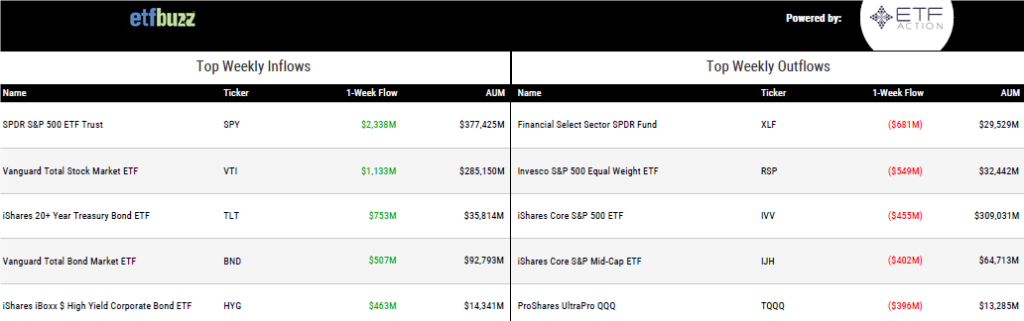

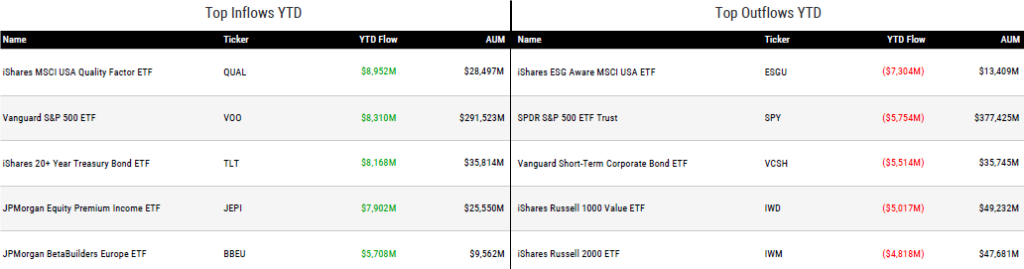

ETF Inflows & Outflows

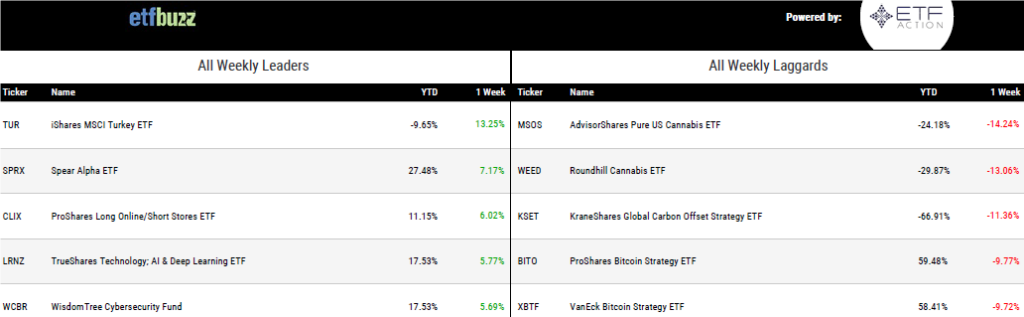

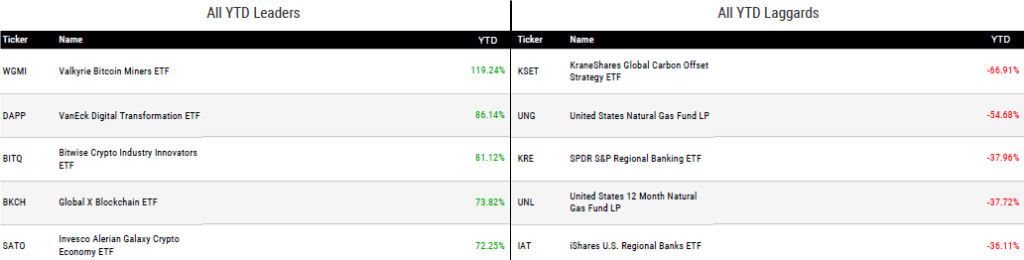

Performance Leaders & Laggards

Weekly ETF Reads

New ETF platform aims at institutions and hedge funds by Steve Johnson

“Tema said it was the largest early-stage VC investment in an ETF platform.”

