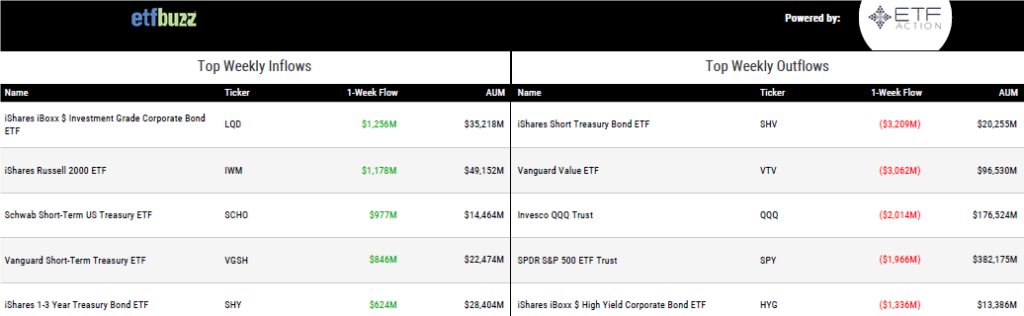

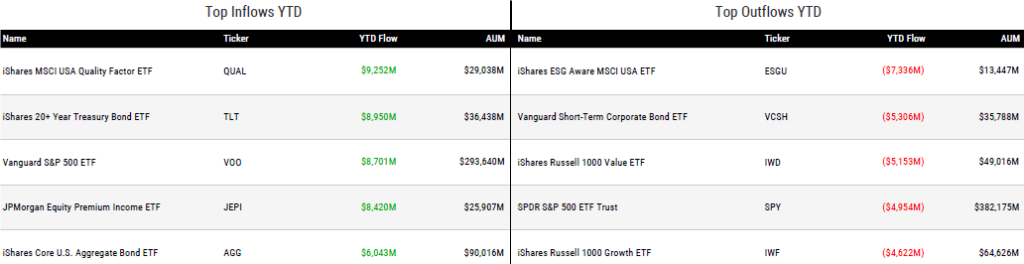

ETF Inflows & Outflows

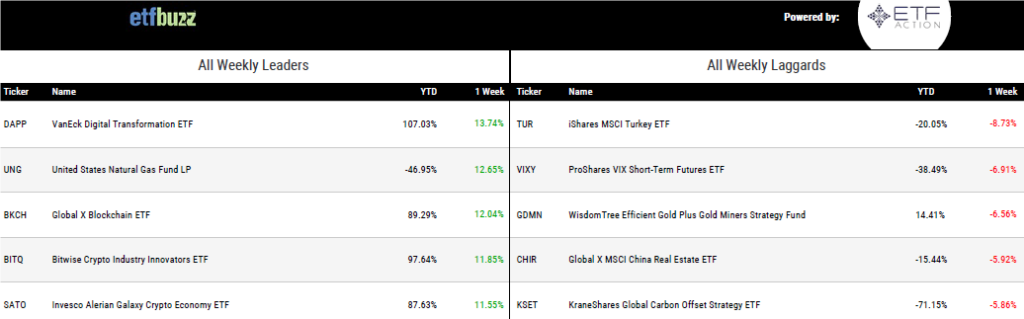

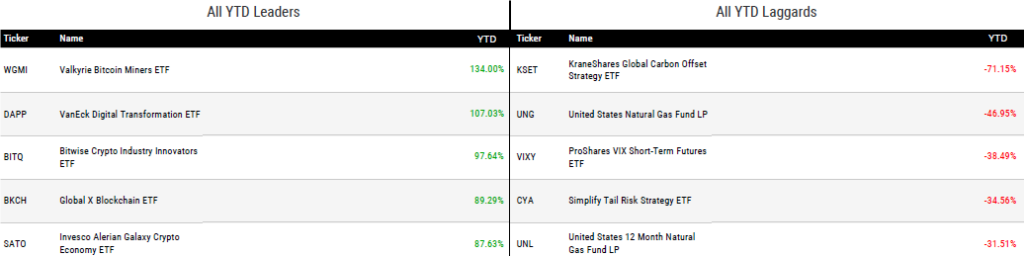

Performance Leaders & Laggards

Weekly ETF Reads

The Patent That Helped Vanguard Clients Pocket Big Gains Expires by Emily Graffeo

“It’s unclear if the expiration marks a minor footnote in history or a pivotal moment for fund managers looking for a fresh edge in an increasingly cutthroat market.”

Fund groups race to launch first US ether futures ETF by Brian Ponte

“Grayscale might also be calling the SEC’s bluff in regard to its statements in favour of futures-based crypto ETFs.”

SEC Not Ready to Approve Ether Futures ETFs, Sources Say — But Why? by Ben Strack

“The main point of contention for the SEC may be its uncertain classification of ether as a commodity or security.”

Why Index Funds and ETFs Are Good for Retirees by Christine Benz

“You get what you don’t pay for.”

Grayscale aims for possible loophole with new bitcoin ETF filing by Steve Johnson

“Grayscale’s filing seems intended to push the envelope with the SEC by using the SEC’s own words against it to launch crypto ETFs.”

