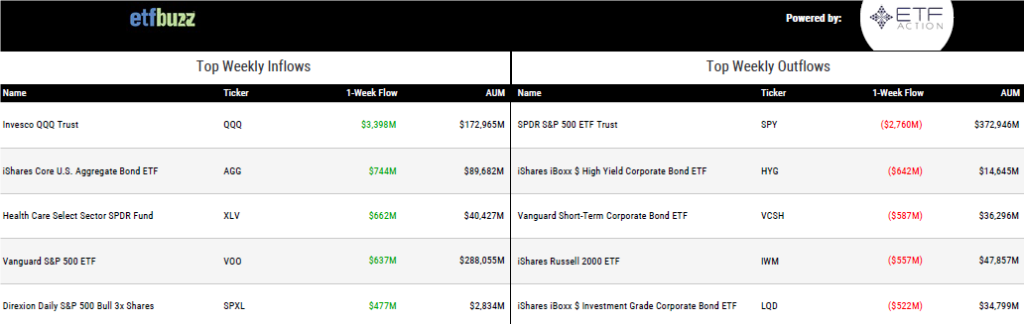

ETF Inflows & Outflows

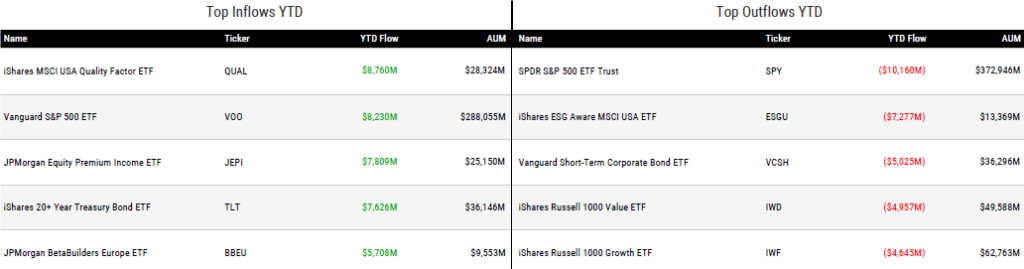

Performance Leaders & Laggards

Weekly ETF Reads

New report from Bloomberg Intelligence underscores why BlackRock and Vanguard could dominate ETFs for years by Beverly Chandler

“Financial advisers see both Vanguard’s and BlackRock’s low fees as providing job security.”

Investors Are Piling Into Actively Managed ETFs by Jack Pitcher

“Active funds still make up a sliver of the roughly $7 trillion ETF market – less than 6% of total assets – but have attracted about 30% of the total flows to ETFs so far this year.”

The State of Crypto ETFs in 2023 by Roxanna Islam

“Outperformance has been catching investor interest, but flows haven’t been matching up.”

SEC orders firm, advisor to pay $933,341 for misuse of leveraged ETFs by Mark Schoeff Jr.

“Schmitz invested about 220 of his 290 clients in the complex ETFs, which they held in their accounts for an average of more than 330 days.”

ETF Groups Partner To Offer Education Resources To Advisors by Edward Hayes

“We’re connecting the ETF Institute’s content with the advisor audience, investor audience, and the broader ETF community audience.”

ETF Tweet of the Week

etf.com celebrated the best in the industry from 2022 with their annual awards this past week. The Lifetime Achievement Award went to industry pioneer and veteran Joanne Hill (great read here). Click the below tweet to see all of the category winners…

And now… the moment you've all been waiting for…

— etf.com (@etfcom) May 3, 2023

It's finally time for the Awards announcement! #etfcomAwards2023

ETF Chart of the Week

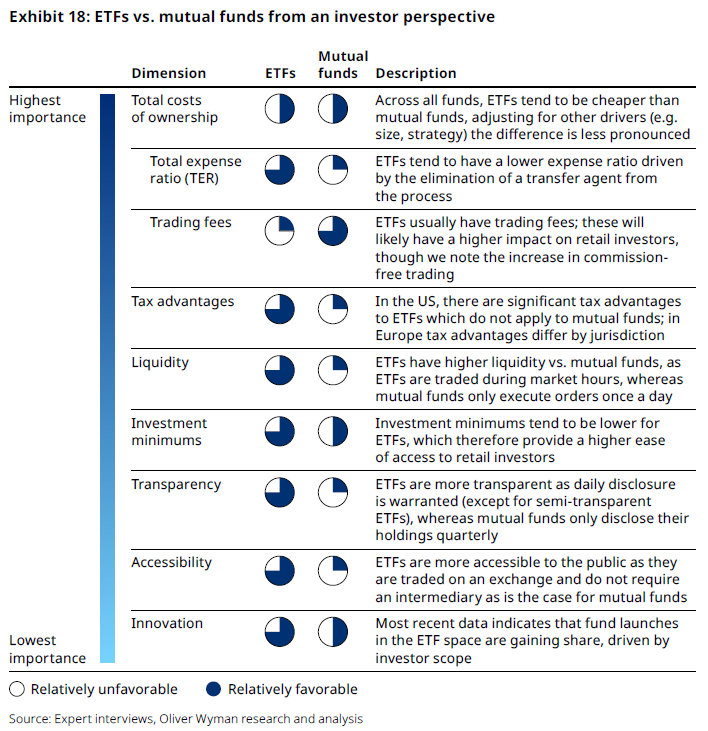

Global consulting firm Oliver Wyman recently published an in-depth look at the industry titled “The Renaissance of ETFs”. The full PDF report is well worth a read as it covers everything from the future growth of ETFs (ETFs are projected to make up 25% of all fund assets by 2027) to how issuers should think about capitalizing on the opportunity. Below is a nice comparison of mutual funds to ETFs, which also explains why money continues flowing out of the former and into the latter…

Last Week’s ETF Buzz