ETF Inflows & Outflows

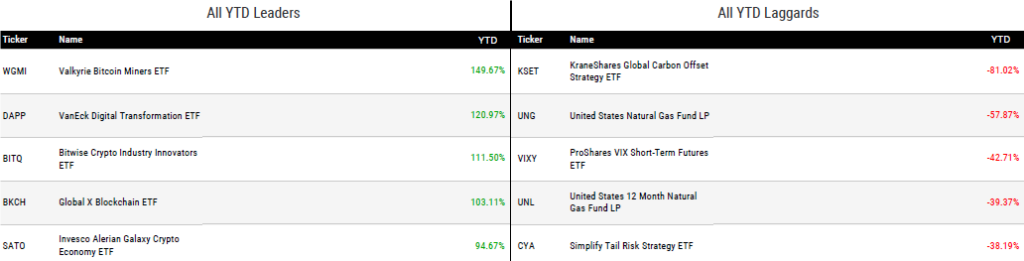

Performance Leaders & Laggards

Weekly ETF Reads

Have Index Funds Become Growth Funds? by John Rekenthaler

“Today, the tech sector harbors more than 70% of the index’s top 10 assets.”

ETFs charge into collateralised loan obligations by Alyson Velati

“The drive for diversification is pushing more innovation in the market.”

The Crypto-related ETFs Vying to Launch This Year by Ben Strack

“Dave Nadig, a financial futurist at data firm VettaFi, said he expects the SEC to lose its case against Grayscale Investments. He believes that this could spur the securities regulator to halt all US-listed crypto futures products.”

BlackRock’s Greater Focus on Active ETFs by Todd Rosenbluth

“We are in the very early days of active ETF adoption.”

Active vs. Passive ETFs: How They Stack Up by Derek Horstmeyer

“While active ETFs fare a little bit better than active mutual funds when it comes to comparing returns against their passive counterparts, it still isn’t too pretty a story.”

Franklin, on ETF Tear, Spending $925M on Putnam by Gabe Alpert

“Franklin Templeton has said it’s seeking to build a heavy-hitter ETF business, and as part of that effort, has converted a handful of mutual funds into ETFs.”

The world’s first meme bond (ish)? by Robin Wigglesworth

“The cocaine bear in question is called the Direxion Daily 20+ Year Treasury Bull 3X Shares ETF.”

Currency-Hedged ETF Focused on Japan Set For Best Month of Flows Since 2017 by Emily Graffeo

“This could be a small awakening for currency-hedged ETFs.”

“That is my distribution strategy. To be better. To create value. And if I can become someone’s favorite fund, I can become a thousand people’s favorite fund.”

5 U.S. Treasury ETFs With High Yields by Katherine Lynch

“Another dynamic working in favor of short-term bond funds is that short-term exchange-traded funds currently offer higher yields than intermediate-term ETFs.”

ETF Tweet of the Week

ETFs accounted for over 30% of U.S. stock market trading in 2022. While some have concerns over ETFs’ growing footprint, investors are clearly turning to the structure when market turbulence arises. An important point from ICI for any ETF worrywarts:

“Most ETF secondary market trades represent investors exchanging shares of ETFs among themselves. Unlike primary market activity, these trades do not affect the ETF’s underlying securities. In 2022, domestic equity ETFs had a total of $5.2 trillion in primary market activity, which represented only 5.2 percent of the $99.8 trillion traded in company stocks during the year.”

According to recent data from @ICI, #ETFs accounted for 30% of daily US stock market trading volume in 2022 – the highest over the past 10 years. Investors use ETFs as an efficient means to change exposures, so their trading volumes are seen to rise during market turbulence. pic.twitter.com/wcnQBj6Iz0

— Luis Berruga (@LuisBerruga) May 30, 2023

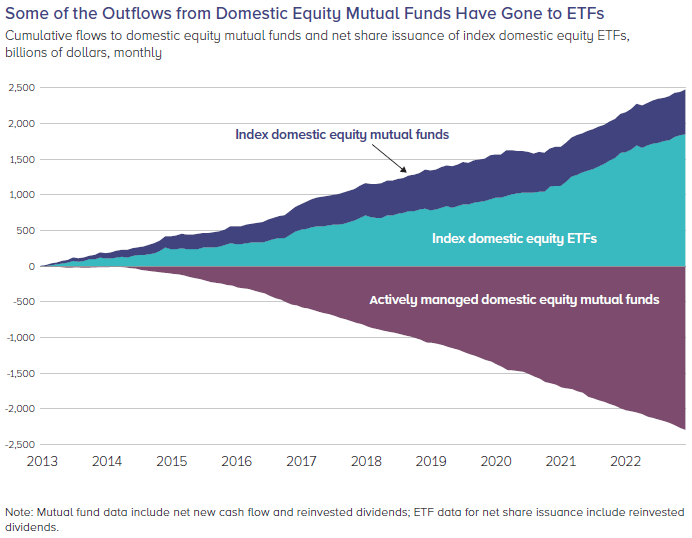

ETF Chart of the Week

Speaking of ICI, they annually produce this well-known graphic which I simply refer to as “The Chart”. The most recently released version shows that from 2013 – 2022, index domestic equity mutual funds and ETFs took in $2.5 trillion. Meanwhile, active domestic equity mutual funds saw $2.3 trillion in outflows. It should be noted that index domestic equity ETFs had nearly 3 times the amount of inflows as index domestic equity mutual funds.