My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

Fido (hearts) ETFs and The (American) age of ETFs by Robin Wigglesworth

“It is starting to look like the coming age of investment fund structure might be dominated by ETFs.”

Bond Investors Swap Mutual Funds for ETFs at Record Pace by Eric Wallerstein and Heather Gillers

“This year is shaping up to be the biggest ‘wrapper swap’ on record.”

How a Basket of ETFs Mimicked the Performance of Top Hedge Funds by Julie Segal

“The ETF outperforms because it avoids the higher fees of hedge funds and the performance snags that come from issues with operations and redemptions.”

Hundreds of New ETFs Debuted This Year Even as Markets Suffered by Vildana Hajric

“The ETF vehicle gives investors control, and then the variety gives them precision.”

A Few Overlooked ETF Launches for Your Portfolio by Sumit Roy

“The payoff from a successful product can be massive, so you can’t fault issuers for trying their luck.”

ETPs more popular for securities lending and collateral by Ari Weinberg

“Ongoing volatility and rising interest rates have given U.S. exchange-traded products the opportunity to prove themselves useful in remote corners of the financial markets.”

The $115 Billion Thematic ETF Boom Lives On Even as Losses Mount by Isabelle Lee

“Thematic investing is captivating. We are narrative creatures and each fund and investment styles come with an inbuilt narrative.”

Why 2022 Was A Milestone Year For ETF Industry by Ron Delegge

“The industry’s 29th year has been filled with plenty of historical milestones.”

ETF Tweet of the Week: A key trend this year has been traditional active managers (Capital Group, AllianceBernstein, DoubleLine, Matthews Asia, etc) finally entering the ETF market – and for good reason. Actively managed ETFs continue punching above their weight. While passive ETFs will likely always be the engine powering industry growth, active ETFs could serve as a turbocharger.

Actively mgd ETFs took in $75b in new cash this yr, which is 14% of total net flows despite making up 4% of total aum. The flows went into 673(!) different ETFs, over 2/3 of the total. Incredible, and good sign for category, considering how rough returns were. Here's the Top 15: pic.twitter.com/PsPLrs1sFh

— Eric Balchunas (@EricBalchunas) December 7, 2022

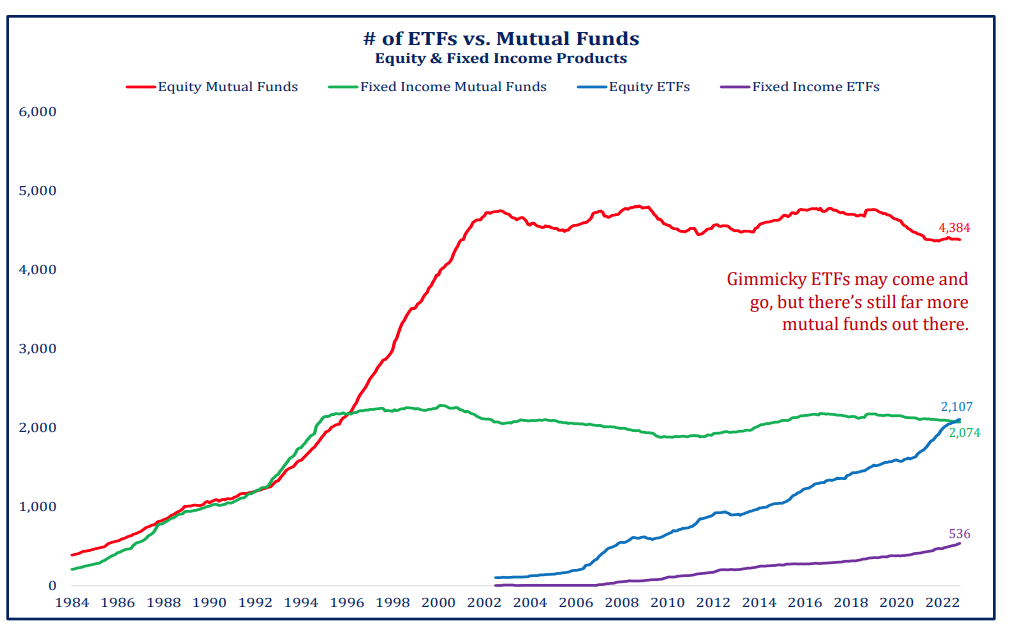

ETF Chart of the Week: “There are too many ETFs”, they say. Well…

Source: Strategas’ Todd Sohn