My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

ETFs Killed Off by Merciless Market at Double the Rate of Last Year by Vildana Hajric & Katie Greifeld

“After weak markets in 2022, many asset managers have reassessed their product lineups.”

Legislation or lawsuits? The spot bitcoin ETF debate forges ahead by Kevin Schmidt

“I think the chances are more than 50-50 that Grayscale will win in this lawsuit.”

Retirees Turn to Dividend ETFs for Income by Lori Ioannou

“Dividend ETFs come in several varieties.”

iPath ETN Redemptions a Death Knell for the Wrapper? by Heather Bell

“The closure of the 21 iPath ETNs will leave just 60 ETNs currently trading.”

When Markets Turned Volatile, Investors Turned to ETFs by Todd Rosenbluth

“When many stocks incurred trading halts due to the banking crisis in mid-March, ETF volume reached some of its highest relative trading levels.”

ETFs offer a route to much-needed bond market liquidity by Henry Timmons

“Investors may not fully appreciate the fixed-income ETF market has replaced the underlying bond market for setting price discovery for many fixed-income assets.”

ETF Trading: Best Practices for Volatile Markets by Walter Joyce

“Timing is one important aspect to consider when trading ETFs.”

ETF Tweet of the Week: I am thrilled to announce a new collaboration between an organization I co-founded, The ETF Institute, and ETF Central. ETF Central is itself a collaboration between Trackinsight and the New York Stock Exchange and is quickly becoming a go-to resource for ETF news, data, content, and now… professional education. Stay tuned, much more to come!

We're thrilled to announce our collaboration with @ETF_Institute to further enhance #ETFeducation!

— ETF Central (@etf_central) April 20, 2023

Join a thriving community of like-minded professionals and elevate your expertise with a #CETF® designation. Read here for more: https://t.co/OqESWKFscT pic.twitter.com/ddDei6fUpS

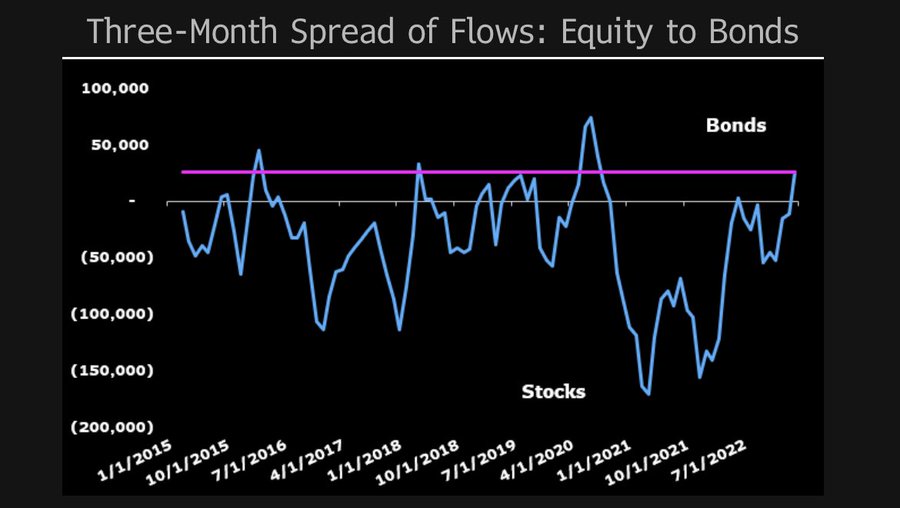

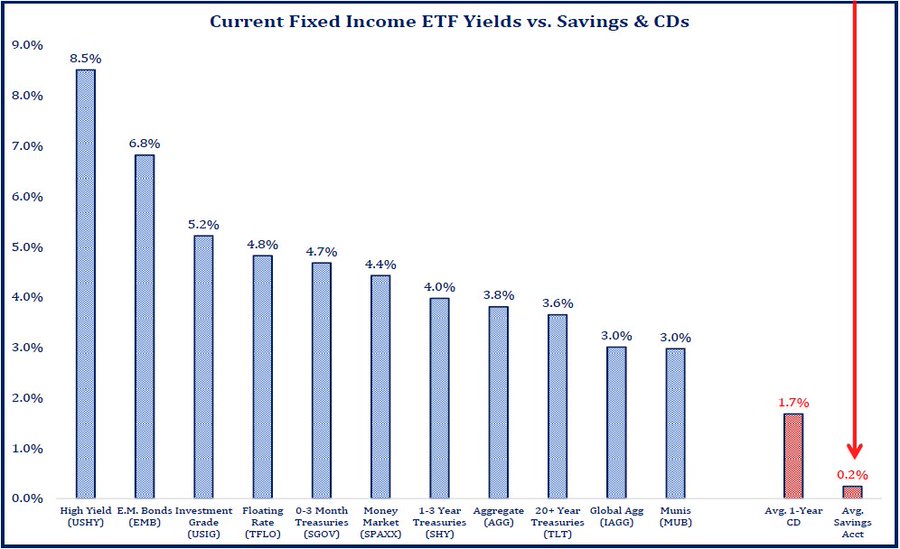

ETF Chart(s) of the Week: Bloomberg’s Eric Balchunas notes that two-thirds of ETF flows this year have gone into bond ETFs – one of the highest spreads ever. Why? Well, as Strategas’ Todd Sohn succinctly highlights, there’s now actually “income” in fixed income…