My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

ETF industry storms through 2022’s headwinds by Steve Johnson

“Global investors continued to put their faith in ETFs, despite their existing holdings drowning in a sea of red ink.”

VettaFi’s Rising ETF Stars of 2022 by Lara Crigger

“Out of the 3,000+ ETFs we track, one fund’s popularity among advisors skyrocketed higher than all the rest in 2022.”

ETF Industry’s $1T Mutual Fund Grab: Part 1 and ETF Conversions’ Pitfalls Eyed by Heather Bell

“A conversion puts you on second base right off the bat – you come in with assets, a track record and dignity.”

Grayscale Blasts SEC’s ‘Illogical’ Denial of GBTC Conversion by Ben Strack

(Note: you can read Grayscale’s January 13th reply brief here if you are so inclined)

“The commission’s brief never comes to terms with the order’s arbitrary premise and the discriminatory result it has produced.”

Here Are the Top ETFs for Retail Investors in 2023 by Claire Ballentine and Suzanne Woolley

“For retail investors, exchange-traded funds provide a simple way to invest in diversified bond portfolios.”

ETF Tweet of the Week: Investor interest in thematic mutual funds & ETFs (think blockchain, cannabis, robotics, etc) has diminished subtantially after experiencing a large spike following the March 2020 Covid-crash. Many of these funds favor growth-oriented stocks, which have generally underperformed (in some cases, severely underperformed) over the past year-and-a-half.

Inflows to global thematic funds and ETFS appear to have more or less stalled following a big surge. This doesn't seem especially surprising considering that thematics tend to have growth bias and growth has been on the outs lately. pic.twitter.com/HuNlvHiZXn

— Jeffrey Ptak (@syouth1) January 8, 2023

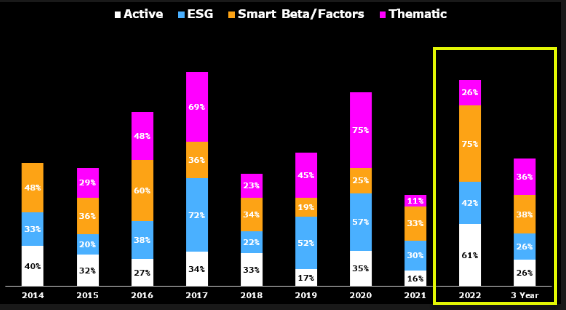

ETF Chart of the Week: Speaking of thematic ETF underperformance, Bloomberg’s Athanasios Psarofagis offers a nice look at the percentage of various ETF categories that have outperformed over the past several years. In 2022, only 26% of thematic ETFs bested the market. On the other end of the spectrum, 75% of smart beta ETFs outperformed – primarily due to factor exposure such as value, low volatility, or quality (good read on smart beta’s resurgence here). 61% of active ETFs and 42% of ESG ETFs posted beats last year. The 3-year track record of all four categories leaves something to be desired, however.