My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

ETFs See Record-breaking Year in Four Charts by Matthew Bartolini

“Based on secondary market trading data (not primary market fund flows), investors’ ETF usage reached new, record-breaking heights in 2022.”

30 years later and still on top for SSGA’s flagship ETF by Kathie O’Donnell

“SPY is losing the land war, but it’s still holding up on sea.”

Big Three’s Grip on $6.7 Trillion ETF Market Slips for a Sixth Year by Katie Greifeld

“Between the innovation and legacy active management moving their own money over, you’re going to have that market share continue to erode.”

The Tax Efficiency of ETFs Alleviated Some Pain for Investors in 2022 by Lan Anh Tran

“Most do a very good job of helping investors defer capital gains taxes, allowing them to pay the taxes that they owe when they owe them, and not when others might stick them with the bill.”

SEC urged to rein in single-stock leveraged and inverse ETFs by David Isenberg

“Single-stock ETFs are trying to ride two horses at the same moment.”

Direct Indexing Is Taking Off. Is It Really Better Than an ETF? by Debbie Carlson

“The strategy has advantages for certain investors, but not everyone.”

SEC Strikes Back in Grayscale Suit Over GBTC ETF Conversion by Cheyenne Ligon

“The SEC is sticking to its guns.”

ETF Tweet of the Week: Bloomberg’s Eric Balchunas – an “ETF Tweet of the Week” regular – deserves another round of applause. Eric emceed Bloomberg’s “ETFs in Depth” event, which I had the pleasure of participating in. The event was first class all the way around and featured a range of ETF experts, analysts, and investors. A record $1.5 trillion gap has opened-up this year between ETF inflows and mutual fund outflows. Bloomberg’s event astutely captured “the why”. The convenience of the ETF wrapper, the rise of active management, mutual fund to ETF conversions, and continued monster inflows into low cost, passive exposure are all powering the industry forward. As for my panel, it was a Great ESG Debate and, luckily for me, Bloobmerg security was in the holiday spirit…

“I hope Bloomberg security doesn’t escort me out of here” – @NateGeraci about to give the cons to ESG investing #ETFsInDepth pic.twitter.com/RL74yTFxKT

— Eric Balchunas (@EricBalchunas) December 15, 2022

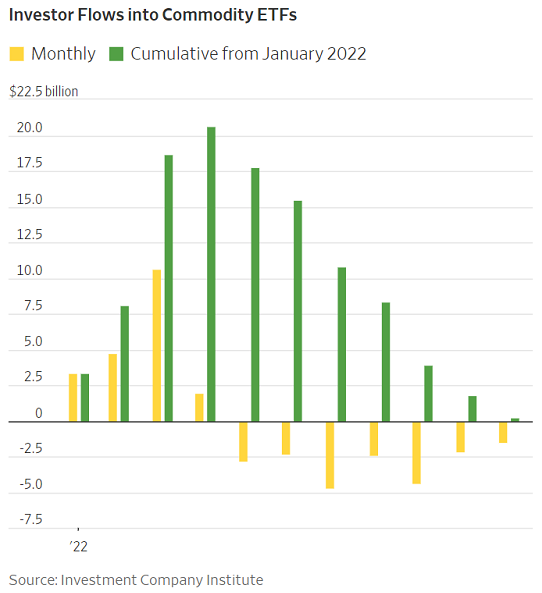

ETF Chart of the Week: $21 billion flowed into commodity ETFs during the first four months of the year. Investors piled in as numerous commodity prices spiked over inflation concerns and the potential impact of the Russia-Ukraine war. Since that time, nearly ALL of that money has come back out – with gold ETFs making up over 70% of the outflows. That’s somewhat surprising, given gold’s relative outperformance this year – and the strong performance of commodity ETFs as whole.