My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

JPMorgan Sees ETF Market Doubling to $15 Trillion in Five Years by Katie Greifeld

“I think we’re just on the very beginning cusp of what could be substantial growth.”

Mutual fund companies can no longer ignore ETFs by Jeff Benjamin

“We launched ETFs because our clients were asking for them. The ETF pool of investors is growing.”

‘Extremely Aggressive’ SEC Poses Headwinds for ETF Industry by Shubham Saharan

“There is a much more adversarial relationship between the SEC and the fund industry than what has existed in many years.”

ESG Died in 2022 by Jan van Eck

“Fund companies now own large percentages of U.S. corporations, and this concentration of power is absolutely a matter of public policy.”

This investment firm is actively working toward a potential ETF mimicking private equity by Christine Idzelis

“The ETF would be cheaper than private equity, which tends to involve around 600 basis points to 800 basis points in fees.”

ETFs Concealing Billions of Dollars of Insider Trades by Jamie Gordon

“ETFs are an attractive instrument for insider trading for several reasons.”

Vanguard’s One-of-a-Kind Fund Design Is About to Get Some Competition by Emily Graffeo and Sam Potter

“A multi-boutique asset manager has this week filed for permission to create ETFs as a share class of its US mutual funds.”

Zero Fee ETF Crosses $1B in AUM for First Time by Sumit Roy

“BKLC’s asset explosion this week suggests zero-fee ETFs have truly arrived, but we shouldn’t make too much of it either.”

ETF Tweet of the Week: Long time followers of this blog know I rarely link my own tweets here. However, since many of you closely follow the ETF space, I thought my quick recap of Exchange might be of interest (click tweet to read entire thread). For a much deeper dive into these topics, you can listen to my live ETF Prime recording featuring Bloomberg’s Eric Balchunas and VettaFi’s Lara Crigger & Dave Nadig. There’s also a nice Exchange summary courtesy of Bloomberg’s Emily Graffeo and various session recaps via VettaFi.

My top 10 @exchangeETF takeaways…

— Nate Geraci (@NateGeraci) February 8, 2023

1) 30yrs after 1st US ETF launched, industry now mature. 30yr old has finally moved out of parent’s basement.

2) Big story this yr will be int’l ETFs. Choose your narrative (weaker dollar, valuations, etc) but seems like real momentum here.

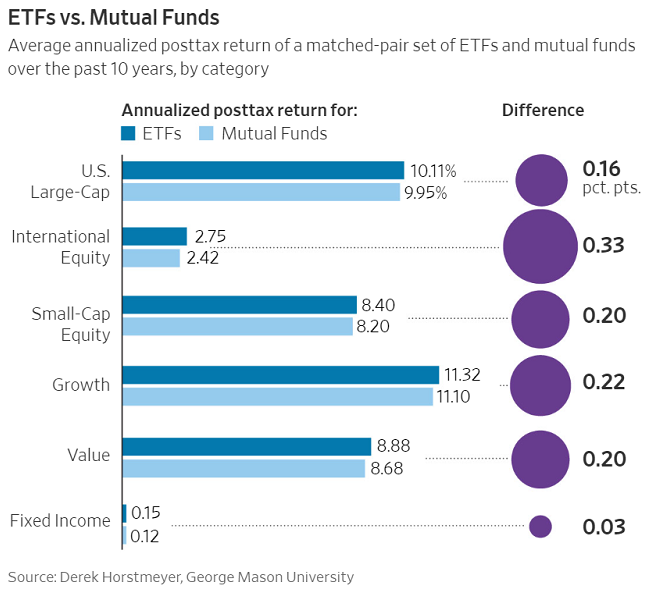

ETF Chart of the Week: The tax efficiency of ETFs has long been touted as an advantage over mutual funds. A new study highlights just how much ETFs can positively impact investor returns:

“On average, our findings show, an ETF gives an extra 0.20 percentage point a year in posttax performance compared with mutual funds, and international-equity ETFs even more – upward of 0.33 percentage point on average.”