Blockchain ETF Issuers With ‘Crypto Street Cred’ May Come Out on Top by Ben Strack

“Only 21 of BlackRock’s 400 or so ETFs have less assets than IBLC.”

What Does Default Do to Treasury ETFs? by Dan Mika

“For ETFs tracking those assets, the boards overseeing each fund would have to decide how to value the bonds they hold.”

Single-Treasury Bond ETFs Prove Their Mettle, 9 Months Later by Todd Rosenbluth

“F/m Investments has grown its asset base to $1.4 billion.”

SGOV vs. BIL: Which Treasury Bill ETF is Best for You? By David Dierking

“Today, you can get nearly a 5% dividend yield from a virtually risk-free investment.”

ETF Tweet of the Week

Bloomberg’s Eric Balchunas produces my “ETF Tweet of the Week” on a regular basis. What can I say? I just call ’em like I see ’em. Below is a tweet I absolutely love and one that ETF issuers should pay very close attention to. If an ETF wishes to have a higher likelihood of success, issuers should make sure it lands above Eric’s “Beta-Adjusted Fee Demarcation Line”. A simple way to think about this? Investors are no longer willing to pay up for closet indexing or exposure they could otherwise get on the cheap.

Busted out a new theorem today at Dem Quant and in note called The Beta-Adjusted Fee Demarcation Line, which is angle bt active share and fee. Better to be above than below gen speaking. The top 10 biggest active eq ETFs all above. Also applies to index, smart-beta, ESG, etc. pic.twitter.com/1ThIQnueBr

— Eric Balchunas (@EricBalchunas) May 18, 2023

ETF Chart(s) of the Week

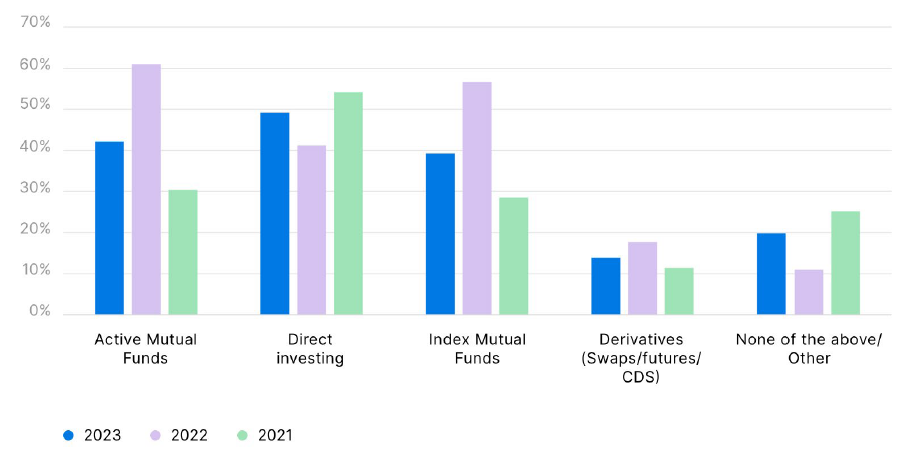

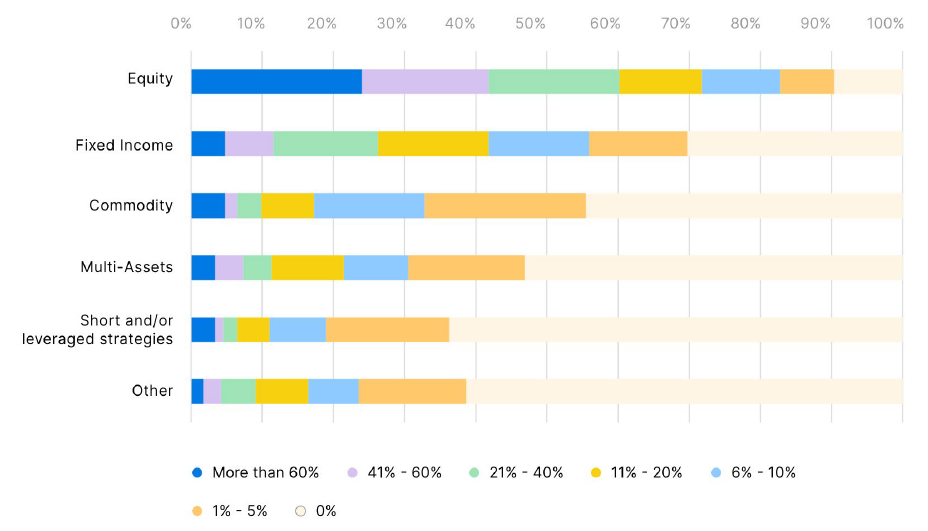

Trackinsight is out with their latest Global ETF Survey, which analyzes how over 500 professional investors and fund allocators use and think about ETFs. The entire 32-page PDF is well worth a read, but I particularly liked the following charts showing current ETF usage and the investment products that ETFs are supplanting in portfolios. My main takeaway? There’s still a LONG runway for ETF growth.

Percentage of portfolio allocated to asset classes using ETFs

Products that ETFs replace in portfolios