My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

The Biggest ETF Launch Ever Is Just a $2 Billion ESG Fund Reshuffle by Peyton Forte & Sam Potter

“The story here with USCA is less about it being a big launch and more about the fact that they were able to pull $2 billion from one ETF and put $2 billion into another brand new ETF without market impact.”

White Label Firms Seeing Interest in Mutual Fund Conversions by Heather Bell

“I have a $300 million mutual fund that used to be $1 billion, and I can no longer sell it because nobody’s buying it.”

How to Cut Your Losses With Defined Outcome ETFs by Lan Anh Tran & Bryan Armour

“Assets have grown to more than $22 billion today from under $200 million in 2018, with 169 products currently on offer.”

BlackRock Looks to Offer ‘Buffer ETFs’ That Aim to Limit Investors’ Losses by Katie Greifeld

“They are likely hearing from their advisers and end-clients that they want products like this, or that clients and advisors are using competitor products.”

Crypto ETFs Have Bounced Back. But Don’t Get Too Excited. by Lori Ioannou

“There are now 26 cryptocurrency ETFs that hold about $1.89 billion in assets.”

ETFs are setting the tone for the underlying bond market. Here’s why by Kevin Schmidt

“Electronic trading is in fact accelerating as more and more people adopt fixed income ETFs.”

ETF Tweet of the Week: This past week, I had the pleasure of participating in an extended conversation with several ETF industry stalwarts including Tuttle Capital’s Matt Tuttle (who’s behind the recently launched Jim Cramer ETFs), Bloomberg’s James Seyffart, Grizzle Investment Management’s Thomas George (behind Grizzle Growth ETF), and WisdomTree’s Jeff Weniger. We discussed everything from ETF growth to thematic ETFs to the regulatory environment. Click the below tweet to listen to the entire conversation.

Tomorrow, Unusual Whales is hosting an ETF space with some of the experts to talk about the future of ETFs, including:

— unusual_whales (@unusual_whales) April 6, 2023

– @TuttleCapital

– @NateGeraci

– @JSeyff

– @thomasg_grizzle

– @JeffWeniger

It's going to be unusual.

Join tomorrow at 11AM EST:https://t.co/RP18udRYJk

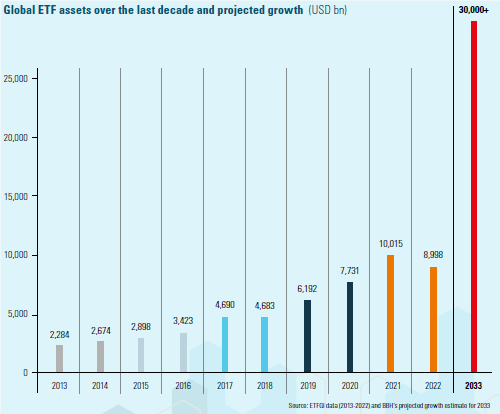

ETF Chart of the Week: In their latest ETF investor survey, Brown Brothers Harriman projects global ETF assets could eclipse $30 trillion over the next decade:

“Given the enhanced investor education and continual product evolution within the ETF wrapper, by 2033, we believe the ETF market could be worth $30+ trillion. Market inflows from the last few years support this growth projection, and year after year, a majority of investors plan to maintain or increase their use of ETFs.”