My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

(Note: The first U.S.-listed ETF, the SPDR S&P 500 ETF (SPY), began trading nearly 30 years ago on January 29th, 1993. Last week’s ETF Buzz featured several articles celebrating the milestone. Below are five additional pieces worth reading, along with my usual weekly ETF roundup).

Happy 30th birthday to the ETF* by Robin Wigglesworth

“The ETF is now even threatening to supplant the classic mutual fund structure as the vehicle of choice for asset managers.”

The first ETF is 30 years old this week. It launched a revolution in low-cost investing by Bob Pisani

“ETFs are still the largest growing asset wrapper in the world.”

Issuers, Experts Reflect on SPY’s 30th Anniversary by Shubham Saharan & Heather Bell

“The iPhone was the original innovation, the infrastructure that bred more innovation – that’s what SPY is.”

Spy, First U.S. ETF, Leads Industry it Started Even as Rivals Gain Ground by Igor Greenwald

“SPY gave birth to an industry that has democratized investing.”

SPDR Celebrates SPY in NYC by Evan Harp

“I think there’s more innovation to be had.”

ETF Investors Won in 2022 by Losing (and Spending) Less by Elisabeth Kashner

“Asset-weighted average ETF expenses dropped by 0.01% in 2022, down to 0.17%. The comparable price five years ago was 0.23%.”

The Rocky History of Bitcoin ETFs in the US by Sumit Roy

“This summer, a decade will have passed since Cameron and Tyler Winklevoss submitted the first filing for a bitcoin ETF.”

Morgan Stanley’s ETF debut strikes chord with fees, tests market with ESG focus by Jeff Benjamin

“With 226 ESG ETFs, it’s a crowded space right now.”

‘Breakout’ ETF provider Pacer’s assets race past $20bn by Chris Flood

“It is very challenging for smaller providers to create funds that can win the attention of investors.”

We Asked ChatGPT to Make a Market-Beating ETF. Here’s What Happened by Sam Potter & Katie Greifeld

“It seems there’s hope for the humans of Wall Street yet.”

Mutual Fund-to-ETF Conversions: The Wave of the Future in Four Charts by John Hyland

“If you’re sitting on a passel of well-known active mutual funds, you have a real conundrum.”

ETF Tweet of the Week: The ongoing Grayscale Bitcoin Trust (GBTC) saga will take a new twist in early March. The company sued the SEC last June in an attempt to convert GBTC into an ETF (the SEC continues denying all comers on a spot bitcoin ETF). Oral arguments are now scheduled to begin March 7th and could produce some fireworks. GBTC is currently trading at a 40+% discount and questions are swiriling around Grayscale’s parent company (as an aside, you can listen to my recent conversation regarding all of this with Grayscale’s Global Head of ETFs, Dave LaValle). Still. No. Spot. Bitcoin. ETF.

We previously anticipated oral arguments to be as soon as Q2 2023, so having them scheduled to begin on March 7 is welcome news.

— Grayscale (@Grayscale) January 24, 2023

Learn more: https://t.co/76g80XWVjY $GBTC

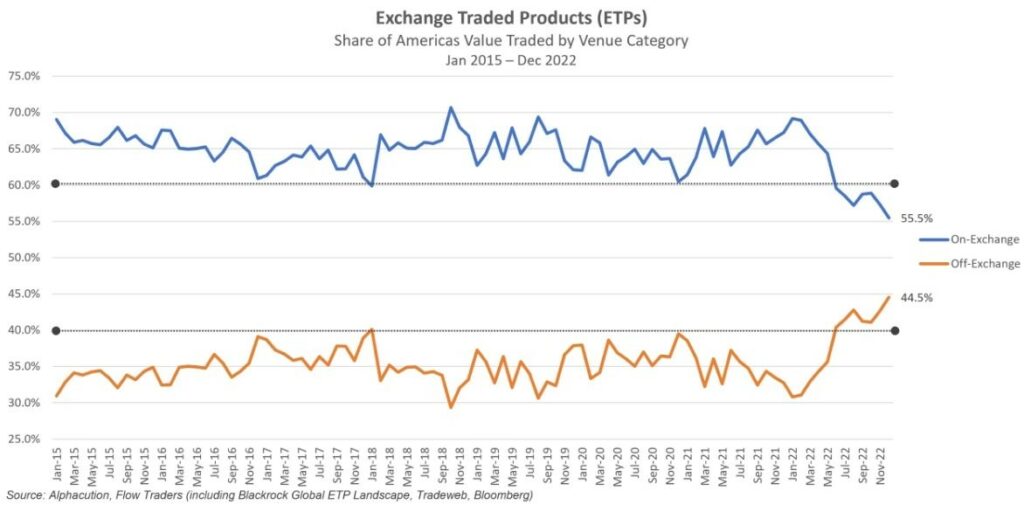

ETF Chart of the Week: It’s not often that I come across an ETF chart that intrigues and befuddles me, but this one checks both boxes. On-exchange (think NYSE or Nasdaq) ETF trading volume has been declining over the past year, while off-exchange volume (think Citadel or Virtu) has been steadily rising. Here’s one theory behind the phenomenon (via the Financial Times):

“Rowady suspects that it’s because the ‘authorised participants’ – the market-makers that lubricate ETF trading – are increasingly the most sophisticated proprietary trading firms. They go where the liquidity is, and may simply find it easier and cheaper to do so away from the NYSE and Nasdaq.”

Another theory is the rise of request-for-quote (RFQ) platforms like Tradeweb (via ETF.com):

“Increasingly in the U.S., investors are using RFQ platforms like Tradeweb. For many people, RFQ platforms have been appealing, and they have made it easier for large institutions. It’s signaling how investors are embracing technology to get better prices.”

Whatever the reason, it’s something to keep an eye on.