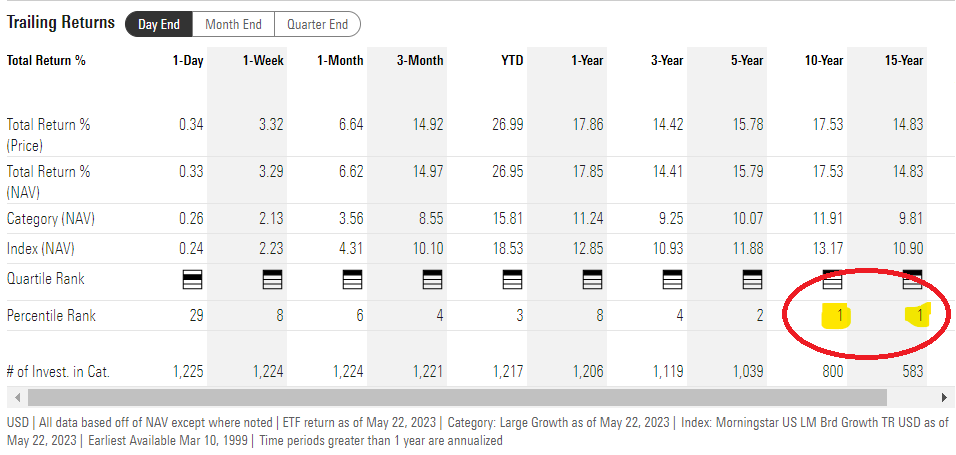

ETF Inflows & Outflows

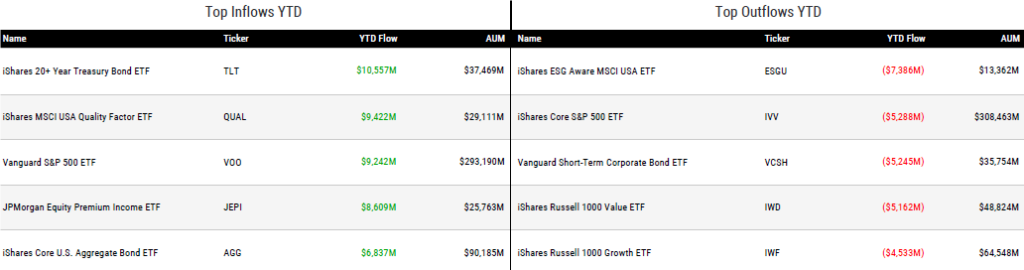

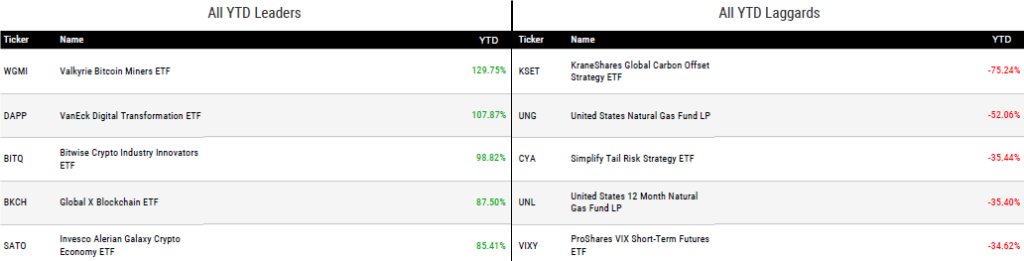

Performance Leaders & Laggards

Weekly ETF Reads

State Street further extends proxy voting choice to ETFs by Emile Hallez

“It looks like a dodge [by fund companies]. Now they can say, ‘People can do whatever they want.’”

Ex-Bridgewater exec Bob Elliott’s Unlimited raises venture capital to help launch ETFs replicating hedge-fund, private-equity strategies by Christine Idzelis

“Unlimited seeks to offer them at a lower cost compared with traditional fee structures seen in hedge-fund and private-equity investing.”

Fido’s money hoover wins again by Robin Wigglesworth

“There’s no real secret as to why Fidelity has now leapfrogged the main S&P 500 offering of its Boston rival: cost.”

The Emerging Markets Debacle by Sumit Roy

“From 2009 to 2023 – that’s 56 quarterly investment committee meetings or meetings with your clients explaining why you’re diversifying into an asset class that’s underperforming so significantly.”

