My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

Thankful Times in the ETF Industry by Todd Rosenbluth

“I am thankful that there’s room for smaller providers to have a chance to succeed.”

Can’t Stand Jim Cramer’s Stock Picks? Now You Can Make Money Betting Against Him by Josh Katzowitz

“It’s the reason why an ETF has been created that allows you to do the exact opposite of what famed analyst Jim Cramer says you should do.”

Are semitransparent ETFs inadvertently creating a market for fully transparent ETFs? by Jeff Benjamin

“There’s just something strong about being transparent and there’s something that seems weak about being nontransparent.”

Fidelity to Join Mutual Fund-to-ETF Club With $430 Million Flip by Isabelle Lee and Emily Graffeo

“In the coming decade, more than $1 trillion worth of mutual fund assets could be converted into ETFs.”

Why Launch an ETF by Cinthia Murphy

“There are many reasons to invest in an ETF. There are just as many reasons to launch one.”

ETF Tweet of the Week: Thematic ETFs covering areas such as disruptive tech, cannabis, and clean energy were all the rage in 2020 and early 2021. Since then? Well, it’s been tough sledding, particularly this year with markets plummeting.

Here's the same thing but this time showing market appreciation. Similar pattern but sharper trajectory. Net-net, these thematic ETFs have lost ~$30B over past 3 years, ~$72B over past year. pic.twitter.com/EhnRpEjYTu

— Jeffrey Ptak (@syouth1) November 22, 2022

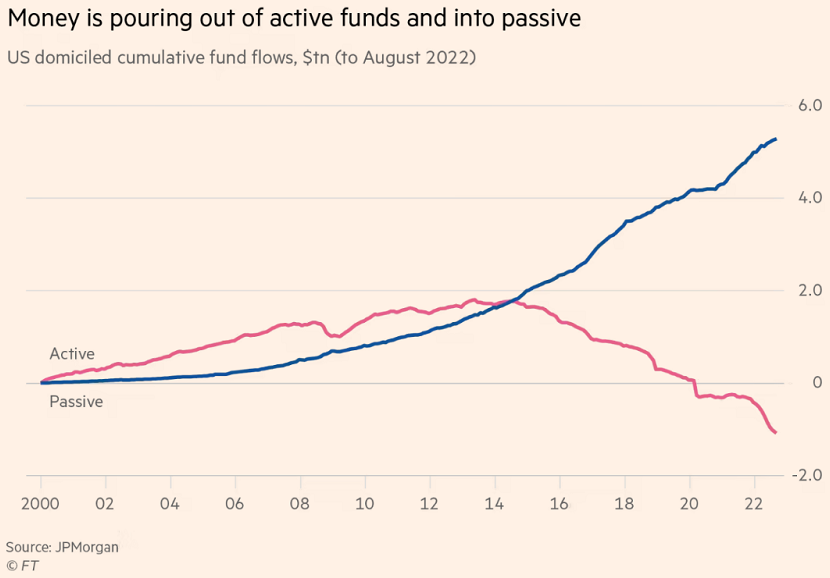

ETF Chart of the Week: Money pouring out of actively managed funds and into passive funds is nothing new, but the trend is accelerating. Just this year, investors have plunked over $550 billion into ETFs (which are mostly passive, or index-based) and withdrawn over $800 billion from mutual funds (which are primarily active). When widening the lens over the past two decades, the magnitude of this shift becomes staggering.

Source: Financial Times’ Emma Boyde