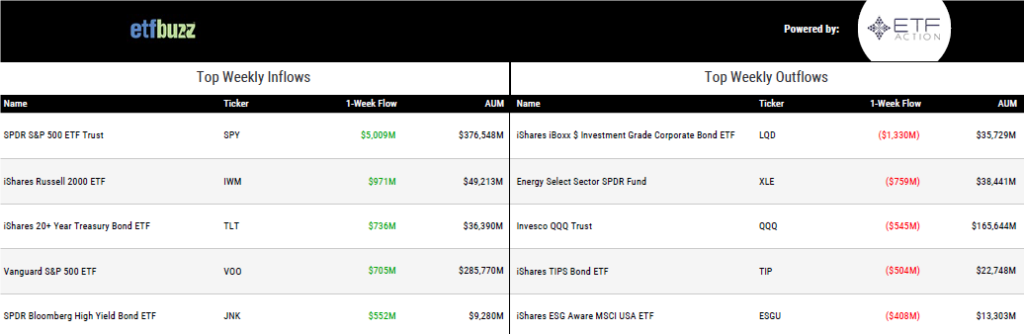

ETF Inflows & Outflows

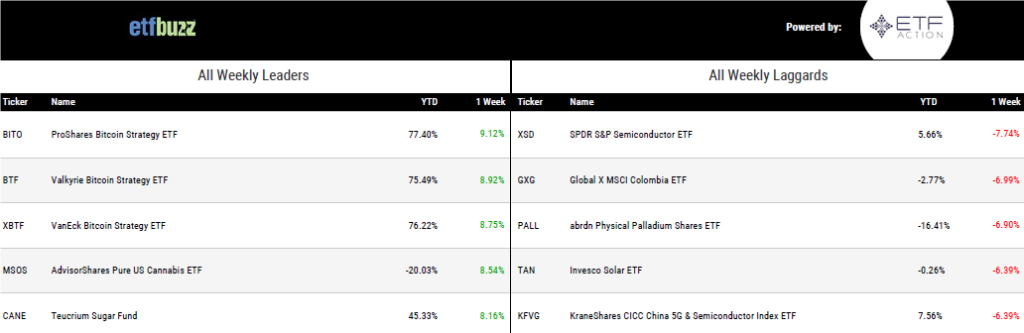

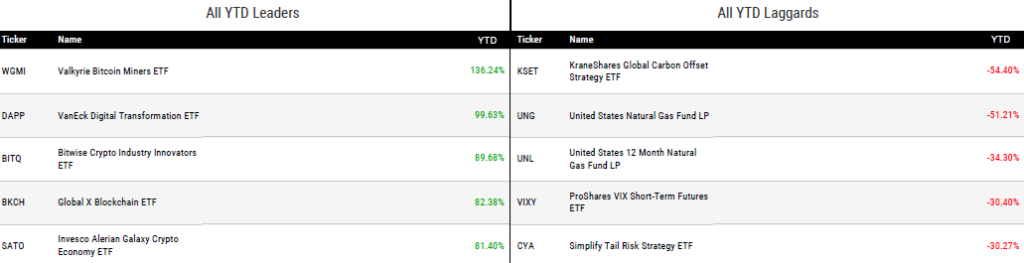

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/27/23

Weekly ETF Reads

Volatile markets increase appeal of ETFs with a buffer by Steve Johnson

“Are buffered funds largely a bear market phenomenon that will be forgotten whenever the next bull market comes around; and are investors’ paying a fair price for the protection they get?”

JPMorgan Overthrows JPMorgan for Crown of Largest Actively Managed ETF by Katie Greifeld

“It’s a huge moment because fixed-income has always been where active dominates in ETFs.”

Tax efficiency helps drive active ETF growth by Steve Deroian

“There are two significant factors driving investor adoption of active and smart beta ETFs.”

Understanding Securities Lending in ETFs by Zachary Evens

“It’s a common practice that can help recoup an ETF’s management fee and give the returns a nudge.”

21Shares and Ark Invest Again Try for Spot Bitcoin ETF — But Why Now? by Ben Strack

“The gamble is that the SEC loses the court case from Grayscale, and thus has to approve spot bitcoin ETFs.”

Analysts Warn Not to Write Off Morgan Stanley’s Tepid ETF Launch by Debbie Carlson

“We’re not looking at an ETF launch over the next five to 10 months; we’re looking over the next five to 10 years.”

ETF Tweet of the Week

I rarely include my own tweets here, but this thread was simply too much fun and one I think ETF nerds will appreciate (click tweet to see an endless stream of creative ideas). VettaFi’s Dave Nadig & I will “Shark Tank” some of these ideas on May 9th’s ETF Prime.

An ETF that doesn’t exist, but you wish did?

— Nate Geraci (@NateGeraci) April 27, 2023

Bonus points for good ticker.

Usual caveat: anything besides spot bitcoin ETF.

Will bat these around Shark Tank-style w/ @DaveNadig on upcoming podcast.

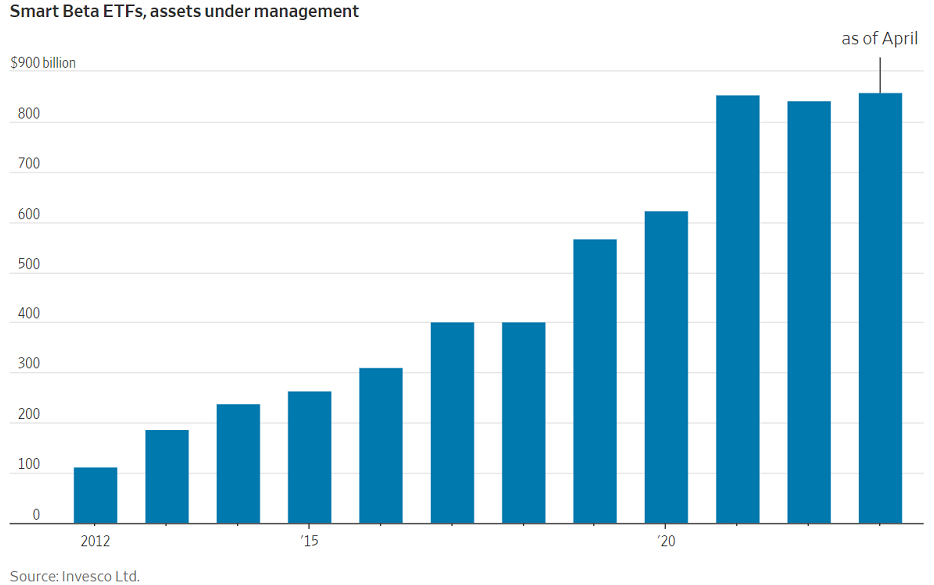

ETF Chart of the Week

The first smart beta ETF celebrated its 20-year anniversary last week. The Invesco S&P 500 Equal Weight ETF (RSP) launched in 2003, pioneering an ETF category that Invesco predicts will eclipse $1 trillion in assets by year-end.

“The ETF transformed how investors could access the S&P 500 Index. At the time, the term Smart Beta was intended as shorthand to concisely explain to investors the benefits of breaking the link between market capitalization and weight.”

Today, there are all flavors of smart beta ETFs – from equally-weighted to factor-based to fundamentally-weighted. I’ve always referred to smart beta as active management without the human emotion and bias. When combined with the typically lower cost, tax efficient ETF wrapper, smart beta can be an attractive value (pun intended) proposition to investors. That said, there’s an interesting story brewing right now – the rise of traditional active ETFs. Is smart beta momentum (see what I did there) waning?