My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

Converting Mutual Funds to ETFs: What to Make of the Trend by Daniel Sotiroff

“Mutual funds undertaking this transformation have stepped into one of the most competitive areas in the asset-management business.”

Exchange-Traded Notes Are More Dangerous Than They Might Appear by Debbie Carlson

“About 80% of all ETNs ever launched have either matured, were redeemed, or have delisted.”

Flows into ETFs treble in March as investors seek safety by Steve Johnson

“Developed market government bond ETFs soaked up a record $33.2bn of the money.”

Crypto ETFs Are Most of the Year’s Best Performing Funds by Sebastian Sinclair

“Of the 20 best performing ETFs on the market year to date, 13 invest in the crypto sector.”

Bitcoin’s Resurgence Spurs Fresh Push to Launch Leveraged ETFs by Vildana Hajric and Katie Greifeld

“I just don’t see it happening.”

Advisors Gaining Comfort With Covered Call ETFs by Todd Rosenbluth

“Covered call ETFs take the complexity and restrictions away and outsource the responsibility of managing the process to the fund company.”

ETF Tweet of the Week: A little ETF education can go a long way. Here are some basic trading tips from the savvy Alpha Architect team…

What's the best time to trade ETFs if you are looking for best execution?

— Wes Gray 🇺🇸 (@alphaarchitect) April 10, 2023

Lessons from Vanguard's research:

1) DO NOT trade ETFs at the beginning of the day.

2) Avoid trading ETFs during fed announcements.

3) Be smart about trading at the close.

Reach out to @RyanPKirlin or… pic.twitter.com/eMfak8EhN9

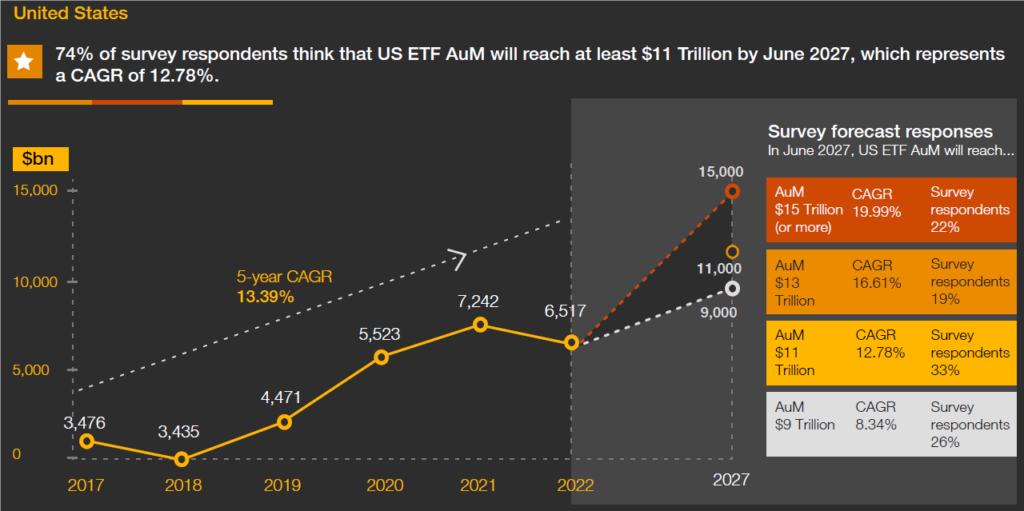

ETF Chart of the Week: Another week, another chart projecting substantial ETF growth. Key expected drivers of this growth include fixed income, thematic, and actively managed ETFs.