My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

ETF Market Expanded in 2022 Through Bear Market, But Took Hits by Isabelle Lee and Vildana Hajric

“Optimists were still to be found in the world of US exchange-traded funds.”

What Would Jack Bogle Think of Single-Stock ETFs? by Jane Wollman Rusoff

“They’re emblematic of ETFs’ possibilities because at the end of the day, an ETF is just a wrapper, a way to package exposure to a certain asset.”

Sun setting on SPY supremacy by Robin Wigglesworth

“2023 might be touch and go, but SPY’s supremacy looks like it will fall eventually.”

Women Rarely Manage ETFs. Meet the Team Looking to Change That by Peyton Forte

“Just 11% of US fund managers are women, a figure that hasn’t budged in the last decade.”

Active fixed-income ETFs offer strong development opportunity, report finds by Kathie O’Donnell

“You have investors that are showing increased preference for the ETF structure.”

VettaFi Voices On: 2023 Predictions by Evan Harp

“I think $1 trillion in assets is pretty much in the bag.”

ETF Tweet of the Week: Capital Group entered the ETF space in February 2022. Less than a year later, the company well-known for their American Funds mutual fund lineup has already crossed over $6 billion in ETF assets – an impressive feat…

With six weeks left before their one year anniversary @CapitalGroup #ETFs have $6B in assets. $CGDV $CGGR $CGGO and siblings are making @EricBalchunas and I keep a close eye to see when they will hit $7B. #etfnerdbet5 pic.twitter.com/0Ayfk2C3Q1

— Todd Rosenbluth (@ToddRosenbluth) January 6, 2023

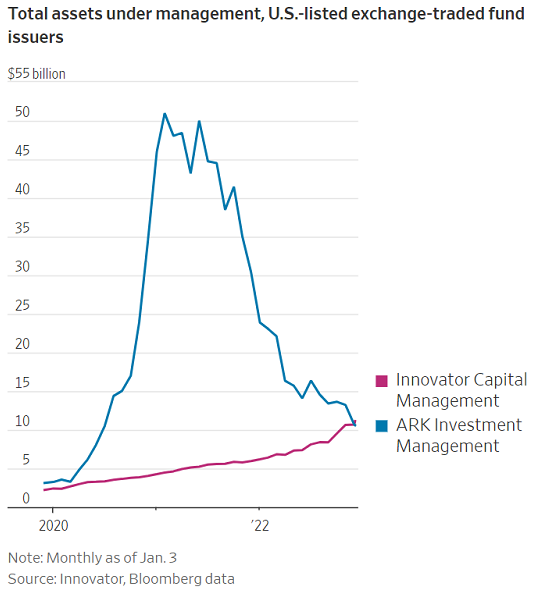

ETF Chart of the Week: Speaking of ETF issuer assets… if you want a clear-cut example of how the markets and investor preferences have shifted over the past several years, look no further than the below chart. Innovator Capital Management recently passed ARK Investment Management in total assets. Innovator is a pioneer and leader in Defined Outcome ETFs, which are risk-mitigating strategies offering investors downside protection. ARK is a pioneer and leader in disruptive innovation stock ETFs, which are risk-seeking strategies attempting to capture signficant upside. My, how the tables have turned…