicting rolling one-month ETF inflows. Very simply, this shows where ETF investors are allocating money at any given time and can offer a nice window into overall sentiment. Recently, flows are swinging back towards US equity ETFs. While only $31 billion has gone into US stock ETFs this year, over $20 billion of that has come in the past month. With the S&P 500 up 13% this year, it appears investors are finally dipping their toes back into the water.