My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

(Note: The first U.S.-listed ETF, the SPDR S&P 500 ETF (SPY), turns 30 years old tomorrow. ETFs are one of the most important financial innovations over the past several decades. It all started with SPY, which was seeded on January 22nd of 1993 and began trading a week later. There are now over 3,000 ETFs with nearly $7 trillion invested. Below are several articles celebrating the milestone. If interested in a deeper dive into the birth of SPY, I highly recommend reading The ETF Files by Bloomberg’s Eric Balchunas. State Street also filed an entertaining and insightful account titled SPY: The Idea That Spawned An Industry.)

How SPY Reinvented Investing: The Story of the First US ETF by State Street SPDR ETFs

“Thirty years later, SPY is the largest, most liquid, and most heavily traded ETF in the world.”

SPY, now 30, reshaped market as the first U.S. ETF by Ari Weinberg

“Regulators and the industry could hardly have predicted the innovation that would come.”

SPY, The U.S.’s First ETF, Turns 30 by Evan Harp

“Every hour, 14.5 million shares of SPY are traded.”

30 ETF Milestones Over 30 Years by Heather Bell and Sean Allocca

“While SPY certainly leads the way, there have been dozens of evolutions and iterations of ETFs worth revisiting.”

The First ETF In U.S. Markets Celebrates Its 30-Year Anniversary by Ron DeLegge

“Few if any could have predicted that the launch of the SPDR would eventually lead to an industry revolution.”

A few unrelated reads that I enjoyed this week…

Inflows to continue, but closures also expected to rise by Kathie O’Donnell

“There have been a historic number of ETFs launched in the past three years, yet no increase in closures the past two years.”

What the Genesis Bankruptcy Means for GBTC by Sumit Roy

“If DCG manages to survive and keep the status quo, it would quell some of the uncertainty surrounding GBTC, but investors will be stuck at square one – waiting for an ETF conversion that may or may not materialize.”

Actively Managed ETFs Are Picking Up Steam. Here’s Why. by Lauren Foster

“We think it’s going to be the fastest-growing product type over the next five years.”

Smart beta rewards discerning devotees in 2022 by Emma Boyde

“Smart or ‘strategic’ beta exchange traded funds account for 16 per cent of all equity ETF assets in the US.”

ETF Tweet of the Week: Someone forgot to bring the cake and champagne for SPY’s 30th anniversary celebration. The ETF has been bleeding money over the past year. Meanwhile, its “minature” version, the SPDR Portfolio S&P 500 ETF (which sports a 0.03% fee versus SPY’s 0.0945% fee), has taken in cash.

Mini-Me ETFs will soon be mini no more, as almost all of them are taking in more cash than their big brother, eg $SPLG $GLDM $QQQM and $IAUM (all of which are lower cost clones forced into mkt bc of fee wars). via @psarofagis pic.twitter.com/uEwajqGmT7

— Eric Balchunas (@EricBalchunas) January 17, 2023

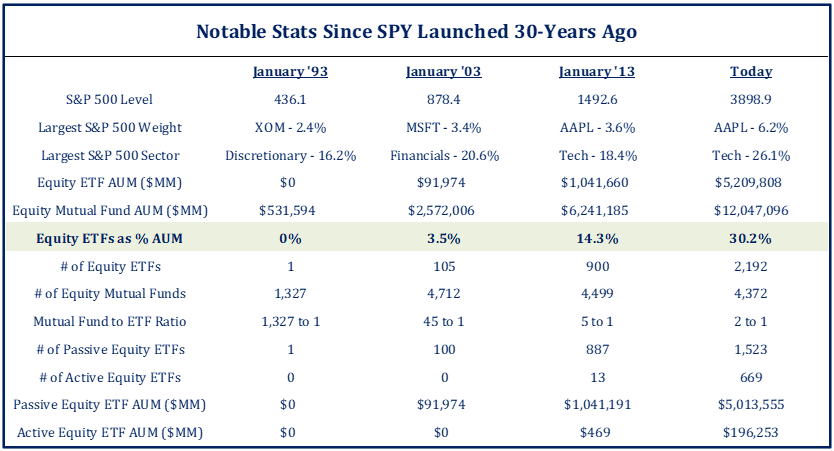

ETF Chart of the Week: The ETF industry “tale of the tape” since SPY launched 30 years ago…