Study: Risk-Managed ETFs Didn’t Meet 2022 Challenges by Dan Mika

“Ultimately, the four funds that underperformed the S&P 500 last year failed primarily due to allocations to 10- and 30-year Treasurys as a safe haven from stock tumult.”

What You Need to Know About AI ETFs by Dinah Wisenberg Brin

“You should approach it as a theme like you would approach any other kind of thematic investment, which means it should not be a core holding, this should be a satellite holding.”

New ETF uses artificial intelligence to time the market by Jeff Benjamin

“If a computer has machine learning, maybe it will teach itself to trade less.”

Choosing a Top Gold ETF by Bryan Armour

“Gold ETFs have played an expanding role in how investors access gold exposure.”

ETF Tweet of the Week

As always, a little ETF education goes a long way. Here’s an excellent explanation of the magic behind ETFs’ tax efficiency and, specifically, custom rebalances (click tweet to read entire thread)…

Asset managers, including active managers, are increasingly embracing ETFs over mutual funds, SMAs, or other investment vehicles. A key reason for this is made possible by the uniqueness of the ETF creation-redemption mechanism.

— Dave Mazza (@MazzaDave) May 22, 2023

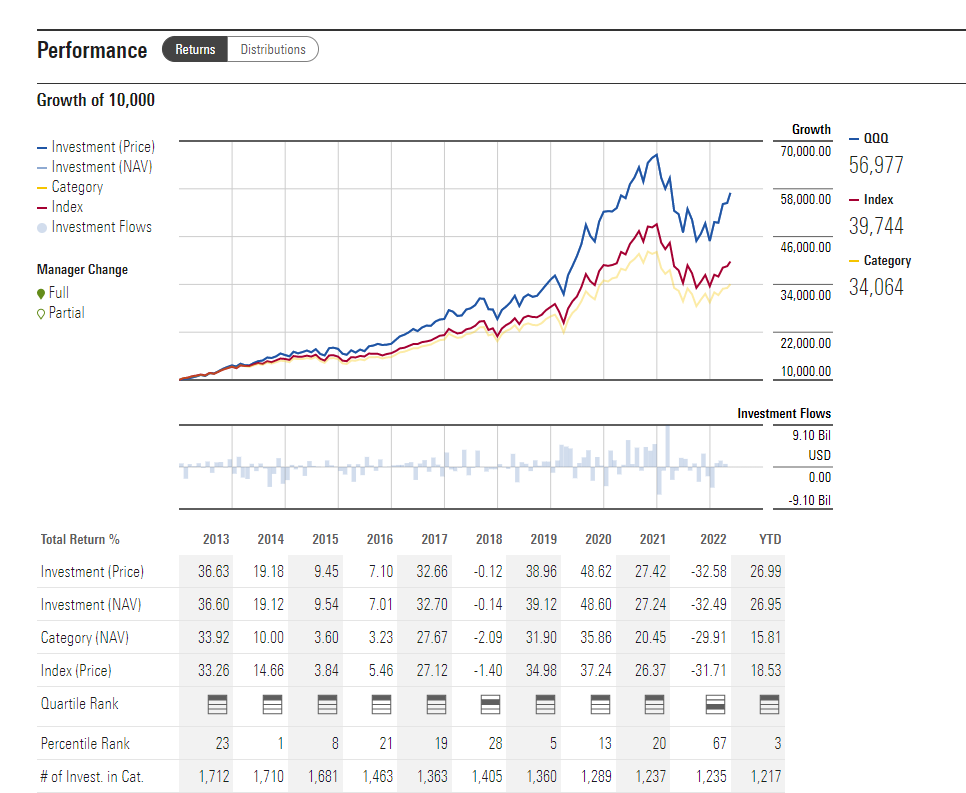

ETF Chart of the Week

The Invesco QQQ ETF (QQQ), which simply tracks the Nasdaq-100 Index, is the top-performing fund in the Morningstar Large Growth Category over the last 10 and 15 years. Per Bloomberg’s Eric Balchunas, half of the ETF’s returns over the past 10 years have come from just 4 stocks: Apple, Microsoft, Amazon and Google – much to the chagrin of active managers.