My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

Hashdex US Head: BTC ETF ‘Feasible’ in 2023 if the ‘World Doesn’t Blow Up’ by Ben Strack

“Our conversion is not really a conversion; it’s just a change in investment policy – a very simple procedure.”

Gen Z, Memes, Digital Revolution Kicked to Curb in Fad-ETF Purge by Peyton Forte

“It’s a blow to many smaller ETF issuers, who were seeking to establish themselves with such targeted offerings.”

ESG Funds Could Face ‘Tons of Closures’ by Shubham Saharan

“The demand for ESG ETFs was so grossly overestimated.”

Investors pull nearly $4bn from iShares ESG ETF in one day by Sonya Swink

“The swap may also indicate waning interest in ESG products in favour of defensive strategic beta.”

Investors Score Lucrative 4.4% Yield On 10 Nearly Risk-Free Stocks by Matt Krantz

“Cash-like bond ETFs are kings and queens in this market.”

What’s Overlooked in Fixed Income by Nick Peters-Golden

“Playing in the senior loan market differs greatly from rolling up treasuries.”

First Factor ETF Celebrates Its 20-Year Anniversary by Ron DeLegge

“The fund’s now-overlooked birth started an explosion in factor-linked ETFs.”

ETF Tweet of the Week: Some investors may be unaware that brokerages and wirehouses can charge ETF issuers for “access”. In other words, if an ETF issuer wants their products offered on a particular platform, they may have to “pay to play”. This practice is especially impactful to smaller ETF issuers who might not have the budget to simply throw (unnecessary) money at gatekeepers. The takeaway for investors? Your advisor or brokerage platform might not be providing access to the entire universe of ETFs, which would be unfortunate to say the least. I would encourage you to find out.

Watching all of the brokerages and wirehouses scramble to start charging ETFs for access is just so gross. "We'll let our advisors buy your funds but you need to subscribe to our data feed for $200k. Oh, also that will be 10 bps for whoknowswhat"

— Meb Faber (@MebFaber) March 29, 2023

Your model is dying, no one…

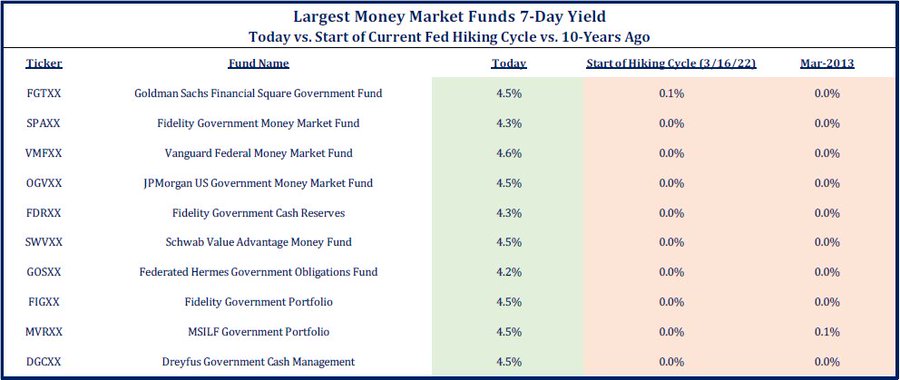

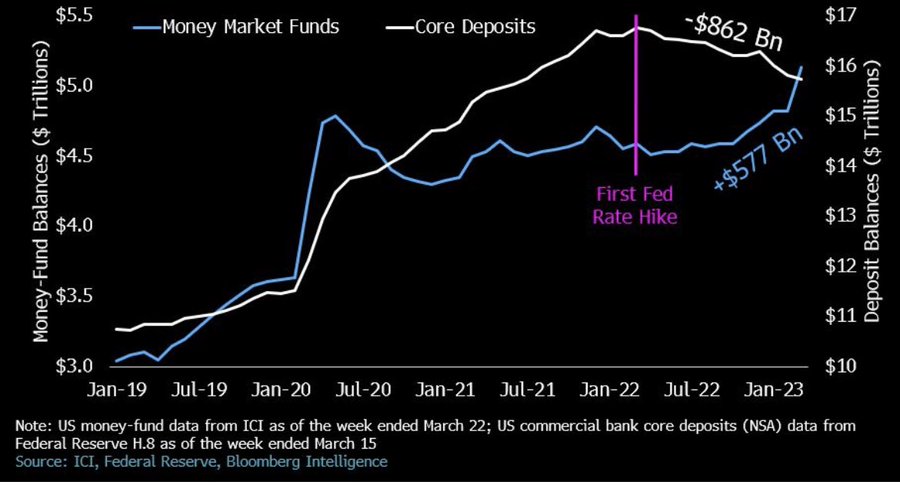

ETF Chart(s) of the Week: While the below charts aren’t directly related to ETFs, they help explain the massive inflows into shorter-term Treasury ETFs this year. Investors have plowed over $20 billion dollars into short-term and ultra-short term Treasury ETFs so far in 2023. Why? Well, one big reason is that bank savings accounts are yielding a national average of 0.37%. That’s right… 0.37%. Meanwhile, money market funds and shorter-term Treasury ETFs are yielding well north of 4%. It doesn’t take a rocket scientist to figure out why investors are shifting their money out of bank accounts…

CNBC Recap: I had the pleasure of joining CNBC’s Bob Pisani and Charles Schwab’s D.J. Tierney to discuss first quarter ETF flows, ESG, long-term investing, and more. Enjoy!