My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

The Last Great ETF Holdout Caves as Capital Group Launches Funds by Emily Graffeo

“Going through the mutual fund world to the ETF world is a little bit like going from a country club into the Amazon jungle.”

ARK Invest Turns to an Innovative Fund Structure by Bobby Blue

“ARK Invest’s move into interval funds will shine a new light on the space, much like how the firm’s success with its active ETFs placed those funds in the spotlight.”

Russia-Ukraine Conflict Sparks Volatility In ETFs by Sumit Roy

“In terms of ETFs, the most obvious fallout from the Russia-Ukraine conflict is on Russia equity ETFs.”

Grayscale urges U.S. investors to push for spot bitcoin ETF by Kathie O’Donnell

“We represent hundreds of thousands of investors in all 50 states in the U.S., and we are hearing from them that they want a bitcoin spot ETF.”

ETF Tweet of the Week: As highlighted above, Grayscale launched a campaign last week encouraging investors to submit comments to the SEC in support of a spot bitcoin ETF. Those supporters are now happily flooding the SEC with said comments. SEC staffers? Probably not so happy.

If $GBTC is approved to convert to a Spot Bitcoin ETF:

We will reduce our management fee

Mechanisms inherent to an ETF should effectively close the discount to NAV

U.S. investors will get a new option to access the spot price of #BitcoinA 🧵 on how you can support our efforts: pic.twitter.com/vsW8pSjBNM

— Grayscale (@Grayscale) February 22, 2022

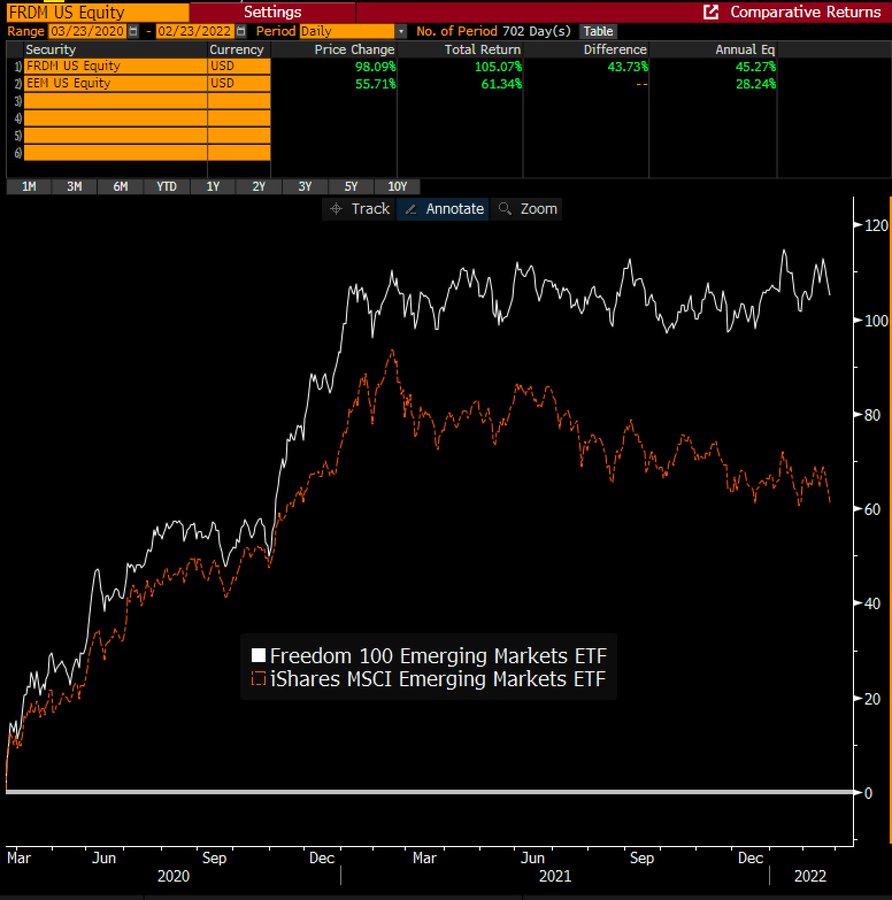

ETF Chart of the Week: Given the Russia-Ukraine war, some investors are taking a much closer look at their emerging market stock exposure. The most popular emerging market ETFs hold roughly 3% in Russian stocks. An alternative to these ETFs is the Freedom 100 Emerging Markets ETF (FRDM), a “freedom-weighted” strategy using personal and economic freedom metrics to determine holdings. As Bloomberg’s Eric Balchunas notes, this approach is serving the ETF well by avoiding China, Turkey, and now Russia.

Source: Bloomberg’s Eric Balchunas

Source: Bloomberg’s Eric Balchunas