ETF Issuers Are Losing Tolerance for ESG as Closures Surge by Peyton Forte

“The ESG boom is over and that’s because there’s no defined criteria or structure to what constitutes ESG.”

What Grayscale’s ETF Bid Signals – or Doesn’t – About Spot Bitcoin Fund Prospects by Ben Strack

“Grayscale’s persistence and creativity will be up against the SEC’s unease with crypto exchanges.”

Best ETF Trading Practices for Advisors: Using Block Desks by Todd Rosenbluth

“As more advisors embrace ETFs by shifting some of their client assets into the more tax-efficient, typically low-cost, and well-diversified products, we find that ETF trading still requires some education.”

Barclays’ cull of 21 ETNs puts structure on shaky ground in US by Steve Johnson

“There is an additional layer of risk, over and above the exposure that you are getting.”

ETF Tweet of the Week

This past week, Grayscale filed for a Global Bitcoin Composite ETF, along with an Ethereum Futures ETF. Bloomberg’s James Seyffart offers an interesting take on Grayscale’s thought process and the SEC’s likely response (click tweet to read entire thread). My take? The SEC has made it crystal clear they will not approve a spot bitcoin ETF until they have oversight of crypto exchanges. I don’t think that changes, regardless of the outcome of Grayscale’s lawsuit against the SEC regarding converting GBTC into an ETF. This latest Grayscale bitcoin ETF filing seems like an acknowledgement of that. In other words, why file for this product if you think a spot bitcoin ETF is a real liklihood? As for the ether futures ETF? Following Grayscale’s ether futures filing, ETF issuers including Bitwise, Direxion, and Roundhill quickly followed suit. I think the SEC might have no other choice but to approve these – actually because of how rigorously they’ve defended against (due to Grayscale’s lawsuit) allowing bitcoin futures ETFs to come to market.

Love the filings on the back of this move. Very Smart IMO. The Grayscale Global Bitcoin Composite ETF ( $BTC) & Grayscale Ethereum Futures ETF ( $ETHG) are the two tickers being filed under this new trust. 1/x https://t.co/fsjG2saP2J pic.twitter.com/bqkRgWou8I

— James Seyffart (@JSeyff) May 9, 2023

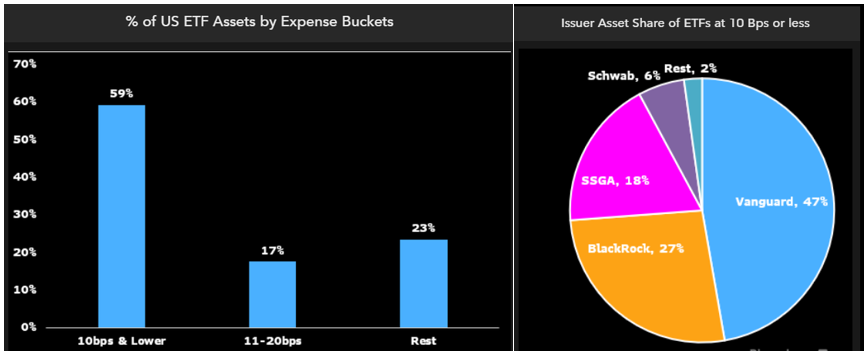

ETF Chart of the Week

Nearly 60% of ETF industry assets are in products that cost 10bps or less. Unsurprisingly, Vanguard ETFs comprise nearly half of that 60%. Bonus stat: ETFs that cost 10bps or less account for only 9% of total industry products!

Bloomberg’s Eric Balchunas notes the cheapest categories of ETFs will likely continue growing – and not simply because of cheap, passive ETFs. Instead, look for cheap, active ETFs from the likes of Dimensional, Avantis, and JPMorgan to help drive assets into the lowest cost buckets.