My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

Goldman makes ‘white-label’ bet on white-hot ETF market by Steve Johnson

“Outsourcing a swath of functions to a white-label manager can help catapult a manager forward by six to 12 months in terms of their ETF launch trajectory and possibly more.”

Can ETFs Come Back From A ‘Down’ Year? by Jeff Schlegel

“The exchange-traded fund train slowed a bit this year, but it’s not in danger of being derailed.”

ETFs May Be Attractive Options During Tax-Loss Harvesting Season by Holly Framsted

“After the bond market losses this year, fixed-income should not be overlooked as part of a tax loss harvesting strategy.”

Michigan Municipal Employees stock up on BondBloxx ETFs, adding 9 in Q3 by Kathie O’Donnell

“About 42% of the pension fund’s total assets are invested in ETFs.”

What Makes an ETF Successful by Cinthia Murphy

“An ETF has to solve an investor problem.”

Goldman Sachs Proves a New Use Case for Bond ETFs by Todd Rosenbluth

“Another milestone occurred for the ETF industry this month as a Goldman Sachs short-term Treasury fund was used in early November to meet initial margin requirements for derivatives trading by a hedge fund at the CME.”

ETF Tweet of the Week: Last week, I noted the accelerating trend of money pouring out of actively managed funds and into passive funds (both mutual funds and ETFs). Just this year, investors have plunked over $550 billion into ETFs (which are mostly passive) and yanked over $800 billion from mutual funds (which are primarily active). Morningstar’s Ben Johnson offers a unique way to view the magnitude of this shift – and exactly where it has occurred – over the past 20 years…

A look at the shift of active/passive market shares across major @MorningstarInc category groups in the U.S. mutual fund and ETF universe over the 20 years through October 2022. pic.twitter.com/RnqmOVxv8c

— Ben Johnson, CFA (@MstarBenJohnson) November 30, 2022

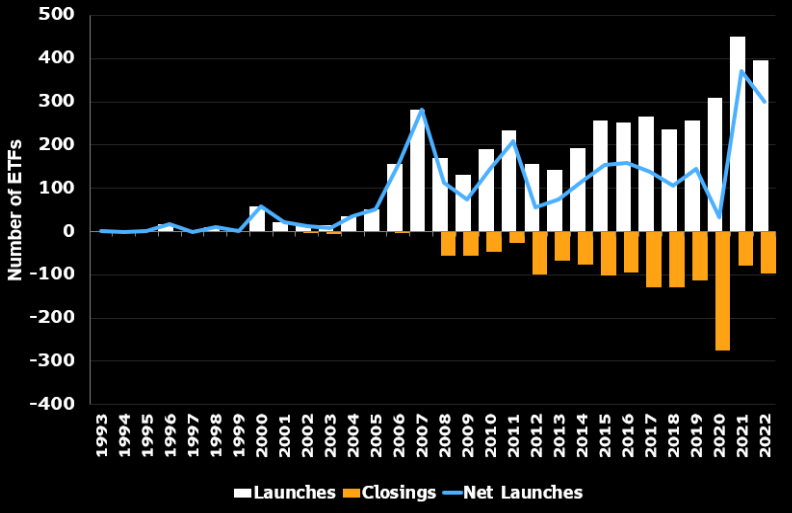

ETF Chart of the Week: Nearly 400 ETFs have launched so far in 2022. While that total is slightly behind 2021’s record-breaking pace, it is still highly impressive given the market environment. Another 750 ETFs have been filed with the SEC in 2022. Several other noteworthy stats courtesy of ETF.com’s Heather Bell:

- 61% of this year’s launches are actively managed

- 57% are stock ETFs

- 20% are bond ETFs

- 23% are a mix that includes leveraged, inverse and commodity ETFs

- 2022’s largest ETF launch is actually a mutual fund conversion, the Dimensional US Marketwide Value ETF (DFUV). The fund converted in May and has $8.2 billion in assets.

Source: Bloomberg’s Eric Balchunas